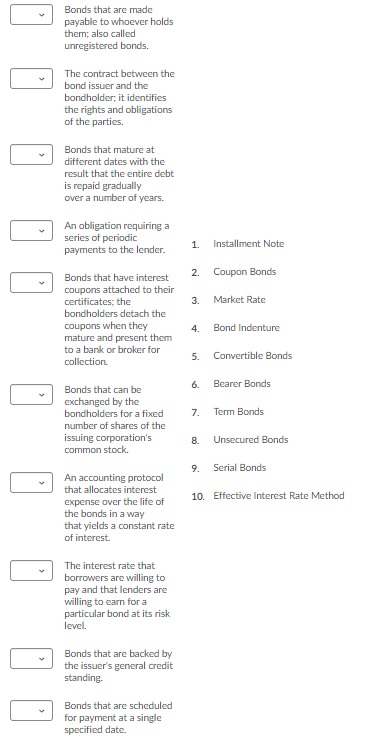

Bonds that are made payable to whoever holds them; also called unregistered bonds. The contract between the bond issuer and the bondholder; it identifies the rights and obligations of the parties. Bonds that mature at different dates with the result that the entire debt is repaid gradually over a number of ycars. An obligation requiring a series of periodic payments to the lender. 1. Installment Note 2 Coupon Bonds Bonds that have interest coupons attached to their certificates; the bondholders detach the coupons when they mature and present them to a bank or broker for collection. 3. Market Rate 4. Bond Indenture 5. Convertible Bonds 6. Bearer Bonds Bonds that can be exchanged by the bondholders for a fixed Term Bonds number of shares of the issuing corporation's common stock. 8. Unsecured Bonds 9. Serial Bonds An accounting protocol that allocates interest 10. Effective Interest Rate Method expense over the life of the bonds in a way that yields a constant rate of interest. The interest rate that borrowers are willing to pay and that lenders are willing to earn for a particular bond at its risk level. Bonds that are backed by the issuer's general credit standing. Bonds that are scheduled for payment at a single specified date. 7.

Bonds that are made payable to whoever holds them; also called unregistered bonds. The contract between the bond issuer and the bondholder; it identifies the rights and obligations of the parties. Bonds that mature at different dates with the result that the entire debt is repaid gradually over a number of ycars. An obligation requiring a series of periodic payments to the lender. 1. Installment Note 2 Coupon Bonds Bonds that have interest coupons attached to their certificates; the bondholders detach the coupons when they mature and present them to a bank or broker for collection. 3. Market Rate 4. Bond Indenture 5. Convertible Bonds 6. Bearer Bonds Bonds that can be exchanged by the bondholders for a fixed Term Bonds number of shares of the issuing corporation's common stock. 8. Unsecured Bonds 9. Serial Bonds An accounting protocol that allocates interest 10. Effective Interest Rate Method expense over the life of the bonds in a way that yields a constant rate of interest. The interest rate that borrowers are willing to pay and that lenders are willing to earn for a particular bond at its risk level. Bonds that are backed by the issuer's general credit standing. Bonds that are scheduled for payment at a single specified date. 7.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.1KTQ

Related questions

Question

Transcribed Image Text:Bonds that are made

payable to whoever holds

them; also called

unregistered bonds.

The contract between the

bond issuer and the

bondholder; it identifies

the rights and obligations

of the parties.

Bonds that mature at

different dates with the

result that the entire debt

is repaid gradually

over a number of years.

An obligation requiring a

series of periodic

payments to the lender.

1.

Installment Note

2.

Coupon Bonds

Bonds that have interest

coupons attached to their

certificates; the

bondholders detach the

coupons when they

mature and present them

to a bank or broker for

3.

Market Rate

4.

Bond Indenture

5.

Convertible Bonds

collection.

6.

Bearer Bonds

Bonds that can be

exchanged by the

bondholders for a fixed

7.

Term Bonds

number of shares of the

issuing corporation's

common stock.

8.

Unsecured Bonds

9.

Serial Bonds

An accounting protocol

that allocates interest

10. Effective Interest Rate Method

expense over the life of

the bonds in a way

that yields a constant rate

of interest.

The interest rate that

borrowers are willing to

pay and that lenders are

willing to earn for a

particular bond at its risk

level.

Bonds that are backed by

the issuer's general credit

standing.

Bonds that are scheduled

for payment at a single

specified date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning