Benefits of diversification Sally Rogers has decided to invest her wealth equally across the following three assets: a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset Malone? Hint. Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O. b. Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair. a. What is the expected return of investing equally in all three assets M, N, and O? % (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) States Boom Probability 32% Asset M Retum 11% 8% Normal Recession - 1% 49% 19% Print Asset N Return 22% 13% 2% Done Asset O Retum - 1% 8% 11% - X

Benefits of diversification Sally Rogers has decided to invest her wealth equally across the following three assets: a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset Malone? Hint. Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O. b. Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair. a. What is the expected return of investing equally in all three assets M, N, and O? % (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) States Boom Probability 32% Asset M Retum 11% 8% Normal Recession - 1% 49% 19% Print Asset N Return 22% 13% 2% Done Asset O Retum - 1% 8% 11% - X

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16MC: When using the NPV method for a particular investment decision, if the present value of all cash...

Related questions

Question

Please type the answer very fast. Thank You

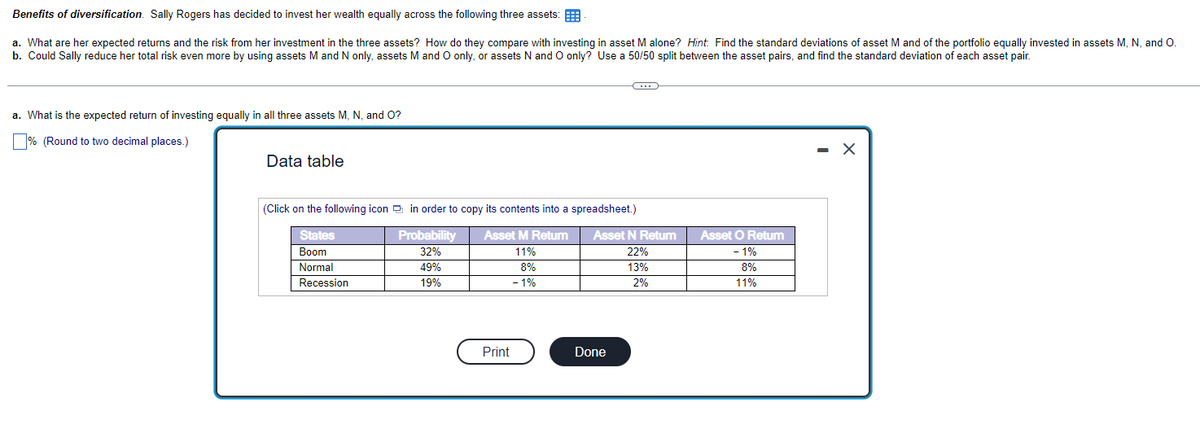

Transcribed Image Text:Benefits of diversification. Sally Rogers has decided to invest her wealth equally across the following three assets:

a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset M alone? Hint: Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O.

b. Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair.

a. What is the expected return of investing equally in all three assets M, N, and O?

% (Round to two decimal places.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Asset M Return

States

Boom

Probability

32%

11%

8%

Normal

49%

Recession

19%

- 1%

Print

Asset N Return

22%

13%

2%

Done

Asset O Return

- 1%

8%

11%

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College