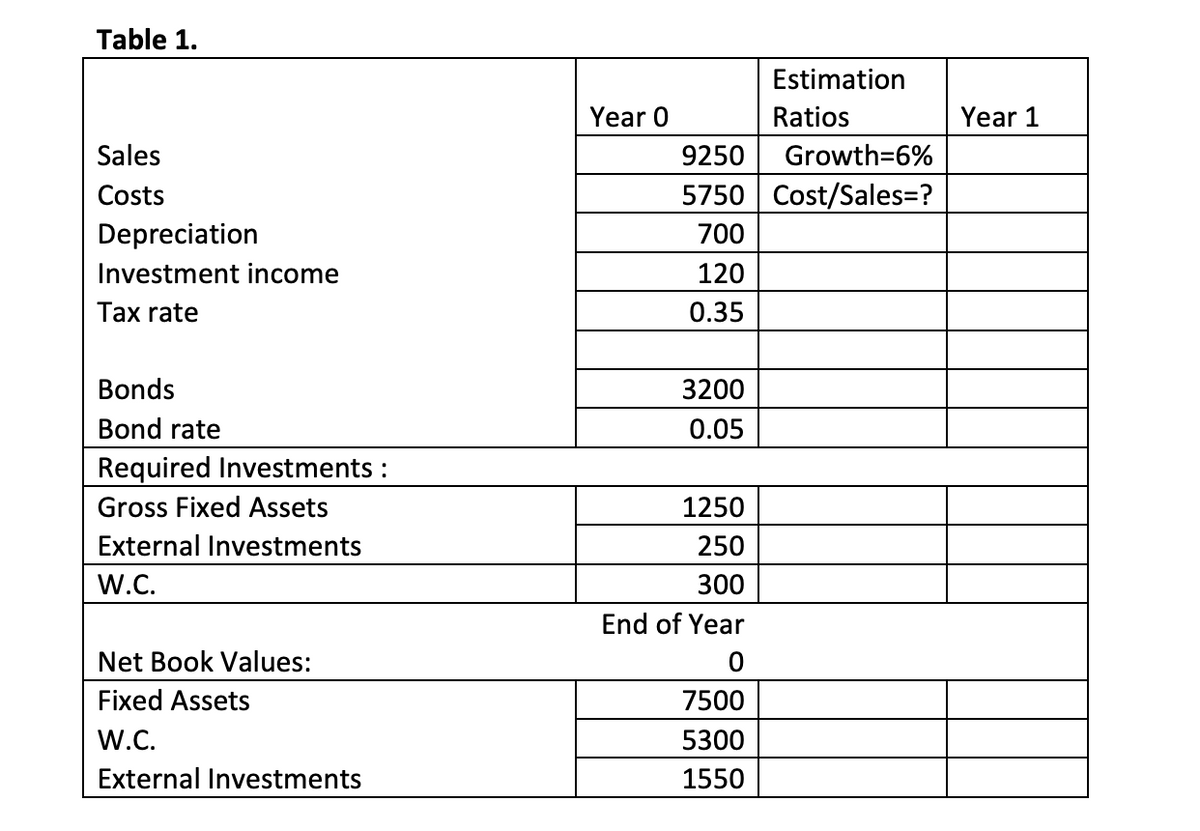

Budgeting Tools last year (year 0) reported $8,250 of sales, $5,750 of operating costs other than depreciation, and $700 of depreciation. Additionally, the company has received $120 investment income. The company had no amortization charges, it had $3,200 of outstanding bonds that carry a 5% interest rate, and its income tax rate was 28%. In order to sustain its operations and thus generate sales and cash flows in the future, the firm was required to make $1,250 of capital expenditures on new fixed assets (or Gross Fixed Assets) and to invest $300 in net operating working capital (W.C.). This information and some other useful information is provided in following Table 1. Assuming that the company will grow forever at a rate of 3% after year 1 and its WACC is 10.25%, estimate the company’s market value.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Budgeting Tools last year (year 0) reported $8,250 of sales, $5,750 of operating costs other than

Assuming that the company will grow forever at a rate of 3% after year 1 and its WACC is 10.25%, estimate the company’s market value.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images