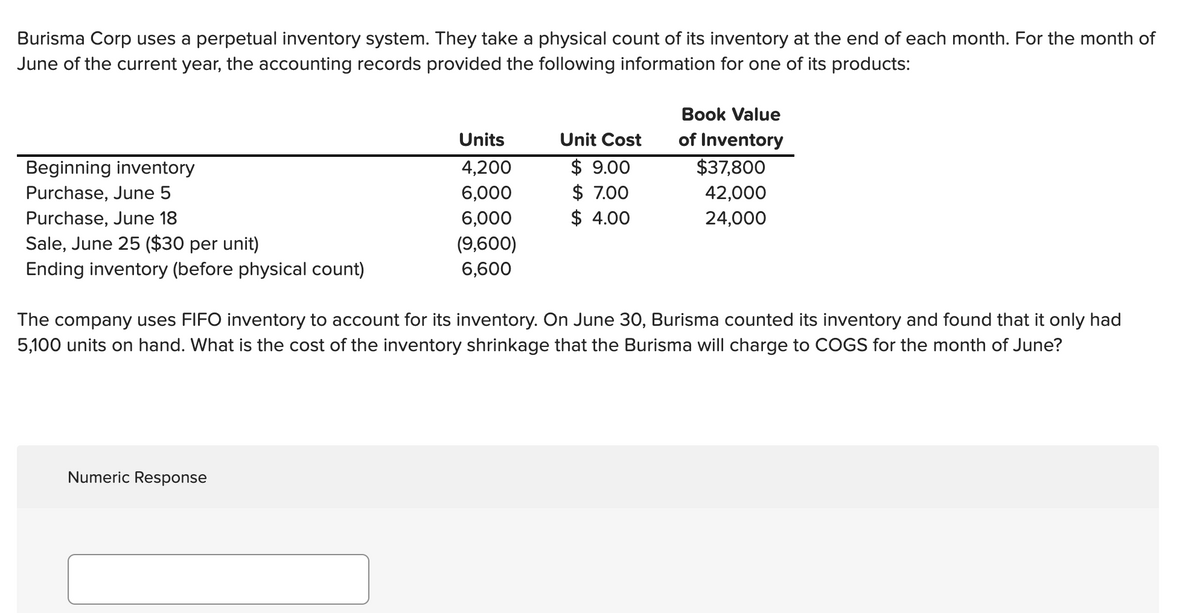

Burisma Corp uses a perpetual inventory system. They take a physical count of its inventory at the end of each month. For the month of June of the current year, the accounting records provided the following information for one of its products: Book Value Units Unit Cost of Inventory $ 9.00 $ 7.00 $ 4.00 Beginning inventory 4,200 $37,800 Purchase, June 5 6,000 6,000 42,000 Purchase, June 18 Sale, June 25 ($30 per unit) 24,000 (9,600) Ending inventory (before physical count) 6,600 The company uses FIFO inventory to account for its inventory. On June 30, Burisma counted its inventory and found that it only had 5,100 units on hand. What is the cost of the inventory shrinkage that the Burisma will charge to COGS for the month of June?

Burisma Corp uses a perpetual inventory system. They take a physical count of its inventory at the end of each month. For the month of June of the current year, the accounting records provided the following information for one of its products: Book Value Units Unit Cost of Inventory $ 9.00 $ 7.00 $ 4.00 Beginning inventory 4,200 $37,800 Purchase, June 5 6,000 6,000 42,000 Purchase, June 18 Sale, June 25 ($30 per unit) 24,000 (9,600) Ending inventory (before physical count) 6,600 The company uses FIFO inventory to account for its inventory. On June 30, Burisma counted its inventory and found that it only had 5,100 units on hand. What is the cost of the inventory shrinkage that the Burisma will charge to COGS for the month of June?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

Transcribed Image Text:Burisma Corp uses a perpetual inventory system. They take a physical count of its inventory at the end of each month. For the month of

June of the current year, the accounting records provided the following information for one of its products:

Book Value

Units

Unit Cost

of Inventory

$37,800

$ 9.00

$ 7.00

$ 4.00

Beginning inventory

4,200

Purchase, June 5

6,000

42,000

Purchase, June 18

6,000

24,000

Sale, June 25 ($30 per unit)

(9,600)

Ending inventory (before physical count)

6,600

The company uses FIFO inventory to account for its inventory. On June 30, Burisma counted its inventory and found that it only had

5,100 units on hand. What is the cost of the inventory shrinkage that the Burisma will charge to COGS for the month of June?

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,