Big Sky Farms Partial Balance Sheet April 30, 2023 Property, plant and equipment: Land Building¹ Less: Accumulated depreciation Equipment2 Less: Accumulated depreciation Total property, plant and equipment $742,000 583,000 670,000 284,080 $ 730,000 159,000 385,920 $1,274,920 The building was purchased on May 3, 2012, and is depreciated to the nearest whole month using the Depreciation is based on a 14-year life, after which it will be demolished and replaced with a new one. The equipment was purchased on November 3, 2020, and is depreciated to the nearest whole month balance method. The total estimated useful life is 10 years with a residual value of $200,000.

Big Sky Farms Partial Balance Sheet April 30, 2023 Property, plant and equipment: Land Building¹ Less: Accumulated depreciation Equipment2 Less: Accumulated depreciation Total property, plant and equipment $742,000 583,000 670,000 284,080 $ 730,000 159,000 385,920 $1,274,920 The building was purchased on May 3, 2012, and is depreciated to the nearest whole month using the Depreciation is based on a 14-year life, after which it will be demolished and replaced with a new one. The equipment was purchased on November 3, 2020, and is depreciated to the nearest whole month balance method. The total estimated useful life is 10 years with a residual value of $200,000.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.4E

Related questions

Question

Transcribed Image Text:25

points

eBook

Print

References

Use the following table:

Property, plant and equipment:

Land

Building¹

Less: Accumulated depreciation

Equipment²

Less: Accumulated depreciation

Total property, plant and equipment

Big Sky Farms

Partial Balance Sheet

April 30, 2023

View transaction list

The building was purchased on May 3, 2012, and is depreciated to the nearest whole month using the straight-line method.

Depreciation is based on a 14-year life, after which it will be demolished and replaced with a new one.

Journal entry worksheet

<

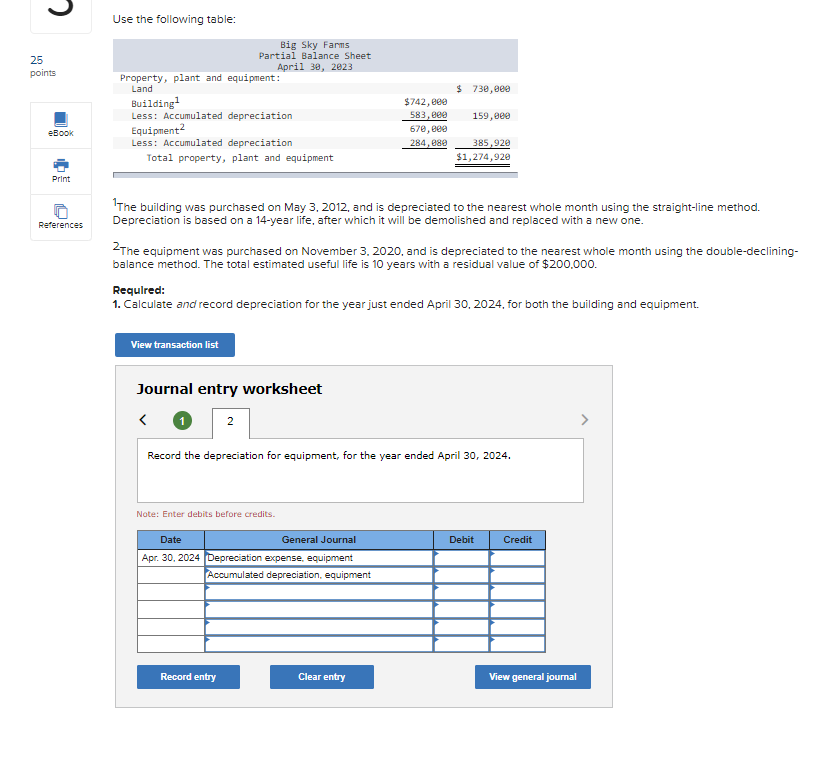

2The equipment was purchased on November 3, 2020, and is depreciated to the nearest whole month using the double-declining-

balance method. The total estimated useful life is 10 years with a residual value of $200,000.

2

Required:

1. Calculate and record depreciation for the year just ended April 30, 2024, for both the building and equipment.

$742,000

583,000

670,000

284,080

Note: Enter debits before credits.

Record entry

$ 730,000

Date

General Journal

Apr. 30, 2024 Depreciation expense, equipment

Accumulated depreciation, equipment

159,000

385,920

$1,274,920

Record the depreciation for equipment, for the year ended April 30, 2024.

Clear entry

Debit

Credit

View general journal

Transcribed Image Text:3

25

points

eBook

Print

References

Use the following table:

Property, plant and equipment:

Land

Building¹

Less: Accumulated depreciation

Equipment²

Less: Accumulated depreciation

Total property, plant and equipment

Big Sky Farms

Partial Balance Sheet

April 30, 2023

View transaction list

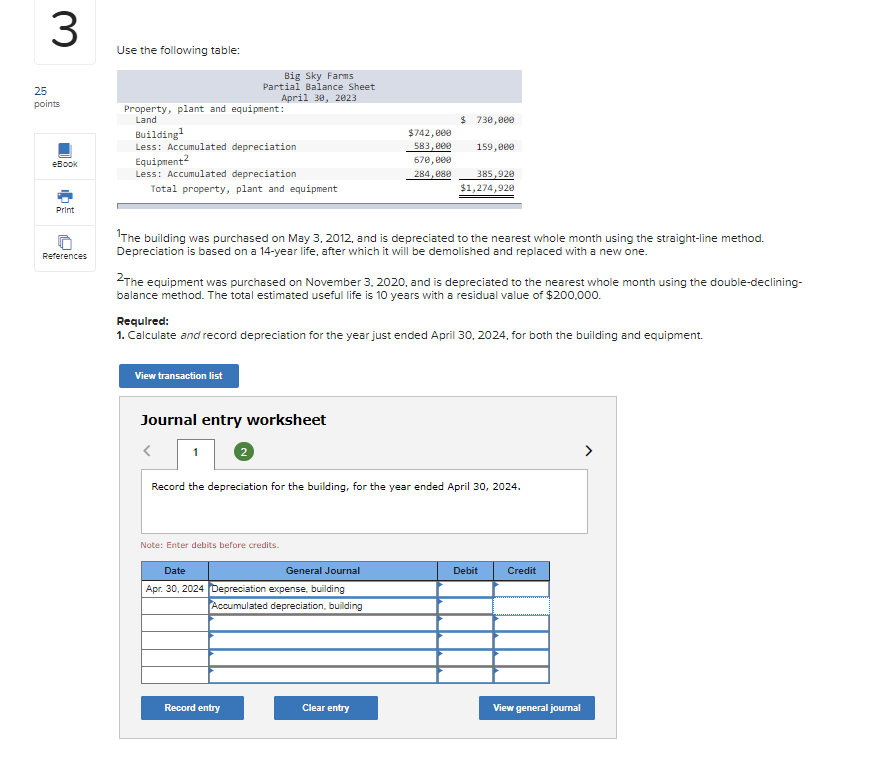

¹The building was purchased on May 3, 2012, and is depreciated to the nearest whole month using the straight-line method.

Depreciation is based on a 14-year life, after which it will be demolished and replaced with a new one.

Journal entry worksheet

1

2The equipment was purchased on November 3, 2020, and is depreciated to the nearest whole month using the double-declining-

balance method. The total estimated useful life is 10 years with a residual value of $200,000.

Required:

1. Calculate and record depreciation for the year just ended April 30, 2024, for both the building and equipment.

$742,000

583,000

670,000

284,080

Note: Enter debits before credits.

$ 730,000

Date

General Journal

Apr. 30, 2024 Depreciation expense, building

Accumulated depreciation, building

Record entry

159,000

385,920

$1,274,920

Record the depreciation for the building, for the year ended April 30, 2024.

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning