Bertra Саpital Coloma, Capital 160,000 The articles of partnership stipulate that profits and losses be assigned in the following manner: Each partner is allocated interest equal to 5 percent of the beginning capital balance. • Bertrand is allocated compensation of $45,000 per year. Any remaining profits and losses are allocated on a 3:3:4 basis, respectively. • Each partner is allowed to withdraw up to $25,000 cash per year. Assuming that the net income is $115,000 and that each partner withdraws the maximum amount allowed, what is the balance in Coloma's capital account at the end of the year? a. $143,000 b. $135,000 c. $168,000 d. $164,000

Bertra Саpital Coloma, Capital 160,000 The articles of partnership stipulate that profits and losses be assigned in the following manner: Each partner is allocated interest equal to 5 percent of the beginning capital balance. • Bertrand is allocated compensation of $45,000 per year. Any remaining profits and losses are allocated on a 3:3:4 basis, respectively. • Each partner is allowed to withdraw up to $25,000 cash per year. Assuming that the net income is $115,000 and that each partner withdraws the maximum amount allowed, what is the balance in Coloma's capital account at the end of the year? a. $143,000 b. $135,000 c. $168,000 d. $164,000

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

Transcribed Image Text:d. $240,000, $160,000, $100,000

LO 14-6

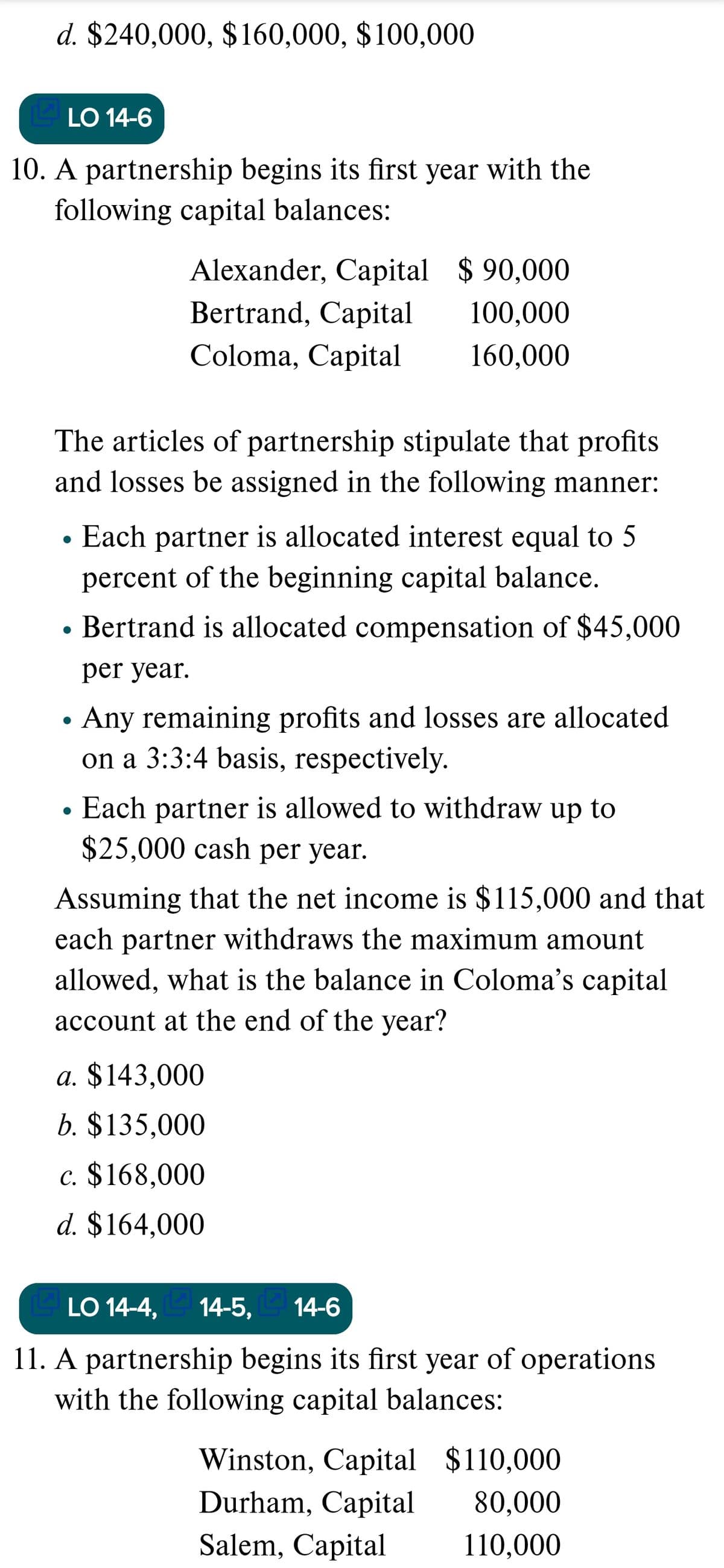

10. A partnership begins its first year with the

following capital balances:

Alexander, Capital $ 90,000

Bertrand, Capital

100,000

Coloma, Capital

160,000

The articles of partnership stipulate that profits

and losses be assigned in the following manner:

Each partner is allocated interest equal to 5

percent of the beginning capital balance.

Bertrand is allocated compensation of $45,000

per year.

Any remaining profits and losses are allocated

on a 3:3:4 basis, respectively.

Each partner is allowed to withdraw up to

$25,000 cash per year.

Assuming that the net income is $115,000 and that

each partner withdraws the maximum amount

allowed, what is the balance in Coloma's capital

account at the end of the year?

a. $143,000

b. $135,000

c. $168,000

d. $164,000

LO 14-4, 14-5,

14-6

11. A partnership begins its first year of operations

with the following capital balances:

Winston, Capital $110,000

Durham, Capital

80,000

Salem, Capital

110,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,