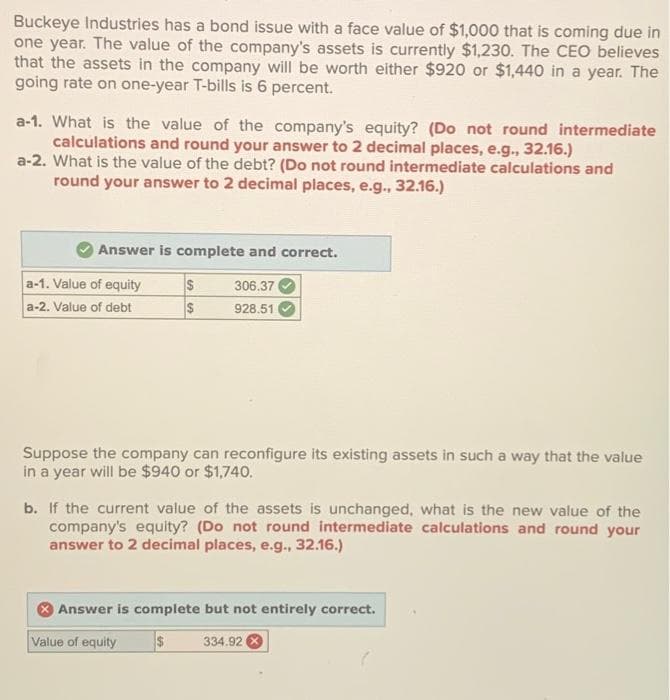

Buckeye Industries has a bond issue with a face value of $1,000 that is coming due in one year. The value of the company's assets is currently $1,230. The CEO believe that the assets in the company will be worth either $920 or $1,440 in a year. The going rate on one-year T-bills is 6 percent. a-1. What is the value of the company's equity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a-2. What is the value of the debt? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete and correct. 306.37 928.51 a-1. Value of equity a-2. Value of debt S $ Suppose the company can reconfigure its existing assets in such a way that the value in a year will be $940 or $1,740. b. If the current value of the assets is unchanged, what is the new value of the company's equity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Value of equity $ 334.92

Buckeye Industries has a bond issue with a face value of $1,000 that is coming due in one year. The value of the company's assets is currently $1,230. The CEO believe that the assets in the company will be worth either $920 or $1,440 in a year. The going rate on one-year T-bills is 6 percent. a-1. What is the value of the company's equity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a-2. What is the value of the debt? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete and correct. 306.37 928.51 a-1. Value of equity a-2. Value of debt S $ Suppose the company can reconfigure its existing assets in such a way that the value in a year will be $940 or $1,740. b. If the current value of the assets is unchanged, what is the new value of the company's equity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Value of equity $ 334.92

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:Buckeye Industries has a bond issue with a face value of $1,000 that is coming due in

one year. The value of the company's assets is currently $1,230. The CEO believes

that the assets in the company will be worth either $920 or $1,440 in a year. The

going rate on one-year T-bills is 6 percent.

a-1. What is the value of the company's equity? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

a-2. What is the value of the debt? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

Answer is complete and correct.

306.37

928.51

a-1. Value of equity

a-2. Value of debt

$

$

Suppose the company can reconfigure its existing assets in such a way that the value

in a year will be $940 or $1,740.

b. If the current value of the assets is unchanged, what is the new value of the

company's equity? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

Value of equity $ 334.92

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning