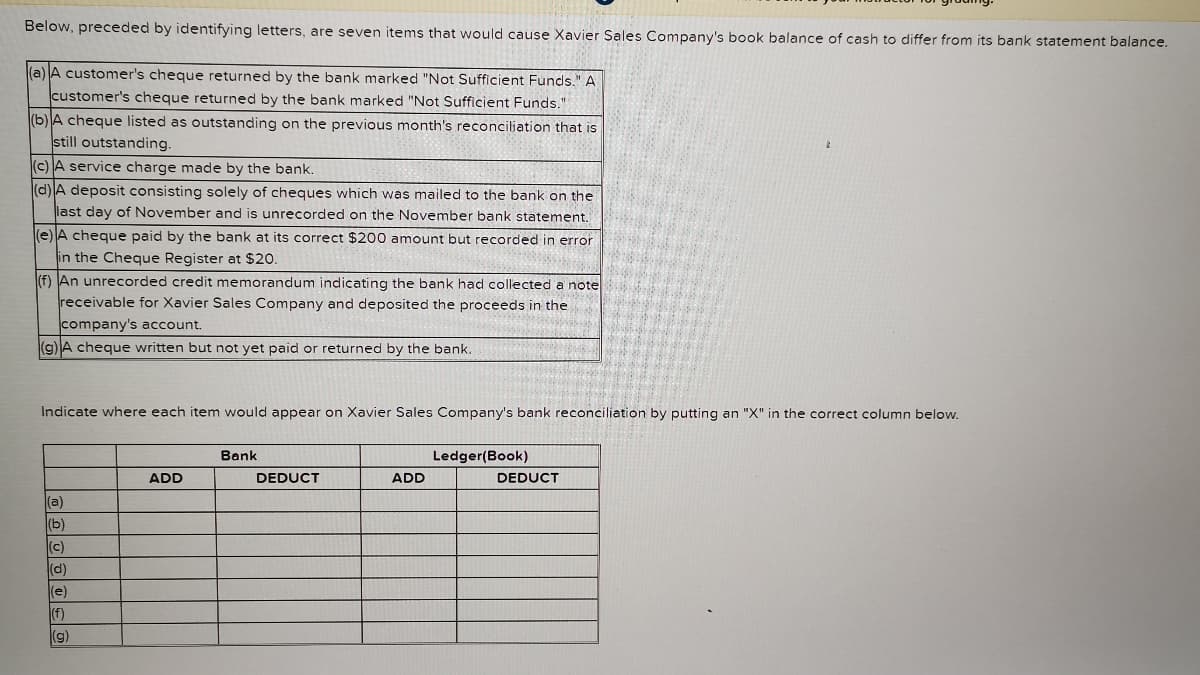

Below, preceded by identifying letters, are seven items that would cause Xavier Sales Company's book balance of cash to differ from its bank statement balance. (a) A customer's cheque returned by the bank marked "Not Sufficient Funds." A customer's cheque returned by the bank marked "Not Sufficient Funds." (b)A cheque listed as outstanding on the previous month's reconciliation that is still outstanding. (c) A service charge made by the bank. (d)A deposit consisting solely of cheques which was mailed to the bank on the last day of November and is unrecorded on the November bank statement. (e)A cheque paid by the bank at its correct $200 amount but recorded in error in the Cheque Register at $20. (f) An unrecorded credit memorandum indicating the bank had collected a note receivable for Xavier Sales Company and deposited the proceeds in the company's account. (9)A cheque written but not yet paid or returned by the bank.

Below, preceded by identifying letters, are seven items that would cause Xavier Sales Company's book balance of cash to differ from its bank statement balance. (a) A customer's cheque returned by the bank marked "Not Sufficient Funds." A customer's cheque returned by the bank marked "Not Sufficient Funds." (b)A cheque listed as outstanding on the previous month's reconciliation that is still outstanding. (c) A service charge made by the bank. (d)A deposit consisting solely of cheques which was mailed to the bank on the last day of November and is unrecorded on the November bank statement. (e)A cheque paid by the bank at its correct $200 amount but recorded in error in the Cheque Register at $20. (f) An unrecorded credit memorandum indicating the bank had collected a note receivable for Xavier Sales Company and deposited the proceeds in the company's account. (9)A cheque written but not yet paid or returned by the bank.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:Below, preceded by identifying letters, are seven items that would cause Xavier Sales Company's book balance of cash to differ from its bank statement balance.

(a) A customer's cheque returned by the bank marked "Not Sufficient Funds." A

customer's cheque returned by the bank marked "Not Sufficient Funds."

(b)A cheque listed as outstanding on the previous month's reconciliation that is

still outstanding.

(c) A service charge made by the bank.

(d)A deposit consisting solely of cheques which was mailed to the bank on the

last day of November and is unrecorded on the November bank statement.

(e)A cheque paid by the bank at its correct $200 amount but recorded in error

in the Cheque Register at $20.

(f) An unrecorded credit memorandum indicating the bank had collected a note

receivable for Xavier Sales Company and deposited the proceeds in the

company's account.

(g) A cheque written but not yet paid or returned by the bank.

Indicate where each item would appear on Xavier Sales Company's bank reconciliation by putting an "X" in the correct column below.

Bank

Ledger(Book)

ADD

DEDUCT

ADD

DEDUCT

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub