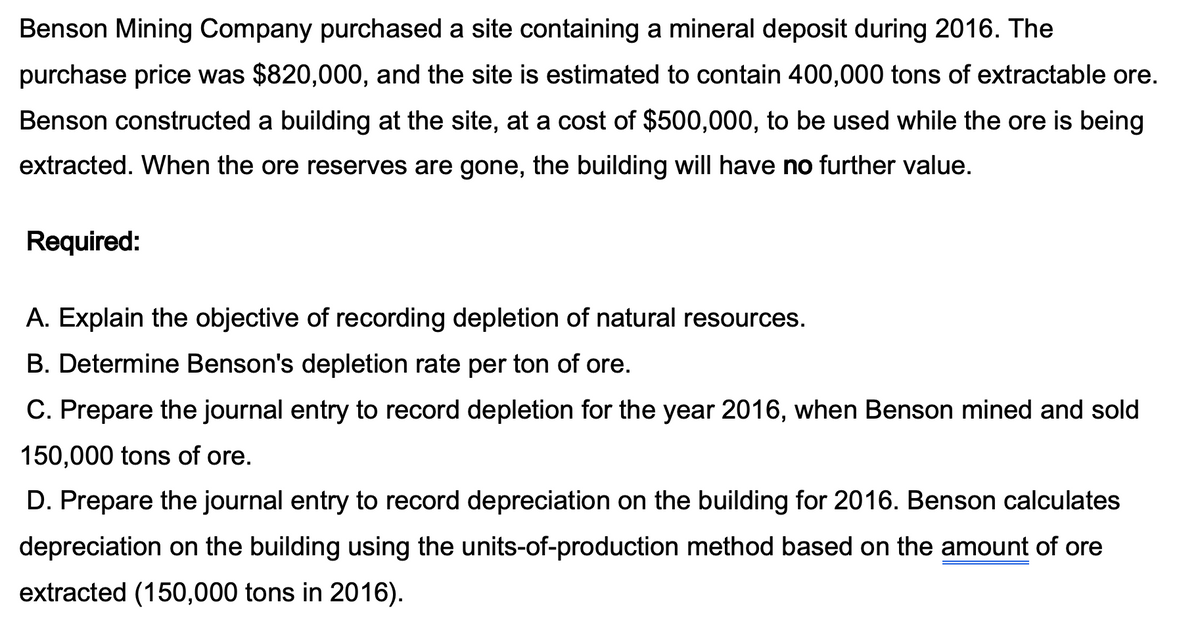

Benson Mining Company purchased a site containing a mineral deposit during 2016. The purchase price was $820,000, and the site is estimated to contain 400,000 tons of extractable ore. Benson constructed a building at the site, at a cost of $500,000, to be used while the ore is being extracted. When the ore reserves are gone, the building will have no further value. Required: A. Explain the objective of recording depletion of natural resources. B. Determine Benson's depletion rate per ton of ore. C. Prepare the journal entry to record depletion for the year 2016, when Benson mined and sold 150,000 tons of ore.

Benson Mining Company purchased a site containing a mineral deposit during 2016. The purchase price was $820,000, and the site is estimated to contain 400,000 tons of extractable ore. Benson constructed a building at the site, at a cost of $500,000, to be used while the ore is being extracted. When the ore reserves are gone, the building will have no further value. Required: A. Explain the objective of recording depletion of natural resources. B. Determine Benson's depletion rate per ton of ore. C. Prepare the journal entry to record depletion for the year 2016, when Benson mined and sold 150,000 tons of ore.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 6PA: Gimli Miners recently purchased the rights to a diamond mine. It is estimated that there are one...

Related questions

Question

100%

please explain the steps clearly

Transcribed Image Text:Benson Mining Company purchased a site containing a mineral deposit during 2016. The

purchase price was $820,000, and the site is estimated to contain 400,000 tons of extractable ore.

Benson constructed a building at the site, at a cost of $500,000, to be used while the ore is being

extracted. When the ore reserves are gone, the building will have no further value.

Required:

A. Explain the objective of recording depletion of natural resources.

B. Determine Benson's depletion rate per ton of ore.

C. Prepare the journal entry to record depletion for the year 2016, when Benson mined and sold

150,000 tons of ore.

D. Prepare the journal entry to record depreciation on the building for 2016. Benson calculates

depreciation on the building using the units-of-production method based on the amount of ore

extracted (150,000 tons in 2016).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning