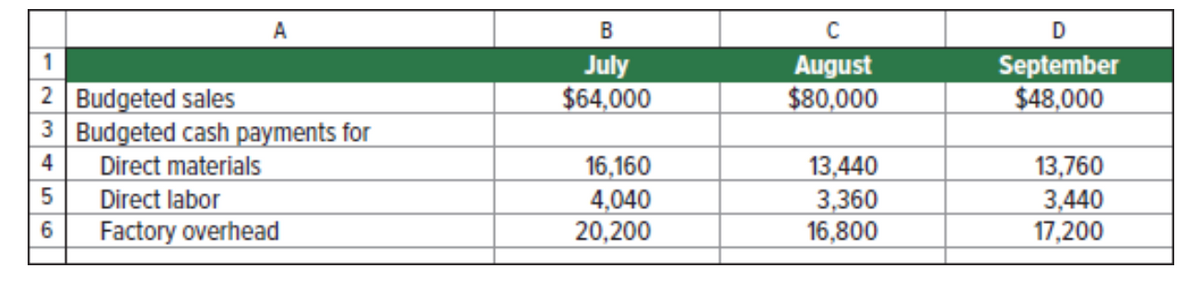

Built-Tight is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for product costs for the quarter follow. Sales are 20% cash and 80% on credit. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $15,000 in cash; $45,000 in accounts receivable; $4,500 in accounts payable; and a $5,000 balance in loans payable. A minimum cash balance of $15,000 is required. Loans are obtained at the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If an excess balance of cash exists, loans are repaid at the end of the month. Operating expenses are paid in the month incurred and consist of sales commissions (10% of sales), office salaries ($4,000 per month), and rent ($6,500 per month). Prepare a cash budget for each of the months of July, August, and September. (Round amounts to the dollar.)

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Built-Tight is preparing its

Sales are 20% cash and 80% on credit. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $15,000 in cash; $45,000 in

Prepare a

Trending now

This is a popular solution!

Step by step

Solved in 2 steps