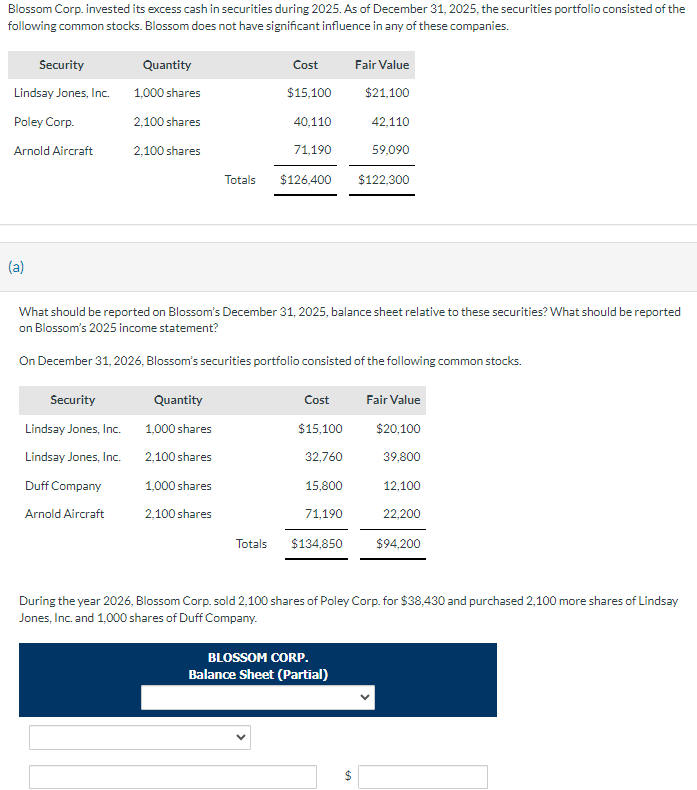

Blossom Corp. invested its excess cash in securities during 2025. As of December 31, 2025, the securities portfolio consisted of the following common stocks. Blossom does not have significant influence in any of these companies. Security Lindsay Jones, Inc. Quantity Cost Fair Value 1,000 shares $15,100 $21,100 Poley Corp. Arnold Aircraft 2,100 shares 40,110 42,110 2,100 shares 71,190 59,090 Totals $126,400 $122,300 (a) What should be reported on Blossom's December 31, 2025, balance sheet relative to these securities? What should be reported on Blossom's 2025 income statement? On December 31, 2026, Blossom's securities portfolio consisted of the following common stocks. Security Quantity Cost Fair Value Lindsay Jones, Inc. 1,000 shares $15,100 $20,100 Lindsay Jones, Inc. 2,100 shares 32,760 39,800 Duff Company 1,000 shares 15,800 12,100 Arnold Aircraft 2,100 shares 71,190 22,200 Totals $134,850 $94,200 During the year 2026, Blossom Corp. sold 2,100 shares of Poley Corp. for $38,430 and purchased 2,100 more shares of Lindsay Jones, Inc. and 1,000 shares of Duff Company. BLOSSOM CORP. Balance Sheet (Partial) $

Blossom Corp. invested its excess cash in securities during 2025. As of December 31, 2025, the securities portfolio consisted of the following common stocks. Blossom does not have significant influence in any of these companies. Security Lindsay Jones, Inc. Quantity Cost Fair Value 1,000 shares $15,100 $21,100 Poley Corp. Arnold Aircraft 2,100 shares 40,110 42,110 2,100 shares 71,190 59,090 Totals $126,400 $122,300 (a) What should be reported on Blossom's December 31, 2025, balance sheet relative to these securities? What should be reported on Blossom's 2025 income statement? On December 31, 2026, Blossom's securities portfolio consisted of the following common stocks. Security Quantity Cost Fair Value Lindsay Jones, Inc. 1,000 shares $15,100 $20,100 Lindsay Jones, Inc. 2,100 shares 32,760 39,800 Duff Company 1,000 shares 15,800 12,100 Arnold Aircraft 2,100 shares 71,190 22,200 Totals $134,850 $94,200 During the year 2026, Blossom Corp. sold 2,100 shares of Poley Corp. for $38,430 and purchased 2,100 more shares of Lindsay Jones, Inc. and 1,000 shares of Duff Company. BLOSSOM CORP. Balance Sheet (Partial) $

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 2MC: During 2021, Anthony Company purchased debt securities as a long-term investment and classified them...

Related questions

Question

Transcribed Image Text:Blossom Corp. invested its excess cash in securities during 2025. As of December 31, 2025, the securities portfolio consisted of the

following common stocks. Blossom does not have significant influence in any of these companies.

Security

Lindsay Jones, Inc.

Quantity

Cost

Fair Value

1,000 shares

$15,100

$21,100

Poley Corp.

Arnold Aircraft

2,100 shares

40,110

42,110

2,100 shares

71,190

59,090

Totals $126,400 $122,300

(a)

What should be reported on Blossom's December 31, 2025, balance sheet relative to these securities? What should be reported

on Blossom's 2025 income statement?

On December 31, 2026, Blossom's securities portfolio consisted of the following common stocks.

Security

Quantity

Cost

Fair Value

Lindsay Jones, Inc.

1,000 shares

$15,100

$20,100

Lindsay Jones, Inc.

2,100 shares

32,760

39,800

Duff Company

1,000 shares

15,800

12,100

Arnold Aircraft

2,100 shares

71,190

22,200

Totals

$134,850

$94,200

During the year 2026, Blossom Corp. sold 2,100 shares of Poley Corp. for $38,430 and purchased 2,100 more shares of Lindsay

Jones, Inc. and 1,000 shares of Duff Company.

BLOSSOM CORP.

Balance Sheet (Partial)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning