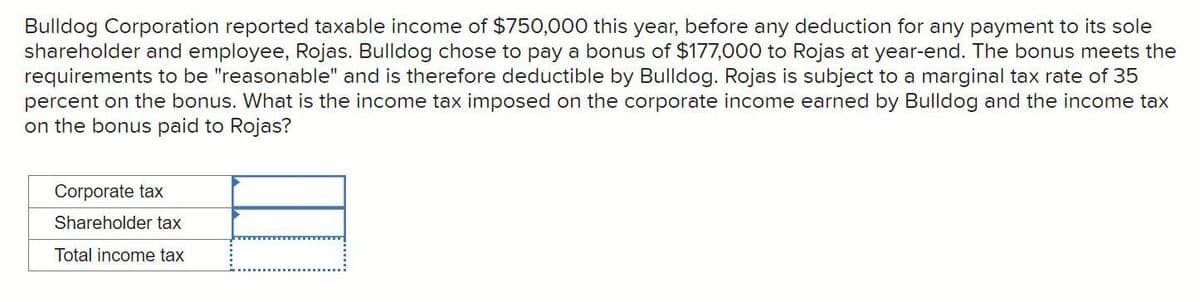

Bulldog Corporation reported taxable income of $750,000 this year, before any deduction for any payment to its sole shareholder and employee, Rojas. Bulldog chose to pay a bonus of $177,000 to Rojas at year-end. The bonus meets the requirements to be "reasonable" and is therefore deductible by Bulldog. Rojas is subject to a marginal tax rate of 35 percent on the bonus. What is the income tax imposed on the corporate income earned by Bulldog and the income tax on the bonus paid to Rojas? Corporate tax Shareholder tax Total income tax

Bulldog Corporation reported taxable income of $750,000 this year, before any deduction for any payment to its sole shareholder and employee, Rojas. Bulldog chose to pay a bonus of $177,000 to Rojas at year-end. The bonus meets the requirements to be "reasonable" and is therefore deductible by Bulldog. Rojas is subject to a marginal tax rate of 35 percent on the bonus. What is the income tax imposed on the corporate income earned by Bulldog and the income tax on the bonus paid to Rojas? Corporate tax Shareholder tax Total income tax

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

What is the income tax imposed on the corporate income earned by Bulldog and the income tax on the bonus paid to Rojas? (No plagiarism)

Transcribed Image Text:Bulldog Corporation reported taxable income of $750,000 this year, before any deduction for any payment to its sole

shareholder and employee, Rojas. Bulldog chose to pay a bonus of $177,000 to Rojas at year-end. The bonus meets the

requirements to be "reasonable" and is therefore deductible by Bulldog. Rojas is subject to a marginal tax rate of 35

percent on the bonus. What is the income tax imposed on the corporate income earned by Bulldog and the income tax

on the bonus paid to Rojas?

Corporate tax

Shareholder tax

Total income tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT