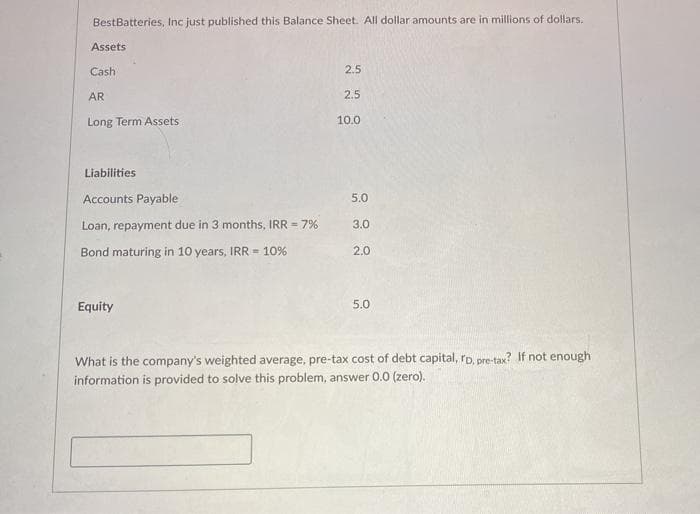

BestBatteries, Inc just published this Balance Sheet. All dollar amounts are in millions of dollars. Assets Cash 2.5 AR 2.5 Long Term Assets 10.0 Liabilities Accounts Payable 5.0 Loan, repayment due in 3 months, IRR - 7% 3.0 Bond maturing in 10 years, IRR - 10% 2,0 Equity 5.0 What is the company's weighted average, pre-tax cost of debt capital, ro. pre-tax? If not enough information is provided to solve this problem, answer 0.0 (zero).

BestBatteries, Inc just published this Balance Sheet. All dollar amounts are in millions of dollars. Assets Cash 2.5 AR 2.5 Long Term Assets 10.0 Liabilities Accounts Payable 5.0 Loan, repayment due in 3 months, IRR - 7% 3.0 Bond maturing in 10 years, IRR - 10% 2,0 Equity 5.0 What is the company's weighted average, pre-tax cost of debt capital, ro. pre-tax? If not enough information is provided to solve this problem, answer 0.0 (zero).

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter7: Analysis Of Financial Statements

Section: Chapter Questions

Problem 12P: The Kretovich Company had a quick ratio of 1.4, a current ratio of 3.0, a days’ sales outstanding of...

Related questions

Question

Transcribed Image Text:BestBatteries, Inc just published this Balance Sheet. All dollar amounts are in millions of dollars.

Assets

Cash

2.5

AR

2.5

Long Term Assets

10.0

Liabilities

Accounts Payable

5.0

Loan, repayment due in 3 months, IRR = 7%

3.0

Bond maturing in 10 years, IRR = 10%

2.0

Equity

5.0

What is the company's weighted average, pre-tax cost of debt capital, rD, pre-tax? If not enough

information is provided to solve this problem, answer 0.0 (zero).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning