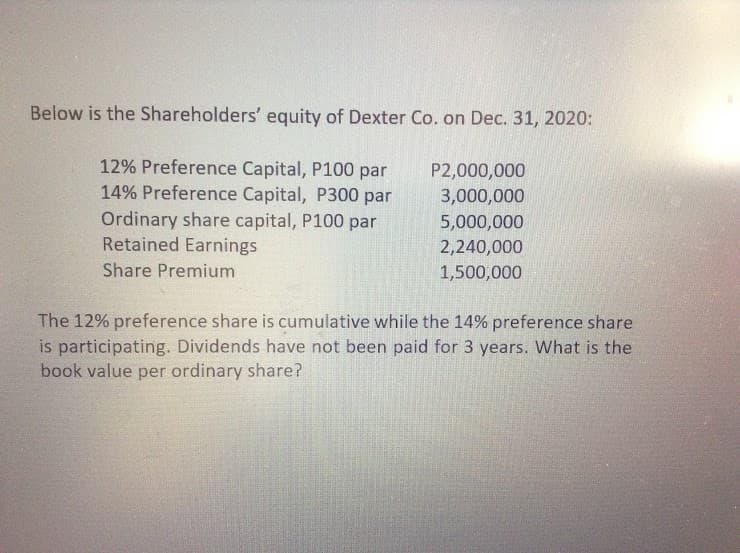

Below is the Shareholders' equity of Dexter Co. on Dec. 31, 2020: 12% Preference Capital, P100 par 14% Preference Capital, P300 par P2,000,000 3,000,000 Ordinary share capital, P100 par Retained Earnings 5,000,000 2,240,000 Share Premium 1,500,000 The 12% preference share is cumulative while the 14% preference share is participating. Dividends have not been paid for 3 years. What is the book value per ordinary share?

Q: Omega company has the following capital structure as at 31st December 2020: Ordinary share…

A: Here; We have Dividend paid now D0 is @ per share Growth rate is 10% Current share price is sh. 20…

Q: Sabo Company reported the following shareholders’ equity at year end: 6% noncumulative preference…

A: The shares or units which provide ownership privilege to the holder are described as ordinary…

Q: ABC Co. 's shareholders' equity on December 31,2020 are as follows: 7% preference shares P100 par…

A: Book value per share is determined by dividing the net assets of the entity by total ordinary shares…

Q: JBL Company’s outstanding share capital at December 31, 2020 consisted of · 45,000 shares of…

A: JBL Company's Outstanding share capital on 31.12.2020 consists of 1. 5% cumulative 45000 preference…

Q: The shareholders' equity section of Hale Co. on December 31, 2018 showed the following: Ordinary…

A: The stock dividend is declared from the retained earnings of the business.

Q: how much is the book value per ordinary share? *

A: Common stockholders are the owners of the company where their share of contribution is presented in…

Q: Stan statement of financial position shows total shareholders' equity of P3,150,000 as of December…

A: Solution: Outstanding shares = Issued shares - shares in treasury = 52000 - 2000 = 50000 shares

Q: Below is the Shareholders ' equity of Dexter Co. on Dec. 31, 2020: 12 % Preference Capital , P100…

A: The company can raise its capital by issuing the share, or debts. The shareholders' of the company…

Q: XYZ Co. had 600,000 ordinary shares issued and outstanding at December 31, 2019. During 2020, no…

A: Earnings per share: When the net income is divided by the number of outstanding shares, we get…

Q: Sabo Company reported the following shareholders’ equity at year end: 6% noncumulative preference…

A: Book value per ordinary share is a ratio of total ordinary shareholder's equity and the number of…

Q: Affleck Company has the following types of outstanding shares at December 31, 2020: ·…

A: Dividend on 12% Preference Share = P4,000,000 x 12% = P480,000 Dividend on 10% Preference Share =…

Q: The following information was extracted from MSU Inc.'s 2020 annual report: Common stock -100…

A: Earnings per share (EPS) can be defined as the ratio of total net income available for common…

Q: At December 31, 2019 and 2020, Lapham Corp. had 200,000 shares of common stock and 20,000 shares of…

A: The earnings per share is calculated as net income available to common shareholders divided by…

Q: Hoseok Corporation has the following data on stock issued and outstanding at December 31, 2020: >10%…

A: Annual Dividend to Preferred shareholders = Preference Share Capital x rate of dividend = P400,000 x…

Q: What is the current cost of bonds? Select one:

A: Bonds are defined as financial instruments used by companies to raise additional funds from the…

Q: Below is the Shareholders' equity of Dexter Co. on Dec. 31, 2020: 12% Preference Capital, P100 par…

A: The book value of a share in the value that a shareholder will receive if the company gets…

Q: . During 2021, CAPTAIN AMERICA Company had two classes of shares issued ind outstanding for the…

A: Calculation of Basic Earnings per share Basic Earnings per share = Earnings available for Common…

Q: he ABC's statement of financial position shows total shareholders’ equity of P3,150,000 as of…

A: Book value per share = Balance of Stockholders Equity/ Number of shares of common stock outstanding…

Q: Below is the Shareholders' equity of Dexter Co. on Dec. 31, 2020: 12% Preference Capital, P100 par…

A: The book value per ordinary share is calculated by dividing the equity available to shareholders by…

Q: he following information for Smith Inc., for the year 2019, is as follows: Earnings from…

A:

Q: The capital accounts of SEB Company as of yearend 2021 are as follows: Ordinary Share Capital (P10…

A: Total market value of Ordinary Share Capital = Ordinary Share Capital + Share Premium = 500,000 +…

