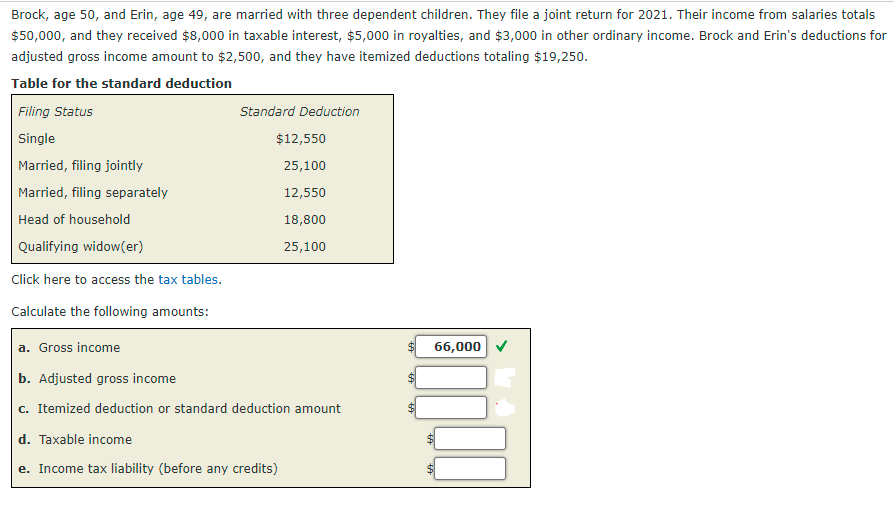

Brock, age 50, and Erin, age 49, are married with three dependent children. They file a joint return for 2021. Their income from salaries totals $50,000, and they received $8,000 in taxable interest, $5,000 in royalties, and $3,000 in other ordinary income. Brock and Erin's deductions for adjusted gross income amount to $2,500, and they have itemized deductions totaling $19,250. Table for the standard deduction Filing Status Standard Deduction Single $12,550 Married, filing jointly 25,100 Married, filing separately 12,550 Head of household 18,800 Qualifying widow(er) 25,100 Click here to access the tax tables. Calculate the following amounts: a. Gross income 66,000 b. Adjusted gross income c. Itemized deduction or standard deduction amount d. Taxable income e. Income tax liability (before any credits)

Brock, age 50, and Erin, age 49, are married with three dependent children. They file a joint return for 2021. Their income from salaries totals $50,000, and they received $8,000 in taxable interest, $5,000 in royalties, and $3,000 in other ordinary income. Brock and Erin's deductions for adjusted gross income amount to $2,500, and they have itemized deductions totaling $19,250. Table for the standard deduction Filing Status Standard Deduction Single $12,550 Married, filing jointly 25,100 Married, filing separately 12,550 Head of household 18,800 Qualifying widow(er) 25,100 Click here to access the tax tables. Calculate the following amounts: a. Gross income 66,000 b. Adjusted gross income c. Itemized deduction or standard deduction amount d. Taxable income e. Income tax liability (before any credits)

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 30CE: Phillis and Trey are married and file a joint tax return. For 2019, they have 4,800 of nonbusiness...

Related questions

Question

100%

Transcribed Image Text:Brock, age 50, and Erin, age 49, are married with three dependent children. They file a joint return for 2021. Their income from salaries totals

$50,000, and they received $8,000 in taxable interest, $5,000 in royalties, and $3,000 in other ordinary income. Brock and Erin's deductions for

adjusted gross income amount to $2,500, and they have itemized deductions totaling $19,250.

Table for the standard deduction

Filing Status

Standard Deduction

Single

$12,550

Married, filing jointly

25,100

Married, filing separately

12,550

Head of household

18,800

Qualifying widow(er)

25,100

Click here to access the tax tables.

Calculate the following amounts:

a. Gross income

66,000

b. Adjusted gross income

c. Itemized deduction or standard deduction amount

d. Taxable income

e. Income tax liability (before any credits)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

2022 Taxable Income and Income tax liability (before any credits)

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT