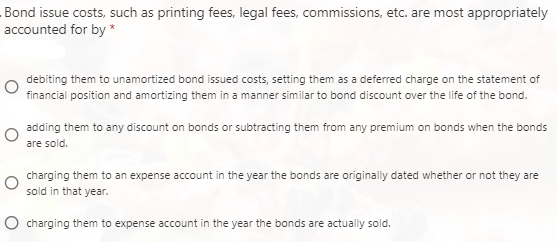

Bond issue costs, such as printing fees, legal fees, commissions, etc. are most appropriately accounted for by * debiting them to unamortized bond issued costs, setting them as a deferred charge on the statement of financial position and amortizing them in a manner similar to bond discount over the life of the bond. adding them to any discount on bonds or subtracting them from any premium on bonds when the bonds are sold. charging them to an expense account in the year the bonds are originally dated whether or not they are sold in that year. O charging them to expense account in the year the bonds are actually sold.

Bond issue costs, such as printing fees, legal fees, commissions, etc. are most appropriately accounted for by * debiting them to unamortized bond issued costs, setting them as a deferred charge on the statement of financial position and amortizing them in a manner similar to bond discount over the life of the bond. adding them to any discount on bonds or subtracting them from any premium on bonds when the bonds are sold. charging them to an expense account in the year the bonds are originally dated whether or not they are sold in that year. O charging them to expense account in the year the bonds are actually sold.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 10MC: The effective-interest method of bond amortization finds the difference between the ________ times...

Related questions

Question

t1

Transcribed Image Text:Bond issue costs, such as printing fees, legal fees, commissions, etc. are most appropriately

accounted for by *

debiting them to unamortized bond issued costs, setting them as a deferred charge on the statement of

financial position and amortizing them in a manner similar to bond discount over the life of the bond.

adding them to any discount on bonds or subtracting them from any premium on bonds when the bonds

are sold.

charging them to an expense account in the year the bonds are originally dated whether or not they are

sold in that year.

O charging them to expense account in the year the bonds are actually sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning