Butterfly Company began October with inventory of $192.000. The business made net purchases of $635,000 and had net sales of $910,000 before a fire destroyed the company's inventory. For the past several years, Butterfly Company's gross margin on sales has been 38 percent. Required 1. Estimate the cost of the inventory destroyed by the fire 2. Identify another reason owners and managers use the gross margin method to estimate inventory on a regular basis Requirement 1. Estimate the cost of the inventory destroyed by the fire Cost of goods available for sale Estimated cost of goods sold Less Estimated cost of inventory destroyed Requirement 2. Identify another reason owners and managers use the gross margin method to estimato inventory on a regular basis. Another reason owners and managers use the gross margin method to estimate inventory cost on a regular basis is to determine

Butterfly Company began October with inventory of $192.000. The business made net purchases of $635,000 and had net sales of $910,000 before a fire destroyed the company's inventory. For the past several years, Butterfly Company's gross margin on sales has been 38 percent. Required 1. Estimate the cost of the inventory destroyed by the fire 2. Identify another reason owners and managers use the gross margin method to estimate inventory on a regular basis Requirement 1. Estimate the cost of the inventory destroyed by the fire Cost of goods available for sale Estimated cost of goods sold Less Estimated cost of inventory destroyed Requirement 2. Identify another reason owners and managers use the gross margin method to estimato inventory on a regular basis. Another reason owners and managers use the gross margin method to estimate inventory cost on a regular basis is to determine

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:ade net purchases of $635,000 and had net sales of $910,000 before a fire destroyed the company's inventory. For

ercent.

d to estimate inventory on a regular basis.

s margin method to estimate inventory on a regular basis.

mate inventory cost on a regular basis is to determine

the cost of ending inventory for interim financial statements.

net purchases.

gross sales revenue.

t

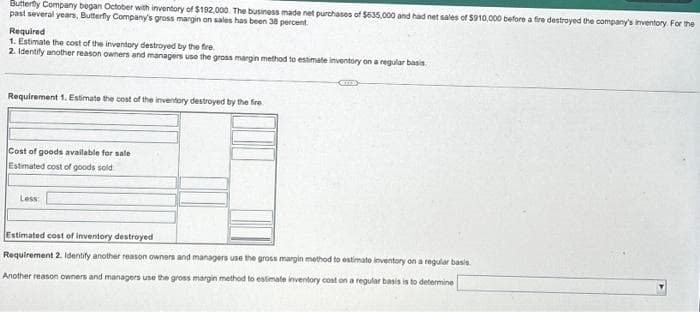

Transcribed Image Text:Butterfly Company began October with inventory of $192,000. The business made net purchases of $635,000 and had net sales of $910,000 before a fire destroyed the company's inventory. For the

past several years, Butterfly Company's gross margin on sales has been 38 percent.

Required

1. Estimate the cost of the inventory destroyed by the fire

2. Identify another reason owners and managers use the gross margin method to estimate inventory on a regular basis

Requirement 1. Estimate the cost of the inventory destroyed by the fire

Cost of goods available for sale

Estimated cost of goods sold

Less

Estimated cost of inventory destroyed

Requirement 2. Identify another reason owners and managers use the gross margin method to estimato inventory on a regular basis.

Another reason owners and managers use the gross margin method to estimate inventory cost on a regular basis is to determine

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning