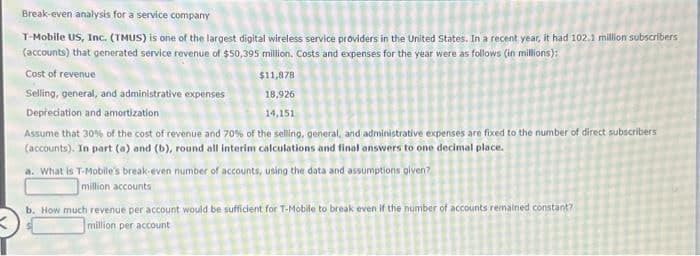

Break-even analysis for a service company T-Mobile US, Inc. (TMUS) is one of the largest digital wireless service providers in the United States. In a recent year, it had 102.1 million subscribers (accounts) that generated service revenue of $50,395 million. Costs and expenses for the year were as follows (in millions): Cost of revenue $11,878 Selling, general, and administrative expenses 18,926 Depreciation and amortization 14,151 Assume that 30% of the cost of revenue and 70% of the selling, general, and administrative expenses are fixed to the number of direct subscribers (accounts). In part (a) and (b), round all interim calculations and final answers to one decimal place. a. What is T-Mobile's break-even number of accounts, using the data and assumptions given? million accounts b. How much revenue per account would be sufficient for T-Mobile to break even if the number of accounts remained constant? million per account

Break-even analysis for a service company T-Mobile US, Inc. (TMUS) is one of the largest digital wireless service providers in the United States. In a recent year, it had 102.1 million subscribers (accounts) that generated service revenue of $50,395 million. Costs and expenses for the year were as follows (in millions): Cost of revenue $11,878 Selling, general, and administrative expenses 18,926 Depreciation and amortization 14,151 Assume that 30% of the cost of revenue and 70% of the selling, general, and administrative expenses are fixed to the number of direct subscribers (accounts). In part (a) and (b), round all interim calculations and final answers to one decimal place. a. What is T-Mobile's break-even number of accounts, using the data and assumptions given? million accounts b. How much revenue per account would be sufficient for T-Mobile to break even if the number of accounts remained constant? million per account

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 16E: Break-even analysis for a service company3 Sprint Corporation (S) is one of the largest digital...

Related questions

Question

answer in text form please (without image)

Transcribed Image Text:Break-even analysis for a service company

T-Mobile US, Inc. (TMUS) is one of the largest digital wireless service providers in the United States. In a recent year, it had 102.1 million subscribers

(accounts) that generated service revenue of $50,395 million. Costs and expenses for the year were as follows (in millions):

Cost of revenue

Selling, general, and administrative expenses

$11,878

18,926

Depreciation and amortization

14,151

Assume that 30% of the cost of revenue and 70% of the selling, general, and administrative expenses are fixed to the number of direct subscribers

(accounts). In part (a) and (b), round all interim calculations and final answers to one decimal place.

a. What is T-Mobile's break-even number of accounts, using the data and assumptions given?

million accounts

b. How much revenue per account would be sufficient for T-Mobile to break even if the number of accounts remained constant?

million per account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub