Business Decisions Sharon, the owner of the Brentwood Motel, is planning to renovate all the rooms in her motel. There are two plans before her. Plan A calls for an immediate cash outlay of $800,000, whereas plan B calls for an immediate outlay of $600,000. Sharon estimates that adopting plan A would yield an income stream of F(t) = 3,090,000e0.02t dollars/year for the next 5 years, whereas adopting plan B would yield an income stream of g(t) = 3,300,000 dollars/year for the next 5 years. If the prevailing rate of interest is 3%/year compounded continuously, which plan will yield the higher net income (in dollars) at the end of 5 years? O plan A n nlan R

Business Decisions Sharon, the owner of the Brentwood Motel, is planning to renovate all the rooms in her motel. There are two plans before her. Plan A calls for an immediate cash outlay of $800,000, whereas plan B calls for an immediate outlay of $600,000. Sharon estimates that adopting plan A would yield an income stream of F(t) = 3,090,000e0.02t dollars/year for the next 5 years, whereas adopting plan B would yield an income stream of g(t) = 3,300,000 dollars/year for the next 5 years. If the prevailing rate of interest is 3%/year compounded continuously, which plan will yield the higher net income (in dollars) at the end of 5 years? O plan A n nlan R

Calculus: Early Transcendentals

8th Edition

ISBN:9781285741550

Author:James Stewart

Publisher:James Stewart

Chapter1: Functions And Models

Section: Chapter Questions

Problem 1RCC: (a) What is a function? What are its domain and range? (b) What is the graph of a function? (c) How...

Related questions

Question

I need help with calculus homework!

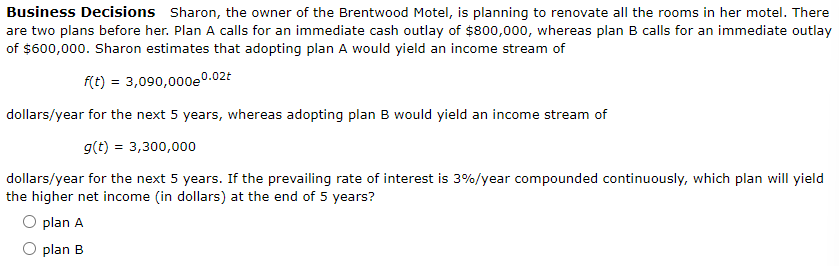

Transcribed Image Text:Business Decisions Sharon, the owner of the Brentwood Motel, is planning to renovate all the rooms in her motel. There

are two plans before her. Plan A calls for an immediate cash outlay of $800,000, whereas plan B calls for an immediate outlay

of $600,000. Sharon estimates that adopting plan A would yield an income stream of

f(t) = 3,090,000e0.02t

dollars/year for the next 5 years, whereas adopting plan B would yield an income stream of

g(t) = 3,300,000

dollars/year for the next 5 years. If the prevailing rate of interest is 3%/year compounded continuously, which plan will yield

the higher net income (in dollars) at the end of 5 years?

O plan A

plan B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781319050740

Author:

Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:

W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:

9781337552516

Author:

Ron Larson, Bruce H. Edwards

Publisher:

Cengage Learning