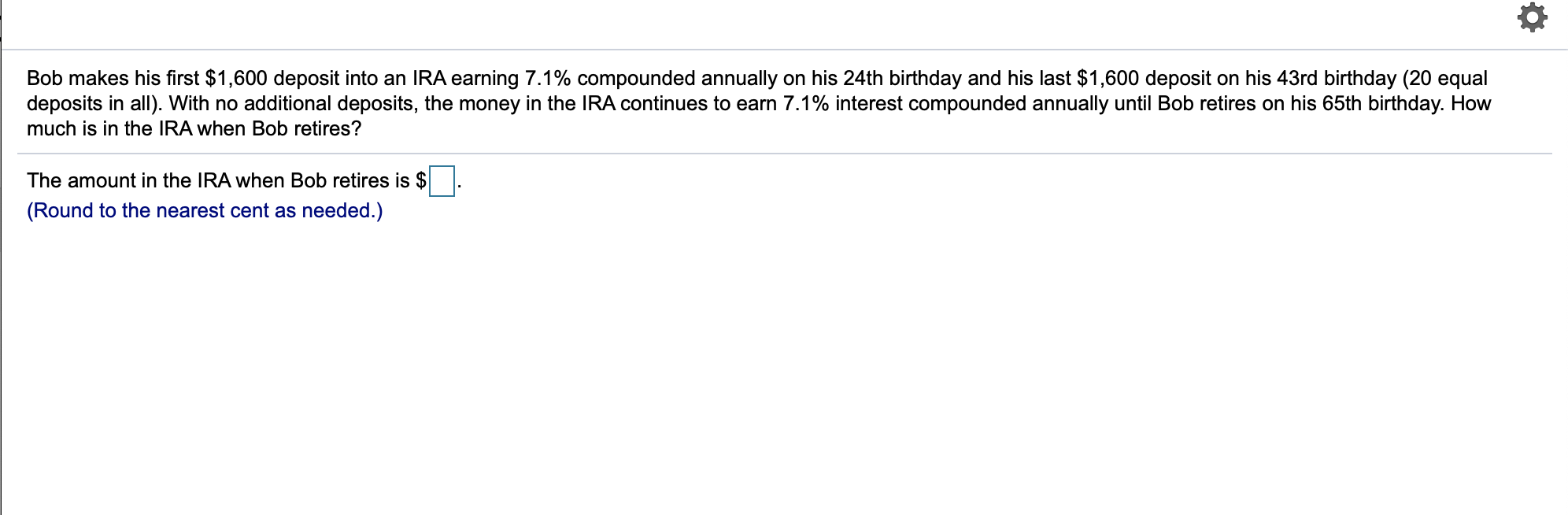

Bob makes his first $1,600 deposit into an IRA earning 7.1% compounded annually on his 24th birthday and his last $1,600 deposit on his 43rd birthday (20 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 7.1% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when Bob retires? The amount in the IRA when Bob retiress is $ (Round to the nearest cent as needed.)

Bob makes his first $1,600 deposit into an IRA earning 7.1% compounded annually on his 24th birthday and his last $1,600 deposit on his 43rd birthday (20 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 7.1% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when Bob retires? The amount in the IRA when Bob retiress is $ (Round to the nearest cent as needed.)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 13E

Related questions

Question

Transcribed Image Text:Bob makes his first $1,600 deposit into an IRA earning 7.1% compounded annually on his 24th birthday and his last $1,600 deposit on his 43rd birthday (20 equal

deposits in all). With no additional deposits, the money in the IRA continues to earn 7.1% interest compounded annually until Bob retires on his 65th birthday. How

much is in the IRA when Bob retires?

The amount in the IRA when Bob retiress is $

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT