Chapter6: Investing And Financing Activities

Section: Chapter Questions

Problem 3.7C

Related questions

Question

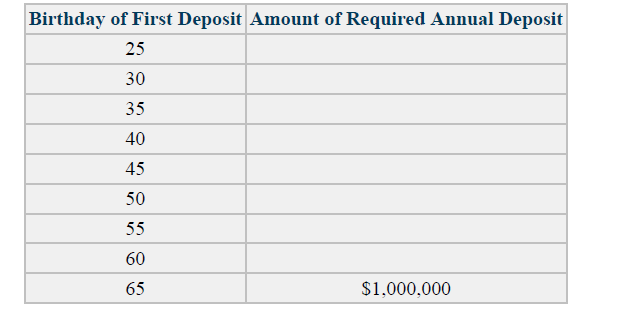

Financial planners (and engineering economists) unanimously encourage people to start early in planning for retirement. To illustrate this point, they frequently produce a table similar to the one below. Fill in the blank cells in this table assuming that your goal is to have $1,000,000 on your 65th birthday and that deposits start on the birthday shown and continue annually in the same amount on each birthday up to and including your 65th birthday. Assume that interest is compounded annually at 10%/year.

Transcribed Image Text:Birthday of First Deposit Amount of Required Annual Deposit

25

30

35

40

45

50

55

60

65

$1,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning