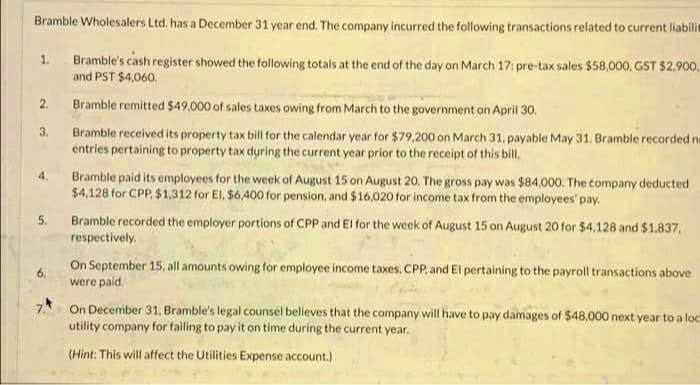

Bramble Wholesalers Ltd. has a December 31 year end. The company incurred the following transactions related to current liabil 1. Bramble's cash register showed the following totals at the end of the day on March 17: pre-tax sales $58,000, GST $2,900 and PST $4,060. 2. Bramble remitted $49,000 of sales taxes owing from March to the government on April 30. 3. Bramble received its property tax bill for the calendar year for $79,200 on March 31, payable May 31. Bramble recordedi entries pertaining to property tax during the current year prior to the receipt of this bill. 4. Bramble paid its employees for the week of August 15 on August 20. The gross pay was $84,000. The company deducted $4,128 for CPP, $1,312 for El, $6,400 for pension, and $16,020 for income tax from the employees' pay. 5. Bramble recorded the employer portions of CPP and El for the week of August 15 on August 20 for $4,128 and $1.837, respectively. 6. On September 15, all amounts owing for employee income taxes. CPP, and El pertaining to the payroll transactions above were paid. 7 On December 31, Bramble's legal counsel believes that the company will have to pay damages of $48,000 next year to a la utility company for failing to pay it on time during the current year. (Hint: This will affect the Utilities Expense account.)

Bramble Wholesalers Ltd. has a December 31 year end. The company incurred the following transactions related to current liabil 1. Bramble's cash register showed the following totals at the end of the day on March 17: pre-tax sales $58,000, GST $2,900 and PST $4,060. 2. Bramble remitted $49,000 of sales taxes owing from March to the government on April 30. 3. Bramble received its property tax bill for the calendar year for $79,200 on March 31, payable May 31. Bramble recordedi entries pertaining to property tax during the current year prior to the receipt of this bill. 4. Bramble paid its employees for the week of August 15 on August 20. The gross pay was $84,000. The company deducted $4,128 for CPP, $1,312 for El, $6,400 for pension, and $16,020 for income tax from the employees' pay. 5. Bramble recorded the employer portions of CPP and El for the week of August 15 on August 20 for $4,128 and $1.837, respectively. 6. On September 15, all amounts owing for employee income taxes. CPP, and El pertaining to the payroll transactions above were paid. 7 On December 31, Bramble's legal counsel believes that the company will have to pay damages of $48,000 next year to a la utility company for failing to pay it on time during the current year. (Hint: This will affect the Utilities Expense account.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

Transcribed Image Text:Bramble Wholesalers Ltd. has a December 31 year end. The company incurred the following transactions related to current liabili

Bramble's cash register showed the following totals at the end of the day on March 17: pre-tax sales $58,000, GST $2.900,

and PST $4,060.

1.

2.

Bramble remitted $49,000 of sales taxes owing from March to the government on April 30.

Bramble received its property tax bill for the calendar year for $79,200 on March 31, payable May 31. Bramble recorded ne

entries pertaining to property tax during the current year prior to the receipt of this bill.

3.

Bramble paid its employees for the week of August 15 on August 20. The gross pay was $84,000. The company deducted

$4,128 for CPP, $1.312 for El, $6,400 for pension, and $16,020 for income tax from the employees' pay,

4.

5.

Bramble recorded the employer portions of CPP and El for the week of August 15 on August 20 for $4,128 and $1.837.

respectively.

On September 15, all amounts owing for employee income taxes, CPP, and El pertaining to the payroll transactions above

were paid.

6.

7.*

On December 31, Bramble's legal counsel believes that the company will have to pay damages of $48,000 next year to a loc

utility company for failing to pay it on time during the current year.

(Hint: This will affect the Utilities Expense account.)

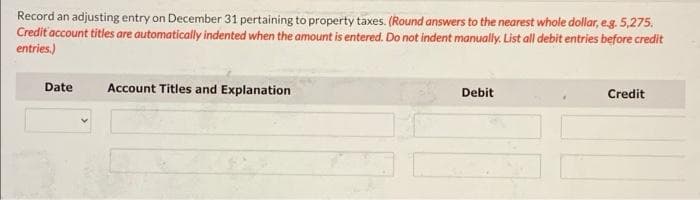

Transcribed Image Text:Record an adjusting entry on December 31 pertaining to property taxes. (Round answers to the nearest whole dollar, eg. 5,275.

Credit 'account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit

entries.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage