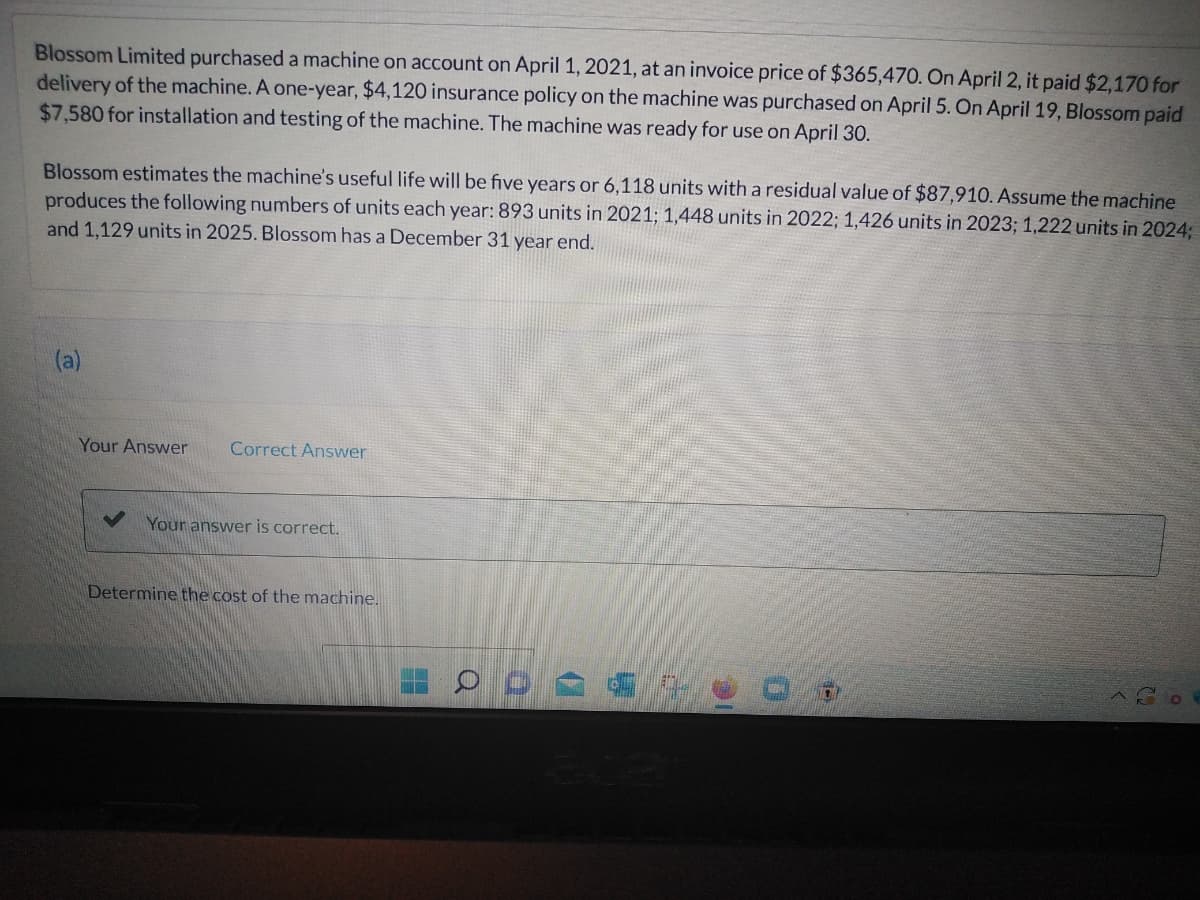

Blossom Limited purchased a machine on account on April 1, 2021, at an invoice price of $365,470. On April 2, it paid $2,170 for delivery of the machine. A one-year, $4,120 insurance policy on the machine was purchased on April 5. On April 19, Blossom paid $7,580 for installation and testing of the machine. The machine was ready for use on April 30. Blossom estimates the machine's useful life will be five years or 6,118 units with a residual value of $87,910. Assume the machine produces the following numbers of units each year: 893 units in 2021; 1,448 units in 2022; 1,426 units in 2023; 1,222 units in 2024; and 1,129 units in 2025. Blossom has a December 31 year end. (a) Your Answer Correct Answer ✓ Your answer is correct. Determine the cost of the machine.

Blossom Limited purchased a machine on account on April 1, 2021, at an invoice price of $365,470. On April 2, it paid $2,170 for delivery of the machine. A one-year, $4,120 insurance policy on the machine was purchased on April 5. On April 19, Blossom paid $7,580 for installation and testing of the machine. The machine was ready for use on April 30. Blossom estimates the machine's useful life will be five years or 6,118 units with a residual value of $87,910. Assume the machine produces the following numbers of units each year: 893 units in 2021; 1,448 units in 2022; 1,426 units in 2023; 1,222 units in 2024; and 1,129 units in 2025. Blossom has a December 31 year end. (a) Your Answer Correct Answer ✓ Your answer is correct. Determine the cost of the machine.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 9P: During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the...

Related questions

Question

2021-2026

Transcribed Image Text:Blossom Limited purchased a machine on account on April 1, 2021, at an invoice price of $365,470. On April 2, it paid $2,170 for

delivery of the machine. A one-year, $4,120 insurance policy on the machine was purchased on April 5. On April 19, Blossom paid

$7,580 for installation and testing of the machine. The machine was ready for use on April 30.

Blossom estimates the machine's useful life will be five years or 6,118 units with a residual value of $87,910. Assume the machine

produces the following numbers of units each year: 893 units in 2021; 1,448 units in 2022; 1,426 units in 2023; 1,222 units in 2024;

and 1,129 units in 2025. Blossom has a December 31 year end.

(a)

Your Answer Correct Answer

Your answer is correct.

Determine the cost of the machine.

ODA

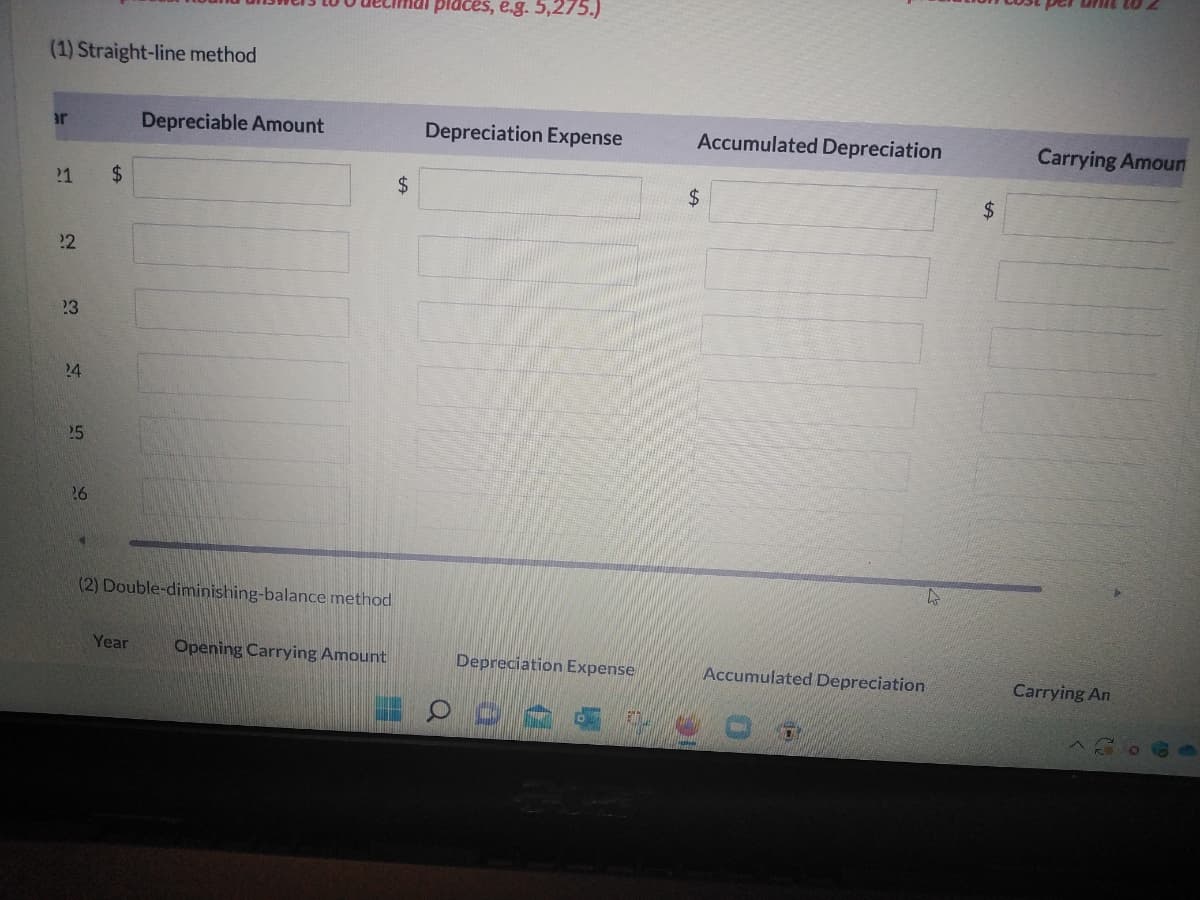

Transcribed Image Text:(1) Straight-line method

ar

21

22

23

24

$

26

(2) Double-diminishing-balance method

Year

Opening Carrying Amount

25

Depreciable Amount

$

places, e.g. 5,275.)

Depreciation Expense

Depreciation Expense

Accumulated Depreciation

$

Accumulated Depreciation

$

Carrying Amoun

Carrying An

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College