Q: JOURNALIZING McAllister Co.'s shareholders' equity on December 31, 2020 shows the following accounts…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: 4. ABC Company had the following classes of shares outstanding as of December 31, 2020: Ordinary…

A: Cumulative preference share holders are are those shareholders having right of of previous dividend…

Q: Flounder Company's net income for 2020 is $672,000, and 91.000 shares of common stock were issued…

A: The diluted earning per share is used to measure a company's earning per share by assuming that all…

Q: ABC Co. ‘s shareholders’ equity on December 31,2020 are as follows: 7% preference shares P100 par…

A: Solution: Book value per share refers to the equity available to the common…

Q: On January 1, 2020, Volume Company had the following account balance carried over from the previous…

A: Treasury Stock The purpose of issue of treasury stock which describes as the repurchase of own stock…

Q: The shareholders' equity section of H Co. on December 31, 2018 showed the following: Ordinary share…

A: solution number of ordinary share for share dividends =(issued share – treasury share ) =(105000 –…

Q: Guimba Corporation has the following data on stock issued and outstanding on December 31, 2020: 10%…

A: Capital which is raised by a corporation by offering shares is known as equity share capital.

Q: Culver Corporation reported net income of $338,240 in 2020 and had 50,400 shares of common stock…

A:

Q: On December 31, 2019 and 2020, Carr Company had outstanding 40,000 preference shares with P100 par…

A: Share Capital:- Share capital is considered as the money which a firm raises from selling ordinary…

Q: The capital accounts of Boom Company as of yearend 2021 are as follows: Ordinary Share Capital (P10…

A: Total market value of Ordinary Share Capital = Ordinary Share Capital + Share Premium = 500,000 +…

Q: As of Dec. 31, 2020, DM Corporation has 10% Preference shares (cumulative and participating) with…

A: "Since you have asked multiple question we will solve the first question for you. If you want any…

Q: For the year 2021, Aquamarine Corporation has earned a net income of P400,000. Compute for the basic…

A: Earning per share refers to earning per share attributable to the ordinary shareholders. It is a net…

Q: As of Dec. 31, 2020, DM Corporation has 10% Preference shares (cumulative and participating) with…

A: Fully Participating Prefered Stock : They share dividend declared with common stock on pro rata…

Q: The shareholders equity of High Company included P3,000,000 of P10 par ordinary share capital and…

A: Cash dividend is paid to Preference Shareholder and Equity Shareholders. Preference Shareholders…

Q: The shareholder' equity of L Corp on Dec 31, 2021 follows: 10% Preference share capital P100 par,…

A: Issue of shares is one of the source of capital for the business. There can be common shares or…

Q: ABC Co. ‘s shareholders’ equity on December 31,2020 are as follows: 7% preference shares P100 par…

A: Common stock holders are the owners of the company.

Q: The capital accounts of Gripit Company as of yearend 2021 are as follows: Ordinary Share Capital…

A: A stock dividend is considered a small stock dividend if the number of shares being issued is less…

Q: ABC Co. had 600,000 ordinary shares issued and outstanding at December 31, 2019. During 2020, no…

A: Earnings per share (EPS) is the ratio of net income available for common shareholders and number of…

Q: A) M. Sunland Corporation has 20,000 shares of 8%, $100 par value, cumulative preferred stock…

A: As posted multiple independent questions we are answering only first question kindly repost the…

Q: On June 30, 2020, when ABC shares were selling for $ 65 each, the equity accounts had the following…

A: The correct answer is Option (d).

Q: The capital accounts of ABC Company as of yearend 2021 are as follows: Ordinary Share Capital (P10…

A: Total market value of Ordinary Share Capital = Ordinary Share Capital + Share Premium = 500,000 +…

Q: ABC Co. had 600,000 ordinary shares issued and outstanding at December 31, 2019. During 2020, no…

A: Investors will find out how much of a company's net income was allocated to each share of common…

Q: ABC Co. ‘s shareholders’ equity on December 31,2020 are as follows: 7% preference shares P100 par…

A: Book Value Per ordinary share Book value per share is the value of per share available to the…

Q: Omega company has the following capital structure as at 31st December 2020: Ordinary share…

A: We will first calculate the cost of each source of capital individually and then we will multiply it…

Q: Sheridan Inc. has 5200 shares of 4%, $100 par value, cumulative preferred stock and 50800 shares of…

A: Preference share dividend: The dividend on preference share is paid on preference shares by using…

Q: During 2021, CAPTAIN AMERICA Company had two classes of shares issued and outstanding for the entire…

A: The basic earnings per share is calculated as net income available to common shareholders divided by…

Use 2 decimal places for the Book Value per share.

Step by step

Solved in 2 steps with 2 images

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.

- Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?

- Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.Preferred Stock Dividends Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has $200,000 available for dividends in 2019, how much could it pay to the common stockholders Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has S200,000 available for dividends in 2019, how much could it pay to the common stockholdersCommon Dividends Thompson Payroll Service began in 2019 with 1,500,000 authorized and 820,000 issued and outstanding S8 par common shares. During 2019, Thompson entered into the following transactions: Declared a S0.20 per-share cash dividend on March 24. Paid the S0.20 per-share dividend on April 6. Repurchased 13,000 common shares for the treasury at a cost of S12 each on May 9. Sold 2,500 unissued common shares for $15 per share on June 19. Declared a $0.40 per-share cash dividend on August 1. Paid the $0.40 per-share dividend on September 14. Declared and paid a 10% stock dividend on October 25 when the market price of the common stock was $15 per share. Declared a 50.45 per-share cash dividend on November 20. Paid the $0.45 per-share dividend on December 20. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) What is the total dollar amount of dividends (cash and stock) for the year? CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.