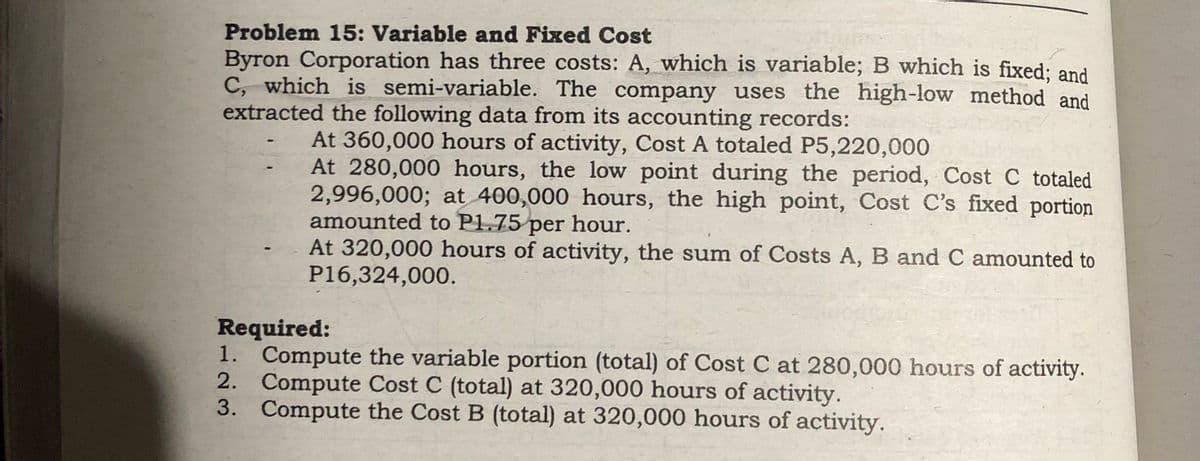

Byron Corporation has three costs: A, which is variable; B which is fixed; and C, which is semi-variable. The company uses the high-low method and extracted the following data from its accounting records: At 360,000 hours of activity, Cost A totaled P5,220,000 At 280,000 hours, the low point during the period, Cost C totaled 2,996,000; at 400,000 hours, the high point, Cost C's fixed portion amounted to P1.75 per hour. At 320,000 hours of activity, the sum of Costs A, B and C amounted to P16,324,000. Required: 1. Compute the variable portion (total) of Cost C at 280,000 hours of activity. 2. Compute Cost C (total) at 320,000 hours of activity. 3. Compute the Cost B (total) at 320,000 hours of activity.

Byron Corporation has three costs: A, which is variable; B which is fixed; and C, which is semi-variable. The company uses the high-low method and extracted the following data from its accounting records: At 360,000 hours of activity, Cost A totaled P5,220,000 At 280,000 hours, the low point during the period, Cost C totaled 2,996,000; at 400,000 hours, the high point, Cost C's fixed portion amounted to P1.75 per hour. At 320,000 hours of activity, the sum of Costs A, B and C amounted to P16,324,000. Required: 1. Compute the variable portion (total) of Cost C at 280,000 hours of activity. 2. Compute Cost C (total) at 320,000 hours of activity. 3. Compute the Cost B (total) at 320,000 hours of activity.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 4BE

Related questions

Question

Transcribed Image Text:Problem 15: Variable and Fixed Cost

Byron Corporation has three costs: A, which is variable; B which is fixed; and

C, which is semi-variable. The company uses the high-low method and

extracted the following data from its accounting records:

At 360,000 hours of activity, Cost A totaled P5,220,000

At 280,000 hours, the low point during the period, Cost C totaled

2,996,000; at 400,000 hours, the high point, Cost C's fixed portion

amounted to P1.75 per hour.

At 320,000 hours of activity, the sum of Costs A, B and C amounted to

P16,324,000.

Required:

1. Compute the variable portion (total) of Cost C at 280,000 hours of activity.

2. Compute Cost C (total) at 320,000 hours of activity.

3. Compute the Cost B (total) at 320,000 hours of activity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,