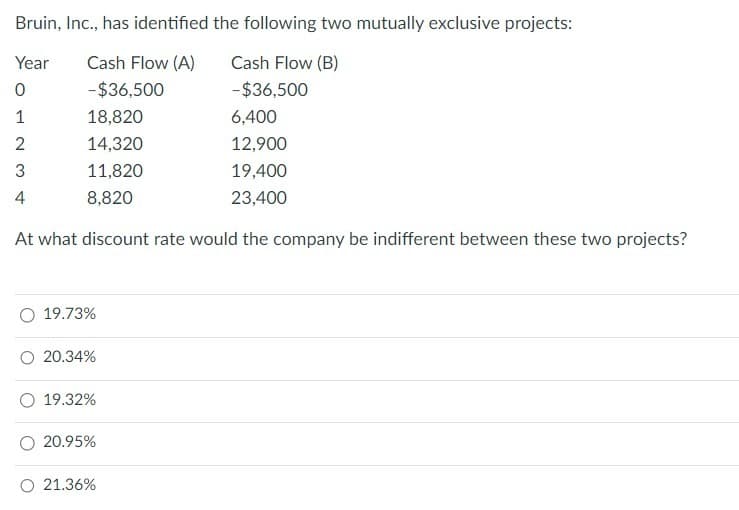

Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$36,500 -$36,500 1 18,820 6,400 2 14,320 12,900 3 11,820 19,400 4 8,820 23,400 At what discount rate would the company be indifferent between these two projects? ○ 19.73% 20.34% 19.32% 20.95% ○ 21.36%

Q: please answer correctly:

A: Let's go through each step in detail to calculate the bid price for the contract. Step 1: Calculate…

Q: What is the risk premium for stock A if its expected real return is 7.16%, the expected inflation…

A: When calculating the risk premium for a stock, the projected return of the stock is subtracted from…

Q: Bhupatbhai

A: Step 1:We have to calculate the net present value of the project.The formula of net present…

Q: Turnbull Co. has a target capital structure of 58% debt, 6% preferred stock, and 36% common equity.…

A: : let's go through the calculations step by step for question one.**Turnbull Co.:**Given data:-…

Q: Part B. Beaver Limited is a retail company that sells sporting goods. The company has a customer…

A: 1.Performance Obligation 1: 1$ Sale = 1 Customer Loyalty PointTotal March Sales = $1,725,000Total…

Q: Which of the following policies is most likely to be implemented during a period of economic…

A: The correct answer is B) Reduction in government spending.During a period of economic recession,…

Q: Nikul

A:

Q: Riverton Silver is considering buying a new extraction system. The new extraction system would be…

A: Here's how to calculate the Net Present Value (NPV) of the new extraction system project for…

Q: What is the expected standard deviation of stock A's returns based on the information presented in…

A: Option a: This option is correct. Step 1:We have to calculate the expected standard deviation of…

Q: P2: Given the following information, how much would you have paid on September 16 to purchase a…

A: Explanation:Step 1:For the British pound call option, you first identify the relevant option from…

Q: MIRR is usually calculated with the same reinvestment rate as that embedded in the O cost of debt ○…

A: With the use of a financial instrument known as the Modified Internal Rate of Return (MIRR), one may…

Q: mr jekins deposited $1,250 into an account that earns 4.25% simple intrest anually .he made no…

A: Simple Interest Formula:Interest earned = Principal amount * Interest rate * Time period

Q: Suppose Westerfield Co. has the following financial information: Debt: 900,000 bonds outstanding…

A: The Cost of Preferred Stock represents the rate of return required by preferred shareholders and is…

Q: Suppose you are evaluating a project with the expected future cash inflows shown in the following…

A: Note: Initial Investment is calculated as = Cash Flow in year 1+ Cash Flow in year 2 + Cash flow in…

Q: Use the following information to calculate the expected return and standard deviation of a portfolio…

A: Step 1: The calculation of the expected return and standard deviation of the portfolio ABC1 3…

Q: Please Provide All Required Answer

A: Step 1:Answer a.Journal entry on June 1:DateAccount Titles and ExplanationsDebitCredit June…

Q: Sadik Inc.'s bonds currently sell for $1,280 and have a par value of $1,000. They pay a $135 annual…

A: Step 1: The calculation of the Yield to call AB1Current price $1,280.00 2Annual coupon $ 135.00…

Q: Question 7 (3 point Listen Your clients have a high ratio mortgage and will require "mortgage…

A: Part 2: ExplanationStep 1: Calculate the Loan Amount\[ \text{Loan Amount} = \text{Purchase Price} -…

Q: The payback method helps firms establish and identify a maximum acceptable payback period that helps…

A: Explanations: Conventional payback period. Year 0Year 1Year 2Year…

Q: A primary benefit of investing in a mutual fund is Multiple Choice Diversification CDIC insurance…

A: Investing in a mutual fund offers diversification, which means spreading your investment across a…

Q: Esfandiari Enterprises is considering a new three-year expansion project that requires an initial…

A: Step 1: Compute for the cash flows associated with the project Year 0 Cash flow is is the…

Q: 1. Since capital budgeting decisions involve the estimation of a project’s future cash flows and the…

A: Behavioral traits can significantly impact capital budgeting decisions, particularly in the…

Q: Raghubhai

A: Calculate the after-tax cost of debt using Excel as follows:Formula sheet:Notes:To understand the…

Q: A new furnace for your small factory is being installed right now, will cost $46,000, and will be…

A: The text in the image describes a capital budgeting scenario where you are considering investing in…

Q: You own a one-year call option to buy one acre of Los Angeles real estate. The exercise price is…

A: Step 1:S = Market price =1.81K = Strike price =2.11r = rate =13.00%e = exponential value = exp(1)…

Q: Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying…

A: Break down of the calculation of the Net Present Value (NPV) for this project: 1. Initial Outlay:…

Q: is this accurate

A: Here is the explanation. It is essential to make use of either the equivalent annuity approach (EAA)…

Q: Global Products plans to issue long-term bonds to raise funds to finance its growth. The company has…

A: a. Coupon Rate on the New Bond Issue:When determining the coupon rate for the new bond issue, we…

Q: Check my work 10 percent. Thirty thousand dollars in out-of-pocket costs will be incurred. For a…

A: Net Amount to Lenders:This is the initial amount available after out-of-pocket costs: $1,000,000…

Q: During the year just ended, Anna Schultz's portfolio, which has a beta of 0.96, earned a return of…

A: The above answer can be explained as under - Treynor's measure can be calculated as - Treynor's…

Q: A fund manager has a portfolio worth $95 million with a beta of 1.16. The manager is concerned about…

A: The objective of the question is to determine the number of futures contracts the fund manager…

Q: es Suppose the following bond quote for IOU Corporation appears in the financial page of today's…

A: currentyield is calculated as the annual coupon payment divided by the current bond price,…

Q: Problem 5-14 Suppose Capital One is advertising a 60-month, 5.99% APR motorcycle loan. If you need…

A: 1. Monthly Interest Rate (Cell D11):Formula: =B11/B12Explanation:Cell B11 contains the APR…

Q: None

A: Step 1:We know regression equation formula is:Y^=b0+b1XWhere b1=∑(Xi−Xˉ)2∑(Xi−Xˉ)(Yi−Yˉ)And…

Q: 11-24. White Ski Resorts operates a series of ski resorts in northern Europe and reports under IFRS.…

A: According to IFRS 16 there are two ways to account for PPE- the cost and revaluation model. The cost…

Q: A financial consultant has an average of seven customers he consults with each day; assume a…

A: First, we need to generate 100 samples from a Poisson distribution with an average of seven…

Q: X tal assets of $5,000 and the following the coming year: Firm A Unlevered Economy Bad Average Good…

A: Step 1:To find the standard deviation of the new ROE distribution after the firm issues $2,000 of…

Q: Question 4 - A stock price is currently worth $20. It is known that at the end of a 6 month period…

A: Step 1 - Up Node (Su) - Continued (C(Su)):Risk-Neutral Valuation: We assume the expected return on…

Q: Problem 11-36 SML Suppose you observe the following situation: State of Economy Bust Normal Boom…

A: Compute the expected return and expected market risk premium:Formulas:

Q: Inez can earn an annual rate of return of 5.3%, compounded semiannually. If she made consecutive…

A: It is possible that Inez will have a balance of RM500 at the beginning of the year if she makes the…

Q: Use the following after-tax cash flows for project A and B to answer the next question: (Numbers in…

A: Step 1: The calculation of the Net present value AB1YearCashflow (A)20 $ -2,900.00 31 $…

Q: IRR A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7…

A: Step 1:We have to calculate the internal rate of return of the project.We will use the IRR function…

Q: None

A: Given information, Tax rate (t) = 40% or 0.40Before-tax cost of debt (rd) = 6% or 0.06Cost of…

Q: How do I fill in this table?

A: The table you provided appears to be a financial model with a terminal value for a company. Let's…

Q: None

A: Step 1:We have to calculate the price of the stock one year from now.The formula for calculating the…

Q: Consider a bond with a coupon rate of 7%. The bond has a par value of $1,000, a current price of…

A: Step 1: Given Value for Calculation Coupon Rate = c = 7%Face Value = fv = $1000Current Price of Bond…

Q: You have the following financial market information. You also have 1.88 million Australian dollar…

A: Here's a detailed explanation for better understanding. Borrow THB: We assume we borrow 3.14 million…

Q: What is the horizon value, i.e., the present value of all free cash flows from 2030 to infinity…

A: To calculate the total value of the company, we need to sum the present value of the cash flows from…

Q: (please correct answer and step by step solutions this question) The current price of a stock is…

A: Step 1: Calculate the Risk-Free Daily RateThe daily risk-free rate (r(daily)) is derived from the…

Q: Vijay

A: Introduction to Compound InterestCompound interest is a fundamental concept in finance that refers…

Bhupatbhai

Step by step

Solved in 2 steps with 2 images

- Assume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?Define each of the following terms: Capital budgeting; payback period; discounted payback period Independent projects; mutually exclusive projects Net present value (NPV) method; internal rate of return (IRR) method; profitability index (PI) Modified internal rate of return (MIRR) method NPV profile; crossover rate Nonnormal cash flow projects; normal cash flow projects; multiple IRRs Reinvestment rate assumption Replacement chain; economic life; capital rationing; equivalent annual annuity (EAA)Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$56,000 -$56000 1 32,000 19,400 2 26,000 23,400 3 19,000 28,000 4 13,200 25,400 Over what range of Discount rates would you choose Project A? Project B? (Please list percentages rounded to 2 decimal places. Hint: The answer is not the same as the IRR.) Project A ____________% Project B ____________% At what discount rate would you be indifferent between these two projects? ____________%

- Net Cash Flows and NPVs for different discount rate for projects S and L are given below Net Cash Flows ($) Discount Rate (%) NPVS NPVL Year (t) Project S Project L 0% $800 $1100 0 $(3000) $(3000) 5 554.32 1 1500 400 10 161.33 2 1200 900 15 (90.74) (259.24) 3 800 1300 20 (309.03) (565.97) 4 300 1500 g) If projects are mutually exclusive, which project would you accept? i) at 5% ii) at 15% h) If projects are independent (not mutually exclusive), which project(s) would you accept? i) at 5% ii) at 15%. Net Cash Flows and NPVs for different discount rate for projects S and L are given below Net Cash Flows ($) Discount Rate (%) NPVS NPVL Year (t) Project S Project L 0% $800 $1100 0 $(3000) $(3000) 5 554.32 1 1500 400 10 161.33 2 1200 900 15 (90.74) (259.24) 3 800 1300 20 (309.03) (565.97) 4 300 1500 h) If projects are independent (not mutually exclusive), which project(s) would you accept? i) at 5% ii) at 15%The Klingon Sausage Corporation is trying to choose between the following two projects: Year Cash Flow (Project I) Cash Flow (Project II) 0 -$363,000 -$165,000 1 184,800 99,600 2 184,800 99,600 3 184,800 99,600 The discount rate of both projects is 8%. Klingon’s manager believes the company has sufficient resources so that the two projects should not be treated as mutually exclusive. Which project should be taken based on the profitability index? A. Project I should be accepted and project II should be rejected. B. None of the projects should be accepted. C. Project I should be rejected and project II should be accepted. D. Both projects should be accepted.

- Textiles Unlimited has gathered projected cash flows for two projects. At what interest rate would the company be indifferent between the two projects? Year Cash Flow (A) Cash Flow (B) 0 -105,000 -105,000 1 42,200 52,600 2 34,600 39,400 3 38,700 35,500 4 45,500 30,100Garage, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$43,500 -$43,500 1 21,400 6,400 2 18,500 14,700 3 13,800 22,800 4 7,600 25,200 What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule? Over what range of discount rates would the company choose project? A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: Project S -$1,000 $899.96 $240 $15 $5 Project L -$1,000 $10 $250 $380 $843.66 The company's WACC is 10.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.

- Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 –$ 28,700 –$ 28,700 1 14,100 4,150 2 12,000 9,650 3 9,050 14,900 4 4,950 16,500 a-1 What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2 Using the IRR decision rule, which project should the company accept? Project A Project B a-3 Is this decision necessarily correct? Yes No b-1 If the required return is 12 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2 Which project will the company choose if it applies the NPV decision rule? Project A Project B c.…Projects W and X are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows. Year Project W Project X 0 –$1,000 –$1,500 1 $200 $350 2 $350 $500 3 $400 $600 4 $600 $750 0 2 4 6 8 10 12 14 16 18 20 800 600 400 200 0 -200 NPV (Dollars) DISCOUNT (REQUIRED) RATE (Percent) Project X Project W If the required rate of return for each project is 2%, do the NPV and IRR methods agree or conflict? The methods conflict. The methods agree.Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 28,000 −$ 28,000 1 13,400 3,800 2 11,300 9,300 3 8,700 14,200 4 4,600 15,800 a-1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. If the required return is 10 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)