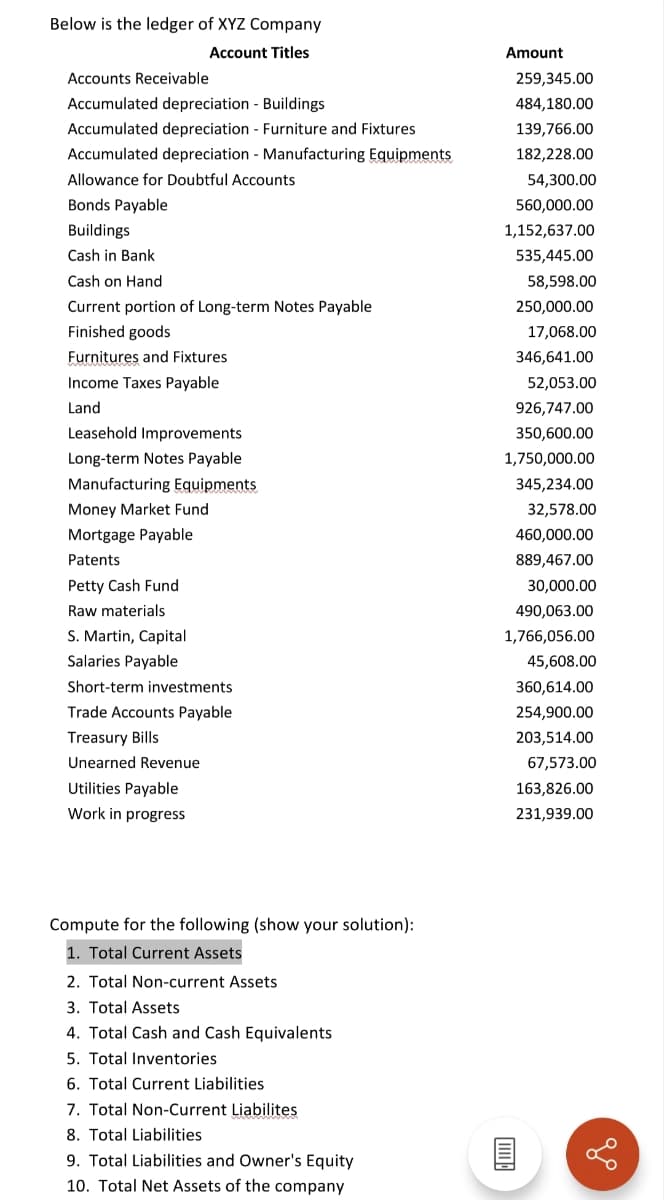

Below is the ledger of XYZ Company Account Titles Accounts Receivable Accumulated depreciation - Buildings Accumulated depreciation - Furniture and Fixtures Accumulated depreciation - Manufacturing Equipments Allowance for Doubtful Accounts Bonds Payable Buildings Cash in Bank Cash on Hand Current portion of Long-term Notes Payable Finished goods Furnitures and Fixtures Income Taxes Payable Land Leasehold Improvements Long-term Notes Payable Manufacturing Equipments Money Market Fund Mortgage Payable Patents Petty Cash Fund Raw materials S. Martin, Capital Salaries Payable Short-term investments Trade Accounts Payable Treasury Bills Unearned Revenue Utilities Payable Work in progress Compute for the following (show your solution): 1. Total Current Assets 2. Total Non-current Assets 3. Total Assets 4. Total Cash and Cash Equivalents 5. Total Inventories 6. Total Current Liabilities 7. Total Non-Current Liabilites 8. Total Liabilities. 9. Total Liabilities and Owner's Equity 10. Total Net Assets of the company Amount 259,345.00 484,180.00 139,766.00 182,228.00 54,300.00 560,000.00 1,152,637.00 535,445.00 58,598.00 250,000.00 17,068.00 346,641.00 52,053.00 926,747.00 350,600.00 1,750,000.00 345,234.00 32,578.00 460,000.00 889,467.00 30,000.00 490,063.00 1,766,056.00 45,608.00 360,614.00 254,900.00 203,514.00 67,573.00 163,826.00 231,939.00

Below is the ledger of XYZ Company Account Titles Accounts Receivable Accumulated depreciation - Buildings Accumulated depreciation - Furniture and Fixtures Accumulated depreciation - Manufacturing Equipments Allowance for Doubtful Accounts Bonds Payable Buildings Cash in Bank Cash on Hand Current portion of Long-term Notes Payable Finished goods Furnitures and Fixtures Income Taxes Payable Land Leasehold Improvements Long-term Notes Payable Manufacturing Equipments Money Market Fund Mortgage Payable Patents Petty Cash Fund Raw materials S. Martin, Capital Salaries Payable Short-term investments Trade Accounts Payable Treasury Bills Unearned Revenue Utilities Payable Work in progress Compute for the following (show your solution): 1. Total Current Assets 2. Total Non-current Assets 3. Total Assets 4. Total Cash and Cash Equivalents 5. Total Inventories 6. Total Current Liabilities 7. Total Non-Current Liabilites 8. Total Liabilities. 9. Total Liabilities and Owner's Equity 10. Total Net Assets of the company Amount 259,345.00 484,180.00 139,766.00 182,228.00 54,300.00 560,000.00 1,152,637.00 535,445.00 58,598.00 250,000.00 17,068.00 346,641.00 52,053.00 926,747.00 350,600.00 1,750,000.00 345,234.00 32,578.00 460,000.00 889,467.00 30,000.00 490,063.00 1,766,056.00 45,608.00 360,614.00 254,900.00 203,514.00 67,573.00 163,826.00 231,939.00

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Below is the ledger of XYZ Company

Account Titles Amount

Accounts Receivable 259,345.00

Accumulated depreciation - Buildings 484,180.00

Accumulated depreciation - Furniture and Fixtures 139,766.00

Accumulated depreciation - Manufacturing Equipments 182,228.00

Allowance for Doubtful Accounts 54,300.00

Bonds Payable 560,000.00

Buildings 1,152,637.00

Cash in Bank 535,445.00

Cash on Hand 58,598.00

Current portion of Long-term Notes Payable 250,000.00

Finished goods 17,068.00

Furnitures and Fixtures 346,641.00

Income Taxes Payable 52,053.00

Land 926,747.00

Leasehold Improvements 350,600.00

Long-term Notes Payable 1,750,000.00

Manufacturing Equipments 345,234.00

Money Market Fund 32,578.00

Mortgage Payable 460,000.00

Patents 889,467.00

Petty Cash Fund 30,000.00

Raw materials 490,063.00

S. Martin, Capital 1,766,056.00

Salaries Payable 45,608.00

Short-term investments 360,614.00

Trade Accounts Payable 254,900.00

Treasury Bills 203,514.00

Unearned Revenue 67,573.00

Utilities Payable 163,826.00

Work in progress 231,939.00

Compute for the following (show your solution):

1. Total Current Assets

2. Total Non-current Assets

3. Total Assets

4. Total Cash and Cash Equivalents

5. Total Inventories

6. Total Current Liabilities

7. Total Non-Current Liabilites

8. Total Liabilities

9. Total Liabilities and Owner's Equity

10. Total Net Assets of the company

Transcribed Image Text:Below is the ledger of XYZ Company

Account Titles

Accounts Receivable

Accumulated depreciation - Buildings

Accumulated depreciation - Furniture and Fixtures

Accumulated depreciation - Manufacturing Equipments

Allowance for Doubtful Accounts

Bonds Payable

Buildings

Cash in Bank

Cash on Hand

Current portion of Long-term Notes Payable

Finished goods

Furnitures and Fixtures

Income Taxes Payable

Land

Leasehold Improvements

Long-term Notes Payable

Manufacturing Equipments

Money Market Fund

Mortgage Payable

Patents

Petty Cash Fund

Raw materials

S. Martin, Capital

Salaries Payable

Short-term investments

Trade Accounts Payable

Treasury Bills

Unearned Revenue

Utilities Payable

Work in progress

Compute for the following (show your solution):

1. Total Current Assets

2. Total Non-current Assets

3. Total Assets

4. Total Cash and Cash Equivalents

5. Total Inventories

6. Total Current Liabilities

7. Total Non-Current Liabilites

8. Total Liabilities

9. Total Liabilities and Owner's Equity

10. Total Net Assets of the company

Amount

259,345.00

484,180.00

139,766.00

182,228.00

54,300.00

560,000.00

1,152,637.00

535,445.00

58,598.00

250,000.00

17,068.00

346,641.00

52,053.00

926,747.00

350,600.00

1,750,000.00

345,234.00

32,578.00

460,000.00

889,467.00

30,000.00

490,063.00

1,766,056.00

45,608.00

360,614.00

254,900.00

203,514.00

67,573.00

163,826.00

231,939.00

go

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 10 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning