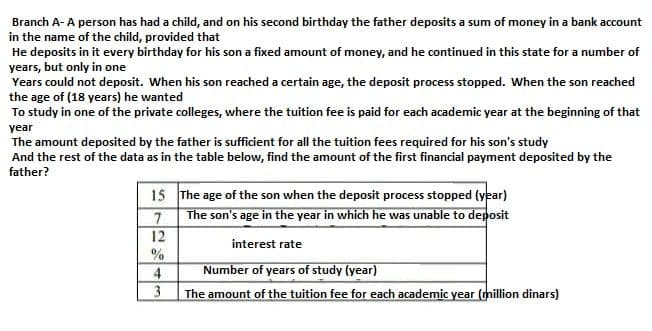

Branch A-A person has had a child, and on his second birthday the father deposits a sum of money in a bank account in the name of the child, provided that He deposits in it every birthday for his son a fixed amount of money, and he continued in this state for a number of years, but only in one Years could not deposit. When his son reached a certain age, the deposit process stopped. When the son reached the age of (18 years) he wanted To study in one of the private colleges, where the tuition fee is paid for each academic year at the beginning of that year The amount deposited by the father is sufficient for all the tuition fees required for his son's study And the rest of the data as in the table below, find the amount of the first financial payment deposited by the father? 15 The age of the son when the deposit process stopped (year) 7The son's age in the year in which he was unable to deposit 12 interest rate 4 Number of years of study (year) 3 The amount of the tuition fee for each academic year (million dinars)

Branch A-A person has had a child, and on his second birthday the father deposits a sum of money in a bank account in the name of the child, provided that He deposits in it every birthday for his son a fixed amount of money, and he continued in this state for a number of years, but only in one Years could not deposit. When his son reached a certain age, the deposit process stopped. When the son reached the age of (18 years) he wanted To study in one of the private colleges, where the tuition fee is paid for each academic year at the beginning of that year The amount deposited by the father is sufficient for all the tuition fees required for his son's study And the rest of the data as in the table below, find the amount of the first financial payment deposited by the father? 15 The age of the son when the deposit process stopped (year) 7The son's age in the year in which he was unable to deposit 12 interest rate 4 Number of years of study (year) 3 The amount of the tuition fee for each academic year (million dinars)

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 50P

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Branch A- A person has had a child, and on his second birthday the father deposits a sum of money in a bank account

in the name of the child, provided that

He deposits in it every birthday for his son a fixed amount of money, and he continued in this state for a number of

years, but only in one

Years could not deposit. When his son reached a certain age, the deposit process stopped. When the son reached

the age of (18 years) he wanted

To study in one of the private colleges, where the tuition fee is paid for each academic year at the beginning of that

year

The amount deposited by the father is sufficient for all the tuition fees required for his son's study

And the rest of the data as in the table below, find the amount of the first financial payment deposited by the

father?

15 The age of the son when the deposit process stopped (year)

7 The son's age in the year in which he was unable to deposit

12

%

interest rate

4

Number of years of study (year)

3

The amount of the tuition fee for each academic year (million dinars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT