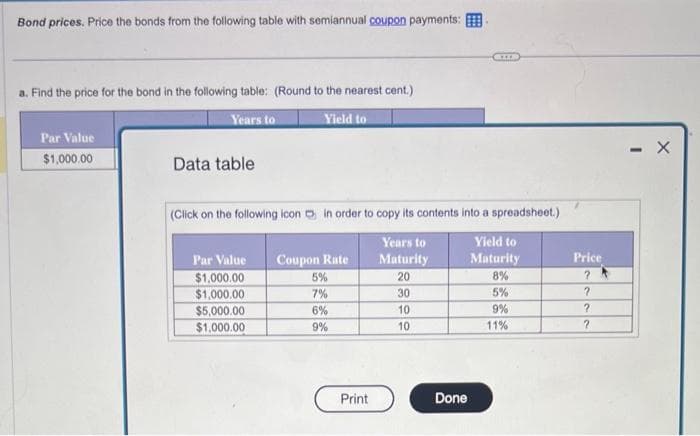

Bond prices. Price the bonds from the following table with semiannual coupon payments: a. Find the price for the bond in the following table: (Round to the nearest cent.) Years to Yield to Par Value $1,000.00 Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yield to Maturity 8% Par Value Coupon Rate $1,000.00 $1,000.00 $5,000.00 $1,000.00 5% 7% 6% 9% Print Years to Maturity 20 30 10 10 HTTP Done 5% 9% 11% Price ? ? ? ? - X

Bond prices. Price the bonds from the following table with semiannual coupon payments: a. Find the price for the bond in the following table: (Round to the nearest cent.) Years to Yield to Par Value $1,000.00 Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yield to Maturity 8% Par Value Coupon Rate $1,000.00 $1,000.00 $5,000.00 $1,000.00 5% 7% 6% 9% Print Years to Maturity 20 30 10 10 HTTP Done 5% 9% 11% Price ? ? ? ? - X

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 7P: Bond Valuation with Semiannual Payments

Renfro Rentals has issued bonds that have a 10% coupon rate,...

Related questions

Question

Transcribed Image Text:Bond prices. Price the bonds from the following table with semiannual coupon payments:

a. Find the price for the bond in the following table: (Round to the nearest cent.)

Years to

Yield to

Par Value

$1,000.00

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Yield to

Maturity

8%

Par Value Coupon Rate

$1,000.00

$1,000.00

$5,000.00

$1,000.00

5%

7%

6%

9%

Print

Years to

Maturity

20

30

10

10

HTTP

Done

5%

9%

11%

Price

?

?

?

?

- X

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning