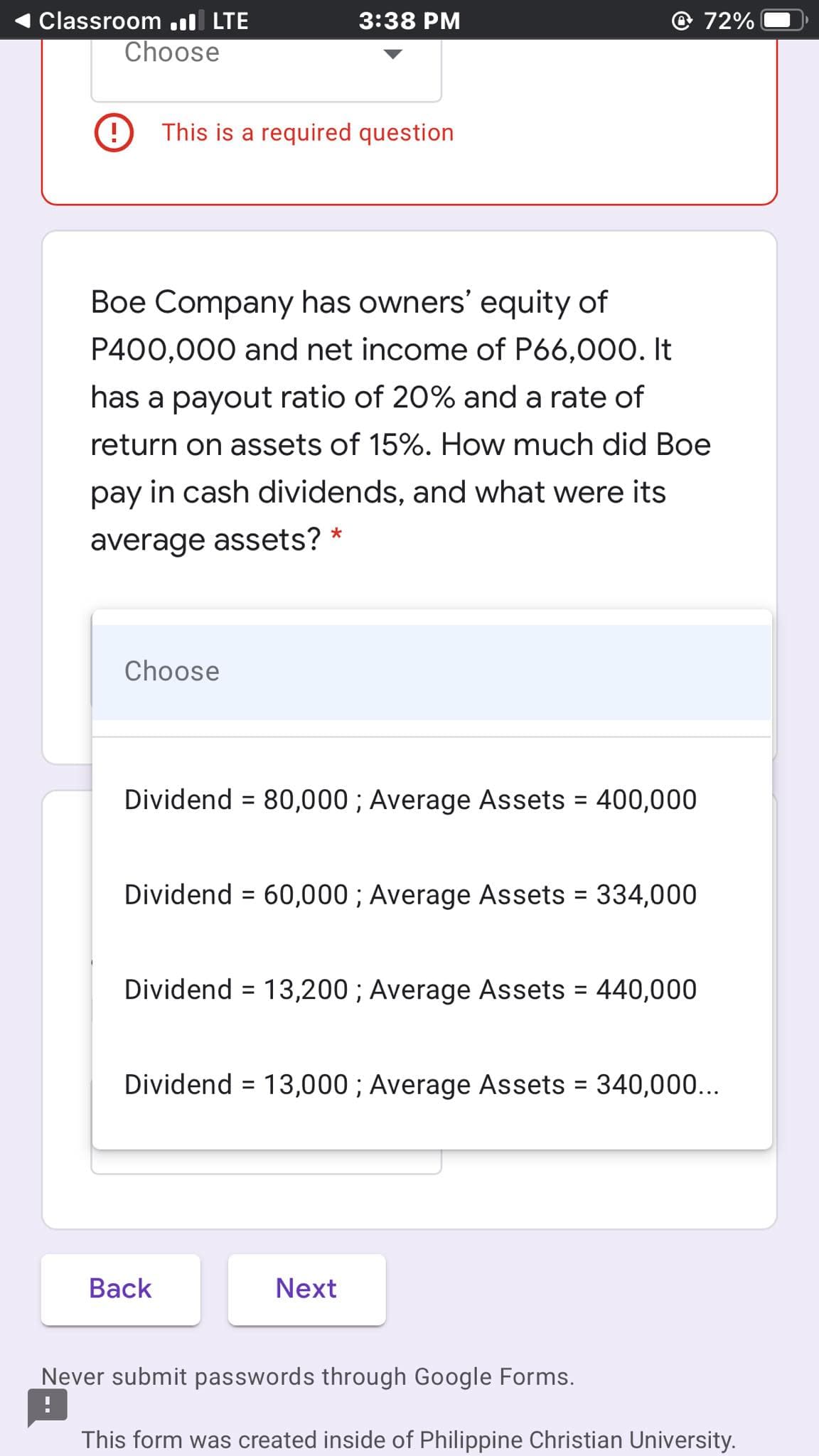

Boe Company has owners' equity of P400,000 and net income of P66,000. It has a payout ratio of 20% and a rate of return on assets of 15%. How much did Boe pay in cash dividends, and what were its average assets? * Choose Dividend = 80,000 ; Average Assets = 400,000 %3D Dividend = 60,000 ; Average Assets = 334,000 %3D Dividend = 13,200 ; Average Assets = 440,000 %3D %3D Dividend = 13,000 ; Average Assets = 340,00... %3D %3D

Boe Company has owners' equity of P400,000 and net income of P66,000. It has a payout ratio of 20% and a rate of return on assets of 15%. How much did Boe pay in cash dividends, and what were its average assets? * Choose Dividend = 80,000 ; Average Assets = 400,000 %3D Dividend = 60,000 ; Average Assets = 334,000 %3D Dividend = 13,200 ; Average Assets = 440,000 %3D %3D Dividend = 13,000 ; Average Assets = 340,00... %3D %3D

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10PROB

Related questions

Question

Transcribed Image Text:Classroom .ıl LTE

3:38 PM

72%

Choose

This is a required question

Boe Company has owners' equity of

P400,000 and net income of P66,000. It

has a payout ratio of 20% and a rate of

return on assets of 15%. How much did Boe

pay in cash dividends, and what were its

average assets?

Choose

Dividend = 80,000 ; Average Assets = 400,000

%3D

Dividend = 60,000 ; Average Assets = 334,000

%3D

%3D

Dividend = 13,200 ; Average Assets = 440,000

Dividend = 13,000 ; Average Assets = 340,00...

Back

Next

Never submit passwords through Google Forms.

This form was created inside of Philippine Christian University.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning