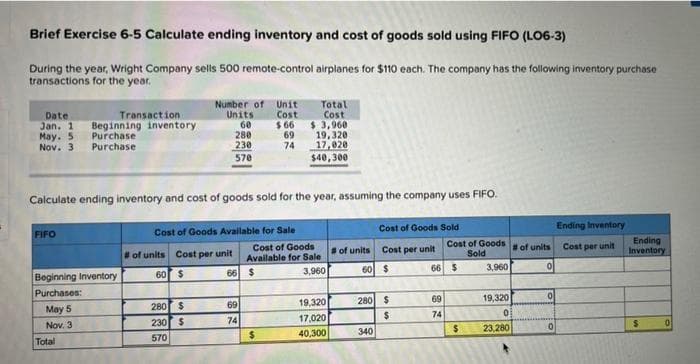

Brief Exercise 6-5 Calculate ending inventory and cost of goods sold using FIFO (LO6-3) During the year, Wright Company sells 500 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. Date Jan. 1 Beginning inventory May. 5 Purchase Nov. 3 Purchase Transaction Number of Unit Units Cost $66 69 74 60 280 230 570 Total Cost $3,960 19,320 17,020 $40,300

Brief Exercise 6-5 Calculate ending inventory and cost of goods sold using FIFO (LO6-3) During the year, Wright Company sells 500 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. Date Jan. 1 Beginning inventory May. 5 Purchase Nov. 3 Purchase Transaction Number of Unit Units Cost $66 69 74 60 280 230 570 Total Cost $3,960 19,320 17,020 $40,300

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.2BE: Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as...

Related questions

Topic Video

Question

help me

Transcribed Image Text:Brief Exercise 6-5 Calculate ending inventory and cost of goods sold using FIFO (LO6-3)

During the year, Wright Company sells 500 remote-control airplanes for $110 each. The company has the following inventory purchase

transactions for the year.

Date

Transaction

Jan. 1 Beginning inventory

May. 5 Purchase

Nov. 3 Purchase

FIFO

Beginning Inventory

Purchases:

May 5

Nov. 3

Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO.

Cost of Goods Sold

Cost per unit

Total

Number of Unit

Units

Cost

60

280

230

570

Cost of Goods

#of units Cost per unit

60 $

66

280 $

230

$

570

vailable for Sale

69

74

$66

69

74

$

$

Total

Cost

$ 3,960

19,320

17,020

$40,300

Cost of Goods

Available for Sale

3,960

19,320

17,020

40,300

# of units

60 $

280 $

$

340

66

69

74

Cost of Goods

Sold

$

$

3,960

19,320

0

23,280

#of units

0

0

0

Ending Inventory

Cost per unit

Ending

Inventory

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,