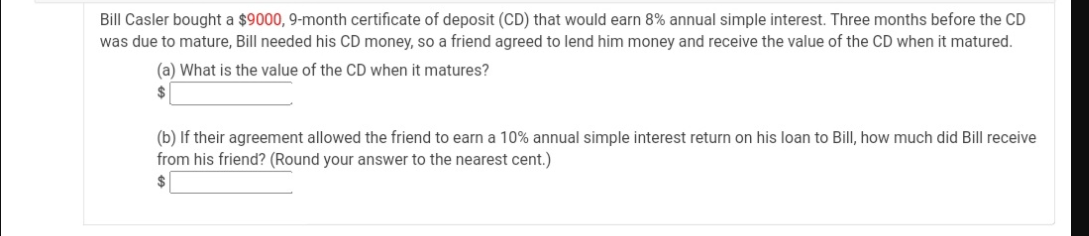

Bill Casler bought a $9000, 9-month certificate of deposit (CD) that would earn 8% annual simple interest. Three months before the CD was due to mature, Bill needed his CD money, so a friend agreed to lend him money and receive the value of the CD when it matured. (a) What is the value of the CD when it matures? $ (b) If their agreement allowed the friend to earn a 10% annual simple interest return on his loan to Bill, how much did Bill receive from his friend? (Round your answer to the nearest cent.)

Bill Casler bought a $9000, 9-month certificate of deposit (CD) that would earn 8% annual simple interest. Three months before the CD was due to mature, Bill needed his CD money, so a friend agreed to lend him money and receive the value of the CD when it matured. (a) What is the value of the CD when it matures? $ (b) If their agreement allowed the friend to earn a 10% annual simple interest return on his loan to Bill, how much did Bill receive from his friend? (Round your answer to the nearest cent.)

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

solve asap all the question with complete explanation and get upvotes

Transcribed Image Text:Bill Casler bought a $9000, 9-month certificate of deposit (CD) that would earn 8% annual simple interest. Three months before the CD

was due to mature, Bill needed his CD money, so a friend agreed to lend him money and receive the value of the CD when it matured.

(a) What is the value of the CD when it matures?

2$

(b) If their agreement allowed the friend to earn a 10% annual simple interest return on his loan to Bill, how much did Bill receive

from his friend? (Round your answer to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT