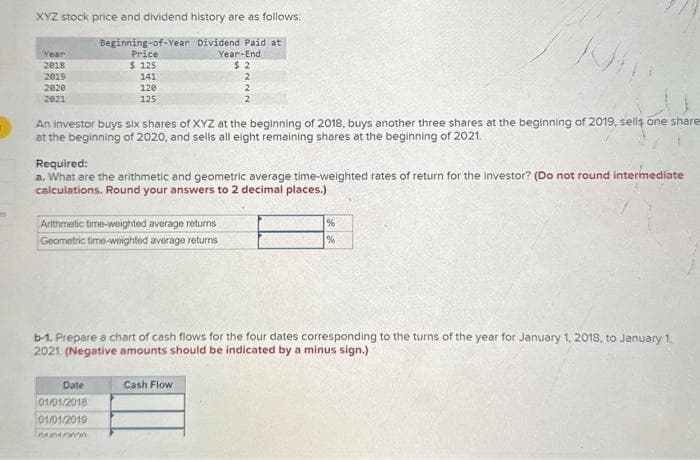

XYZ stock price and dividend history are as follows: Beginning-of-Year Dividend Paid at Price $ 125 141 Year 2018 2019 2020 2021 120 125 Year-End $2 An investor buys six shares of XYZ at the beginning of 2018, buys another three shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all eight remaining shares at the beginning of 2021. Arithmetic time-weighted average returns Geometric time-weighted average returns Date 01/01/2018 01/01/2019 64012320 2 Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2 2 Cash Flow b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021 (Negative amounts should be indicated by a minus sign.) % % b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, 16 January 1, 2021. (Negative amounts should be indicated by a minus sign.) Date 01/01/2018 01/01/2019 01/01/2020 01/01/2021 Cash Flow b-2. What is the dollar-weighted rate of return? (Hint: If your calculator cannot calculate internal rate of return, you will have to use a spreadsheet or trial and error.) (Negative value should be indicated by a minus sign. Round your answer to 4 decimal places.) Rate of return

XYZ stock price and dividend history are as follows: Beginning-of-Year Dividend Paid at Price $ 125 141 Year 2018 2019 2020 2021 120 125 Year-End $2 An investor buys six shares of XYZ at the beginning of 2018, buys another three shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all eight remaining shares at the beginning of 2021. Arithmetic time-weighted average returns Geometric time-weighted average returns Date 01/01/2018 01/01/2019 64012320 2 Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2 2 Cash Flow b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021 (Negative amounts should be indicated by a minus sign.) % % b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, 16 January 1, 2021. (Negative amounts should be indicated by a minus sign.) Date 01/01/2018 01/01/2019 01/01/2020 01/01/2021 Cash Flow b-2. What is the dollar-weighted rate of return? (Hint: If your calculator cannot calculate internal rate of return, you will have to use a spreadsheet or trial and error.) (Negative value should be indicated by a minus sign. Round your answer to 4 decimal places.) Rate of return

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 69E:

Stock Dividends

Crystal Corporation has the following information regarding its common stock: S10...

Related questions

Question

Accounting

Transcribed Image Text:XYZ stock price and dividend history are as follows:

Beginning-of-Year Dividend Paid at

Price

$ 125

141

Year

2018

2019

2020

2021

120

125

Year-End

$2

An investor buys six shares of XYZ at the beginning of 2018, buys another three shares at the beginning of 2019, sells one share

at the beginning of 2020, and sells all eight remaining shares at the beginning of 2021.

Arithmetic time-weighted average returns

Geometric time-weighted average returns

Date

01/01/2018

01/01/2019

64012320

2

Required:

a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate

calculations. Round your answers to 2 decimal places.)

2

2

Cash Flow

b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1,

2021 (Negative amounts should be indicated by a minus sign.)

%

%

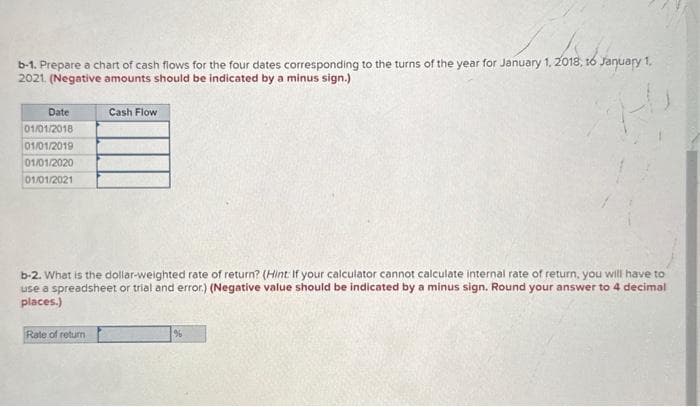

Transcribed Image Text:b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, 16 January 1,

2021. (Negative amounts should be indicated by a minus sign.)

Date

01/01/2018

01/01/2019

01/01/2020

01/01/2021

Cash Flow

b-2. What is the dollar-weighted rate of return? (Hint: If your calculator cannot calculate internal rate of return, you will have to

use a spreadsheet or trial and error.) (Negative value should be indicated by a minus sign. Round your answer to 4 decimal

places.)

Rate of return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning