1. For each plan, determine the division of the net income under each of the following assumptions: (1) net income of $276,000 and (2) net income of $480,000. Present the data in tabular form, using the following columnar headings: $276,000

1. For each plan, determine the division of the net income under each of the following assumptions: (1) net income of $276,000 and (2) net income of $480,000. Present the data in tabular form, using the following columnar headings: $276,000

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.1BPR

Related questions

Question

Transcribed Image Text:Instructions

1. For each plan, determine the division of the net

income under each of the following assumptions:

(1) net income of $276,000 and (2) net income of

$480,000. Present the data in tabular form, using

the following columnar headings:

Plan

Black

$276,000

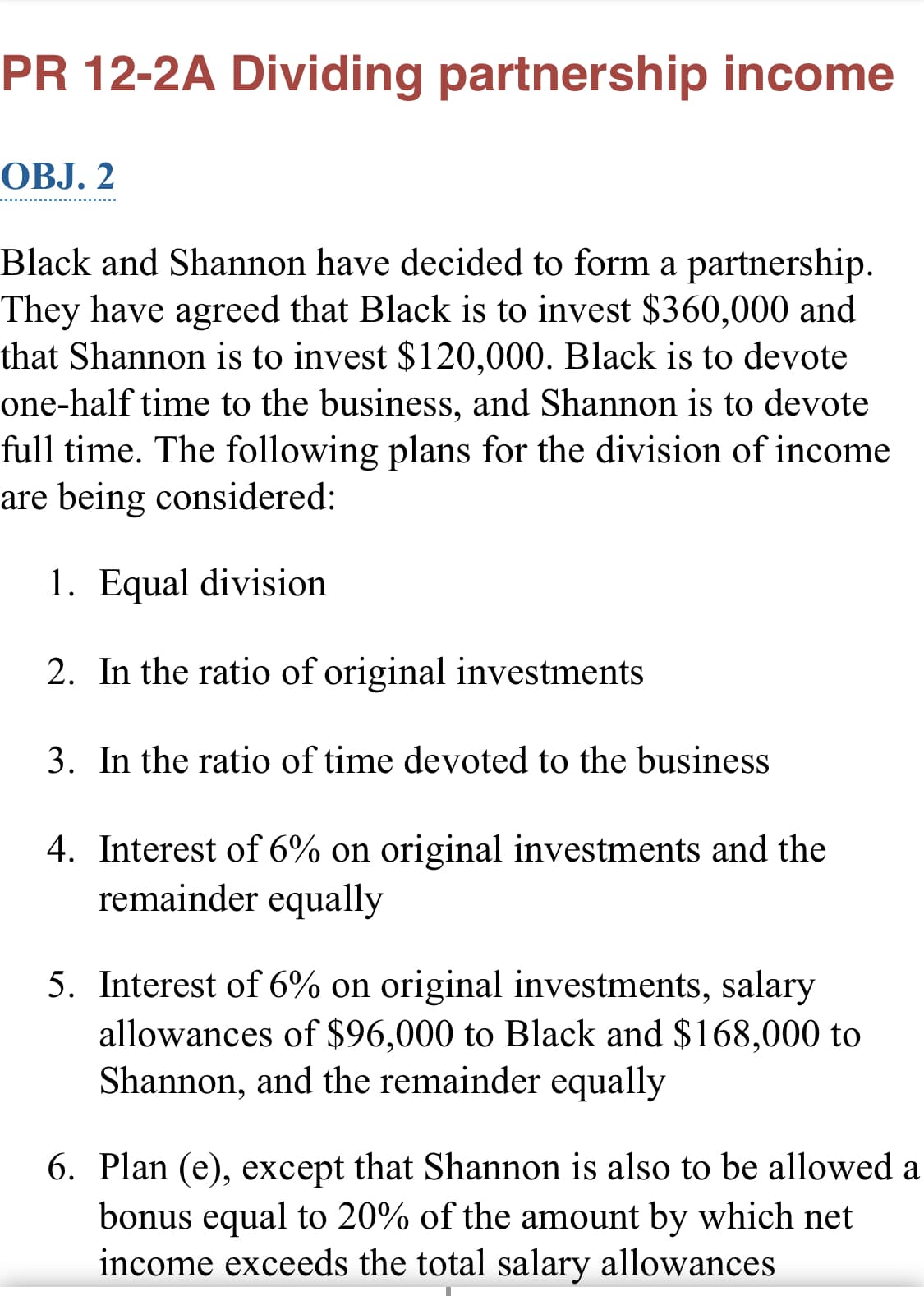

Transcribed Image Text:PR 12-2A Dividing partnership income

OBJ. 2

Black and Shannon have decided to form a partnership.

They have agreed that Black is to invest $360,000 and

that Shannon is to invest $120,000. Black is to devote

one-half time to the business, and Shannon is to devote

full time. The following plans for the division of income

are being considered:

1. Equal division

2. In the ratio of original investments

3. In the ratio of time devoted to the business

4. Interest of 6% on original investments and the

remainder equally

5. Interest of 6% on original investments, salary

allowances of $96,000 to Black and $168,000 to

Shannon, and the remainder equally

6. Plan (e), except that Shannon is also to be allowed a

bonus equal to 20% of the amount by which net

income exceeds the total salary allowances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,