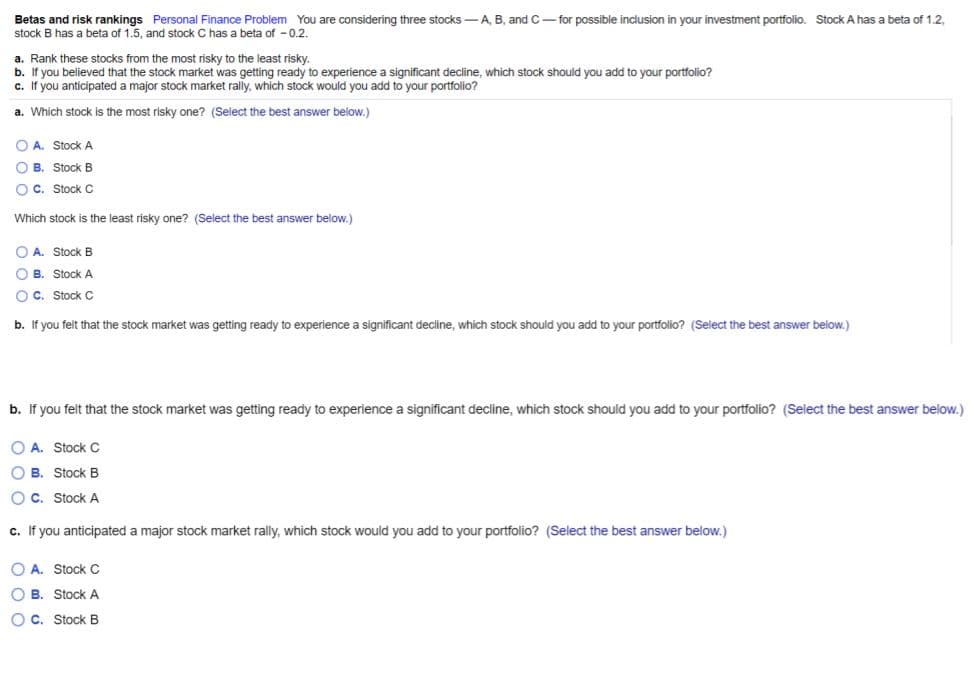

Betas and risk rankings Personal Finance Problem You are considering three stocks -A, B, and C-for possible inclusion in your investment portfolio. Stock A has a beta of 1.2, stock B has a beta of 1.5, and stock C has a beta of -0.2. a. Rank these stocks from the most risky to the least risky. b. If you believed that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? c. If you anticipated a major stock market rally, which stock would you add to your portfolio? a. Which stock is the most risky one? (Select the best answer below.) O A. Stock A O B. Stock B O C. Stock C Which stock is the least risky one? (Select the best answer below.) O A. Stock B O B. Stock A O C. Stock C b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) O A. Stock C O B. Stock B OC. Stock A c. If you anticipated a major stock market rally, which stock would you add to your portfolio? (Select the best answer below.) O A. Stock C O B. Stock A O c. Stock B

Betas and risk rankings Personal Finance Problem You are considering three stocks -A, B, and C-for possible inclusion in your investment portfolio. Stock A has a beta of 1.2, stock B has a beta of 1.5, and stock C has a beta of -0.2. a. Rank these stocks from the most risky to the least risky. b. If you believed that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? c. If you anticipated a major stock market rally, which stock would you add to your portfolio? a. Which stock is the most risky one? (Select the best answer below.) O A. Stock A O B. Stock B O C. Stock C Which stock is the least risky one? (Select the best answer below.) O A. Stock B O B. Stock A O C. Stock C b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.) O A. Stock C O B. Stock B OC. Stock A c. If you anticipated a major stock market rally, which stock would you add to your portfolio? (Select the best answer below.) O A. Stock C O B. Stock A O c. Stock B

Chapter14: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 8DTM

Related questions

Question

Transcribed Image Text:Betas and risk rankings Personal Finance Problem You are considering three stocks -A, B, and C- for possible inclusion in your investment portfolio. Stock A has a beta of 1.2,

stock B has a beta of 1.5, and stock C has a beta of - 0.2.

a. Rank these stocks from the most risky to the least risky.

b. If you believed that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio?

c. If you anticipated a major stock market rally, which stock would you add to your portfolio?

a. Which stock is the most risky one? (Select the best answer below.)

O A. Stock A

O B. Stock B

O C. Stock C

Which stock is the least risky one? (Select the best answer below.)

O A. Stock B

O B. Stock A

O C. Stock C

b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.)

b. If you felt that the stock market was getting ready to experience a significant decline, which stock should you add to your portfolio? (Select the best answer below.)

O A. Stock C

O B. Stock B

O C. Stock A

c. If you anticipated a major stock market rally, which stock would you add to your portfolio? (Select the best answer below.)

O A. Stock C

O B. Stock A

OC. Stock B

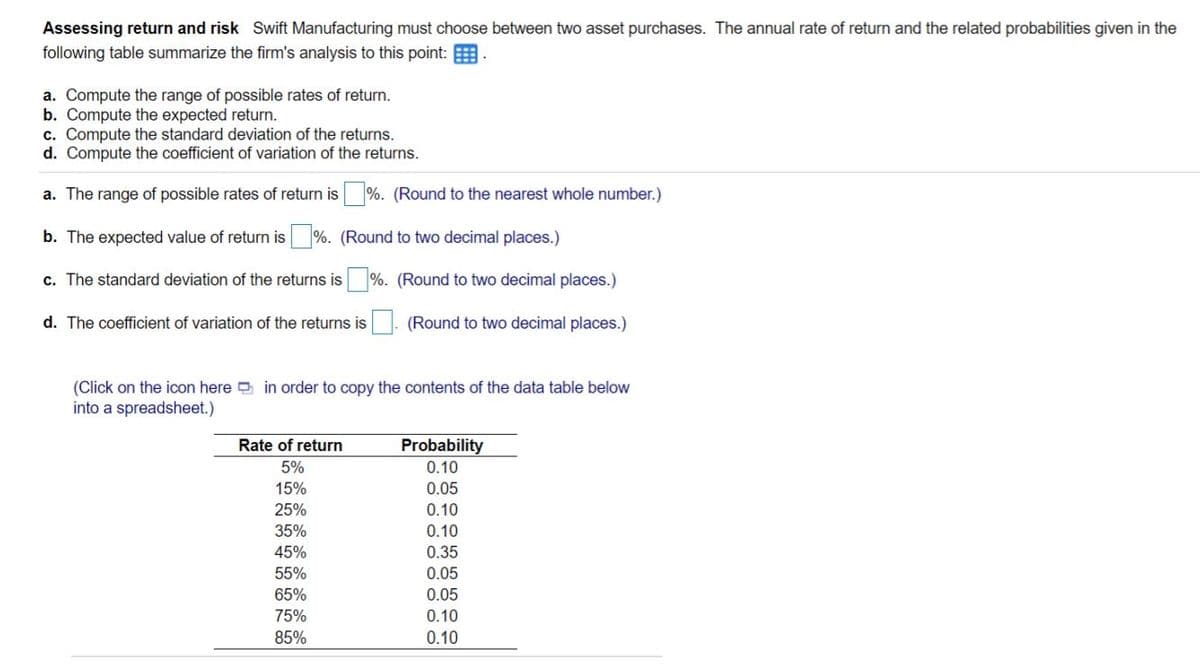

Transcribed Image Text:Assessing return and risk Swift Manufacturing must choose between two asset purchases. The annual rate of return and the related probabilities given in the

following table summarize the firm's analysis to this point: E

a. Compute the range of possible rates of return.

b. Compute the expected return.

c. Compute the standard deviation of the returns.

d. Compute the coefficient of variation of the returns.

a. The range of possible rates of return is %. (Round to the nearest whole number.)

b. The expected value of return is %. (Round to two decimal places.)

c. The standard deviation of the returns is %. (Round to two decimal places.)

d. The coefficient of variation of the returns is

(Round to two decimal places.)

(Click on the icon here in order to copy the contents of the data table below

into a spreadsheet.)

Rate of return

Probability

5%

0.10

15%

0.05

25%

0.10

35%

0.10

45%

0.35

55%

0.05

65%

0.05

75%

0.10

85%

0.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you