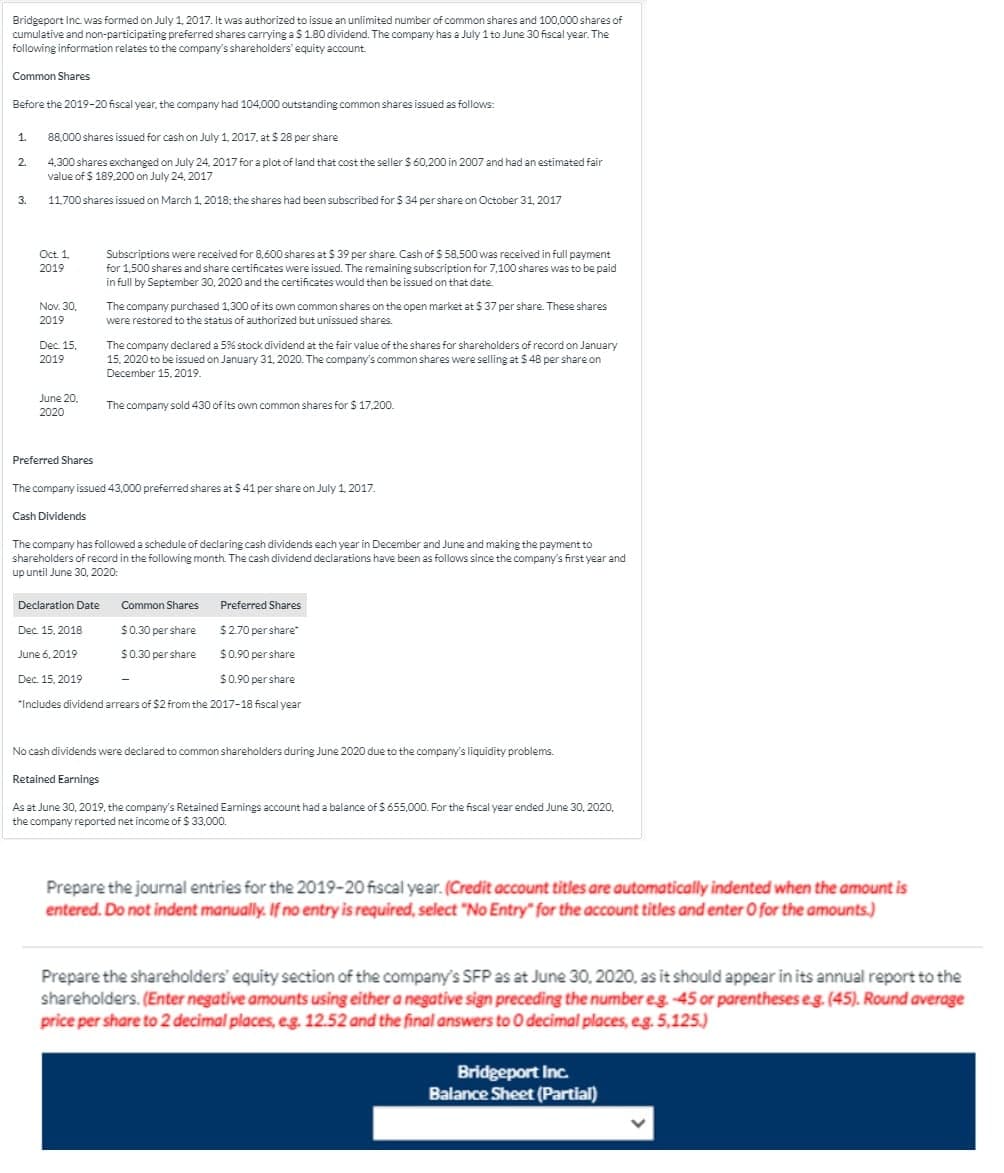

Bridgeport Inc was formed on July 1, 2017. It was authorized to issue an unlimited number of common shares and 100,000 shares of cumulative and non-participating preferred shares carrying a$1.80 dividend. The company has a July 1 to June 30 fiscal year. The following information relates to the company's shareholders' equity account. Common Shares Before the 2019-20 fiscal year, the company had 104.000 outstanding common shares issued as follows: 1. 88,000 shares issued for cash on July 1, 2017. at $ 28 per share 4,300 shares exchanged on July 24, 2017 for a plot of land that cost the seller $ 60,200 in 2007 and had an estimated fair value of $ 189,200 on July 24, 2017 2. 3. 11700 shares issued on March 1, 2018; the shares had been subscribed for $ 34 per share on October 31, 2017 Oct 1. Subscriptions were received for 8,600 shares at $ 39 per share Cash of $ 58,500 was received in full payment 2019 for 1,500 shares and share certificates were issued. The remaining subscription for 7,100 shares was to be paid in full by September 30, 2020 and the certificates would then be issued on that date. Nov. 30, The company purchased 1,300 of its own common shares on the open market at $ 37 per share. These shares were restored to the status of authorized but unissued shares. 2019 Dec 15. The company declared a 5% stock dividend at the fair value of the shares for shareholders of record on January 15, 2020 to be issued on January 31, 2020. The company's common shares were selling at $ 48 per share on December 15, 2019. 2019 June 20, The company sold 430 of its own common shares for $ 17.200. 2020 Preferred Shares The company isued 43,000 preferred shares at $ 41 per share on July 1, 2017. Cash Dividends The company has followed a schedule of declaring cash dividends each year in December and June and making the payment to shareholders of record in the following month. The cash dividend declarations have been as follows since the company's first year and up until June 30, 2020: Declaration Date Common Shares Preferred Shares Dec. 15, 2018 $0.30 per share $270 per share " June 6, 2019 $0.30 per share $0.90 per share Dec. 15, 2019 S0.90 per share "Includes dividend arrears of $2 from the 2017-18 fiscal year No cash dividends were declared to common shareholders during June 2020 due to the company's liquidity problems. Retained Earnings As at June 30, 2019. the company's Retained Earnings account had a balance of $ 655.000. For the fiscal year ended June 30, 2020, the company reported net income of $ 33,000. . Prepare the journal entries for the 2019-20 fiscal year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Prepare the shareholders' equity section of the company's SFP as at June 30, 2020, as it should appear in its annual report to the shareholders. (Enter negative amounts using either a negative sign preceding the number eg 45 or parentheses eg. (45). Round average price per share to 2 decimal places, eg. 12.52 and the final answers to O decimal places, eg. 5,125.) Bridgeport Inc. Balance Sheet (Partial)

Bridgeport Inc was formed on July 1, 2017. It was authorized to issue an unlimited number of common shares and 100,000 shares of cumulative and non-participating preferred shares carrying a$1.80 dividend. The company has a July 1 to June 30 fiscal year. The following information relates to the company's shareholders' equity account. Common Shares Before the 2019-20 fiscal year, the company had 104.000 outstanding common shares issued as follows: 1. 88,000 shares issued for cash on July 1, 2017. at $ 28 per share 4,300 shares exchanged on July 24, 2017 for a plot of land that cost the seller $ 60,200 in 2007 and had an estimated fair value of $ 189,200 on July 24, 2017 2. 3. 11700 shares issued on March 1, 2018; the shares had been subscribed for $ 34 per share on October 31, 2017 Oct 1. Subscriptions were received for 8,600 shares at $ 39 per share Cash of $ 58,500 was received in full payment 2019 for 1,500 shares and share certificates were issued. The remaining subscription for 7,100 shares was to be paid in full by September 30, 2020 and the certificates would then be issued on that date. Nov. 30, The company purchased 1,300 of its own common shares on the open market at $ 37 per share. These shares were restored to the status of authorized but unissued shares. 2019 Dec 15. The company declared a 5% stock dividend at the fair value of the shares for shareholders of record on January 15, 2020 to be issued on January 31, 2020. The company's common shares were selling at $ 48 per share on December 15, 2019. 2019 June 20, The company sold 430 of its own common shares for $ 17.200. 2020 Preferred Shares The company isued 43,000 preferred shares at $ 41 per share on July 1, 2017. Cash Dividends The company has followed a schedule of declaring cash dividends each year in December and June and making the payment to shareholders of record in the following month. The cash dividend declarations have been as follows since the company's first year and up until June 30, 2020: Declaration Date Common Shares Preferred Shares Dec. 15, 2018 $0.30 per share $270 per share " June 6, 2019 $0.30 per share $0.90 per share Dec. 15, 2019 S0.90 per share "Includes dividend arrears of $2 from the 2017-18 fiscal year No cash dividends were declared to common shareholders during June 2020 due to the company's liquidity problems. Retained Earnings As at June 30, 2019. the company's Retained Earnings account had a balance of $ 655.000. For the fiscal year ended June 30, 2020, the company reported net income of $ 33,000. . Prepare the journal entries for the 2019-20 fiscal year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Prepare the shareholders' equity section of the company's SFP as at June 30, 2020, as it should appear in its annual report to the shareholders. (Enter negative amounts using either a negative sign preceding the number eg 45 or parentheses eg. (45). Round average price per share to 2 decimal places, eg. 12.52 and the final answers to O decimal places, eg. 5,125.) Bridgeport Inc. Balance Sheet (Partial)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 18E: Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares...

Related questions

Question

answer quickly

Transcribed Image Text:Bridgeport Inc was formed on July 1, 2017. It was authorized to issue an unlimited number of common shares and 100,000 shares of

cumulative and non-participating preferred shares carrying a $1.80 dividend. The company has a July 1 to June 30 fiscal year. The

following information relates to the company's shareholders' equity account.

Common Shares

Before the 2019-20 fiscal year, the company had 104,000 outstanding common shares issued as follows:

1.

88.000 shares issued for cash on July 1, 2017. at $28 per share

4.300 shares exchanged on July 24. 2017 for a plot of land that cost the seller $ 60,200 in 2007 and had an estimated fair

value of $ 189.200 on July 24, 2017

2.

3.

11.700 shares issued on March 1, 2018: the shares had been subscribed for $ 34 per share on October 31, 2017

Oct. 1

Subscriptions were received for 8,600 shares at $ 39 per share Cash of $ 58,500 was received in full payment

for 1,500 shares and share certificates were issued. The remaining subscription for 7,100 shares was to be paid

in full by September 30, 2020 and the certificates would then be issued on that date

2019

Nov. 30,

The company purchased 1,300 ofits own common shares on the open market at $ 37 per share. These shares

2019

were restored to the status of authorized but unissued shares.

Dec 15,

The company declared a 5% stock dividend at the fair value of the shares for shareholders of record on January

15. 2020 to be issued on January 31, 2020. The company's common shares were selling at $48 per share on

December 15, 2019.

2019

June 20,

The company sold 430 of its own common shares for $ 17,200.

2020

Preferred Shares

The company issued 43,000 preferred shares at $ 41 per share on July 1. 2017.

Cash Dividends

The company has followed a schedule of declaring cash dividends each year in December and June and making the payment to

shareholders of record in the following month. The cash dividend declarations have been as follows since the company's first year and

up until June 30, 2020:

Declaration Date Common Shares Preferred Shares

Dec. 15, 2018

S.30 per share s2.70 pershare"

June 6, 2019

s

$0.30 per share

$0.90 per share

Dec. 15, 2019

s0.90 per share

"Includes dividend arrears of $2 from the 2017-18 fiscal year

No cash dividends were declared to common shareholders during June 2020 due to the company's liquidity problems.

Retained Earnings

As at June 30, 2019, the company's Retained Earnings account had a balance of $ 655,000. For the fiscal year ended June 30, 2020,

the company reported net income of $ 33,000.

.

Prepare the journal entries for the 2019-20 fiscal year. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Prepare the shareholders' equity section of the company's SFP as at June 30, 2020, as it should appear in its annual report to the

shareholders. (Enter negative amounts using either a negative sign preceding the number eg 45 or parentheses eg. (45). Round average

price per share to 2 decimal places, eg. 12.52 and the final answers to O decimal places, eg. 5,125.)

Bridgeport Inc.

Balance Sheet (Partial)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning