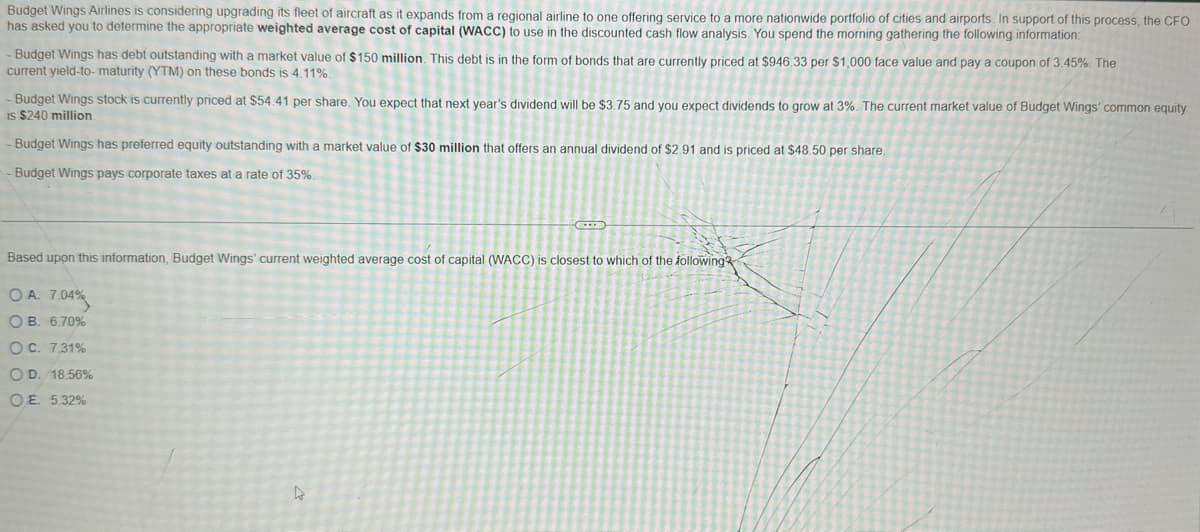

Budget Wings Airlines is considering upgrading its fleet of aircraft as it expands from a regional airline to one offering service to a more nationwide portfolio of cities and airports. In support of this process, the CFO has asked you to determine the appropriate weighted average cost of capital (WACC) to use in the discounted cash flow analysis. You spend the morning gathering the following information: -Budget Wings has debt outstanding with a market value of $150 million. This debt is in the form of bonds that are currently priced at $946.33 per $1,000 face value and pay a coupon of 3.45%. The current yield-to- maturity (YTM) on these bonds is 4.11%. - Budget Wings stock is currently priced at $54.41 per share. You expect that next year's dividend will be $3.75 and you expect dividends to grow at 3%. The current market value of Budget Wings' common equity is $240 million. -Budget Wings has preferred equity outstanding with a market value of $30 million that offers an annual dividend of $2.91 and is priced at $48.50 per share. - Budget Wings pays corporate taxes at a rate of 35%. C Based upon this information, Budget Wings' current weighted average cost of capital (WACC) is closest to which of the following OA. 7.04% OB. 6.70% O C. 7.31% OD. 18.56% OE. 5.32%

Cost of Debt, Cost of Preferred Stock

This article deals with the estimation of the value of capital and its components. we'll find out how to estimate the value of debt, the value of preferred shares , and therefore the cost of common shares . we will also determine the way to compute the load of every cost of the capital component then they're going to estimate the general cost of capital. The cost of capital refers to the return rate that an organization gives to its investors. If an organization doesn’t provide enough return, economic process will decrease the costs of their stock and bonds to revive the balance. A firm’s long-run and short-run financial decisions are linked to every other by the assistance of the firm’s cost of capital.

Cost of Common Stock

Common stock is a type of security/instrument issued to Equity shareholders of the Company. These are commonly known as equity shares in India. It is also called ‘Common equity

Step by step

Solved in 3 steps with 2 images