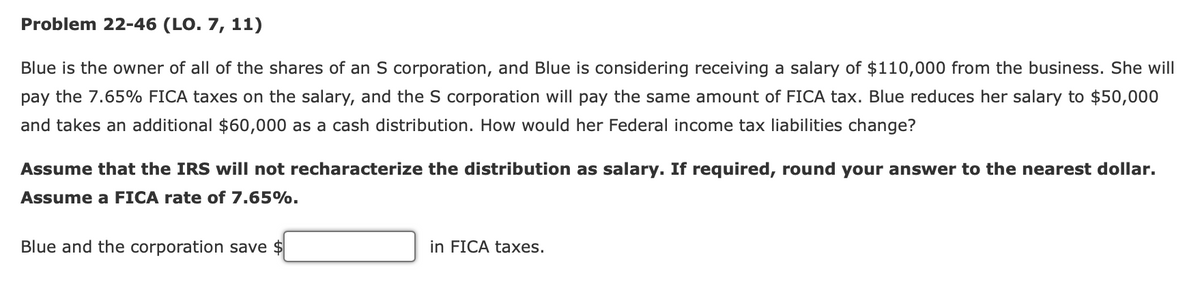

Blue is the owner of all of the shares of an S corporation, and Blue is considering receiving a salary of $110,000 from the business. She will pay the 7.65% FICA taxes on the salary, and the S corporation will pay the same amount of FICA tax. Blue reduces her salary to $50,000 and takes an additional $60,000 as a cash distribution. How would her Federal income tax liabilities change? Assume that the IRS will not recharacterize the distribution as salary. If required, round your answer to the nearest dollar. Assume a FICA rate of 7.65%. Blue and the corporation save $ in FICA taxes.

Blue is the owner of all of the shares of an S corporation, and Blue is considering receiving a salary of $110,000 from the business. She will pay the 7.65% FICA taxes on the salary, and the S corporation will pay the same amount of FICA tax. Blue reduces her salary to $50,000 and takes an additional $60,000 as a cash distribution. How would her Federal income tax liabilities change? Assume that the IRS will not recharacterize the distribution as salary. If required, round your answer to the nearest dollar. Assume a FICA rate of 7.65%. Blue and the corporation save $ in FICA taxes.

Chapter22: S Corporations

Section: Chapter Questions

Problem 52P

Related questions

Question

4.

Transcribed Image Text:Problem 22-46 (LO. 7, 11)

Blue is the owner of all of the shares of an S corporation, and Blue is considering receiving a salary of $110,000 from the business. She will

pay the 7.65% FICA taxes on the salary, and the S corporation will pay the same amount of FICA tax. Blue reduces her salary to $50,000

and takes an additional $60,000 as a cash distribution. How would her Federal income tax liabilities change?

Assume that the IRS will not recharacterize the distribution as salary. If required, round your answer to the nearest dollar.

Assume a FICA rate of 7.65%.

Blue and the corporation save $

in FICA taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you