BU Contractors received a begun in 2021 and completed in 2023. Cost and other data are presented below Cost Incurred during the year Estimated total costs to complete llings during the year sh collections during the year 2022 3,725,000 6,625,000 6,125,000 6,000,000 7,000,000 6,000,000 5,500,000 7,100,000 6,400,000 2021 7,650,000 9,350,000 2023 entage of completion.

BU Contractors received a begun in 2021 and completed in 2023. Cost and other data are presented below Cost Incurred during the year Estimated total costs to complete llings during the year sh collections during the year 2022 3,725,000 6,625,000 6,125,000 6,000,000 7,000,000 6,000,000 5,500,000 7,100,000 6,400,000 2021 7,650,000 9,350,000 2023 entage of completion.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 26E

Related questions

Question

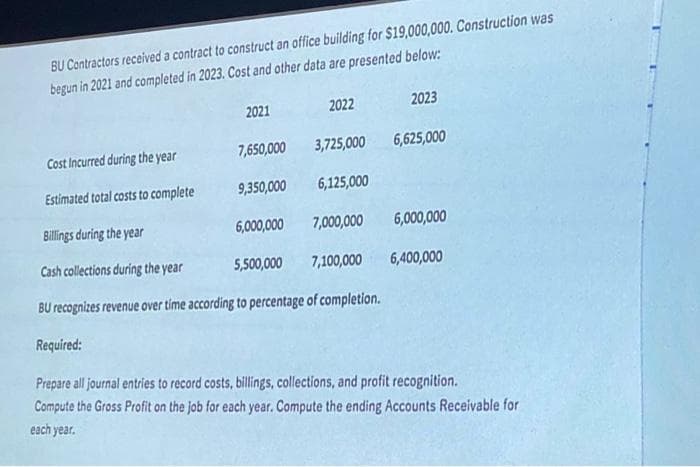

Transcribed Image Text:BU Contractors received a contract to construct an office building for $19,000,000. Construction was

begun in 2021 and completed in 2023. Cost and other data are presented below:

Cost Incurred during the year

Estimated total costs to complete

2021

7,650,000

9,350,000

2022

3,725,000

6,125,000

2023

6,625,000

6,000,000

7,000,000

6,000,000

5,500,000 7,100,000 6,400,000

Billings during the year

Cash collections during the year

BU recognizes revenue over time according to percentage of completion.

Required:

Prepare all journal entries to record costs, billings, collections, and profit recognition.

Compute the Gross Profit on the job for each year. Compute the ending Accounts Receivable for

each year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT