mortization Schedule To continue your analysis of facility expenditures, you want to complete an amortization table detailing payment, principal, interest, cumulative principal, and cumulative interest. 35. Ensure that the New_Construction worksheet is active 36. Enter a reference in cell B12 to the beginning loan balance. 37. Enter a reference in cell C12 to the payment amount. 38. Enter a function in cell D12 based on the payment and loan details that calculates the amount of interest paid on the first payment. Be sure to use the appropriate absolute, relative, or mixed cell references. All results should be formatted as positive numbers. 39. Enter a function in cell E12 based on the payment and loan details that calculates the amount of principal paid on the first payment. Be sure to use the appropriate absolute, rela- tive, or mixed cell references and ensure the results are positive. 40. Enter a formula in cell F12 to calculate the remaining balance after the current payment. The remaining balance is calculated by subtracting the principal payment from the balance in column B. 41. Enter a function in cell G12 based on the payment and loan details that calculates the amount of cumulative interest paid on the first payment. Be sure to use the appropriate abso- lute, relative, or mixed cell references and ensure the results are positive. 42. Enter a function in cell H12 based on the payment and loan details that calculates the amount of cumulative principal paid on the first payment. Be sure to use the appropriate ab- solute, relative, or mixed cell references. All results should be formatted as positive numbers. 43. Enter a reference to the remaining balance of payment 1 in cell B13. 44. Use the fill handle to copy the functions created in the prior steps down to complete the amor- tization table. Expand the width of columns D:H as needed. 45. Save the workbook. orm, PowerPivot, and 3D Maps You want to create a PivotTable to analyze sales information. To complete this task, you will use Get & Transform to connect and transform the data. Then you will use 3D Maps to create a geo- graphic visualization of warehouse information. MAC TROUBLESHOOTING: The standard installation of Excel for Mac does include drivers for importing SQL databases but does not include drivers to import data from Access. To import data from Access, third-party ODBC drivers must be purchased and installed. The required drivers can be downloaded. For more information search ODBC drivers that are compatible with Excel for Mac on https://support.office.com. C D E 1 2 A1 A ⠀ |× ✓ fx B 3 Facility Amortization Table Payment Details 4 5 6 Payment 7 APR 8 Years 9 Pmts per Year Loan Details $8,647.55 Loan $450,000.00 5.75% Periodic Rate 5 # of Payments 0.479% 60 12 LL F G H 10 Payment 11 Number Beginning Balance Payment Amount Principal Interest Paid Repayment Remaining Balance Cumulative Interest Cumulative Principal 12 1 13 2 3 14 15 st 16 5 17 6 18 7 19 8 20 9 21 10 22 11 23 12 24 13 25 14 26 15 Employee_Info New_Construction +

mortization Schedule To continue your analysis of facility expenditures, you want to complete an amortization table detailing payment, principal, interest, cumulative principal, and cumulative interest. 35. Ensure that the New_Construction worksheet is active 36. Enter a reference in cell B12 to the beginning loan balance. 37. Enter a reference in cell C12 to the payment amount. 38. Enter a function in cell D12 based on the payment and loan details that calculates the amount of interest paid on the first payment. Be sure to use the appropriate absolute, relative, or mixed cell references. All results should be formatted as positive numbers. 39. Enter a function in cell E12 based on the payment and loan details that calculates the amount of principal paid on the first payment. Be sure to use the appropriate absolute, rela- tive, or mixed cell references and ensure the results are positive. 40. Enter a formula in cell F12 to calculate the remaining balance after the current payment. The remaining balance is calculated by subtracting the principal payment from the balance in column B. 41. Enter a function in cell G12 based on the payment and loan details that calculates the amount of cumulative interest paid on the first payment. Be sure to use the appropriate abso- lute, relative, or mixed cell references and ensure the results are positive. 42. Enter a function in cell H12 based on the payment and loan details that calculates the amount of cumulative principal paid on the first payment. Be sure to use the appropriate ab- solute, relative, or mixed cell references. All results should be formatted as positive numbers. 43. Enter a reference to the remaining balance of payment 1 in cell B13. 44. Use the fill handle to copy the functions created in the prior steps down to complete the amor- tization table. Expand the width of columns D:H as needed. 45. Save the workbook. orm, PowerPivot, and 3D Maps You want to create a PivotTable to analyze sales information. To complete this task, you will use Get & Transform to connect and transform the data. Then you will use 3D Maps to create a geo- graphic visualization of warehouse information. MAC TROUBLESHOOTING: The standard installation of Excel for Mac does include drivers for importing SQL databases but does not include drivers to import data from Access. To import data from Access, third-party ODBC drivers must be purchased and installed. The required drivers can be downloaded. For more information search ODBC drivers that are compatible with Excel for Mac on https://support.office.com. C D E 1 2 A1 A ⠀ |× ✓ fx B 3 Facility Amortization Table Payment Details 4 5 6 Payment 7 APR 8 Years 9 Pmts per Year Loan Details $8,647.55 Loan $450,000.00 5.75% Periodic Rate 5 # of Payments 0.479% 60 12 LL F G H 10 Payment 11 Number Beginning Balance Payment Amount Principal Interest Paid Repayment Remaining Balance Cumulative Interest Cumulative Principal 12 1 13 2 3 14 15 st 16 5 17 6 18 7 19 8 20 9 21 10 22 11 23 12 24 13 25 14 26 15 Employee_Info New_Construction +

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

This needs to be done with the PMT functions, I can't figure out why the principal and interest don't add to the payment amount. I need help on 38 - 42. Thank you!

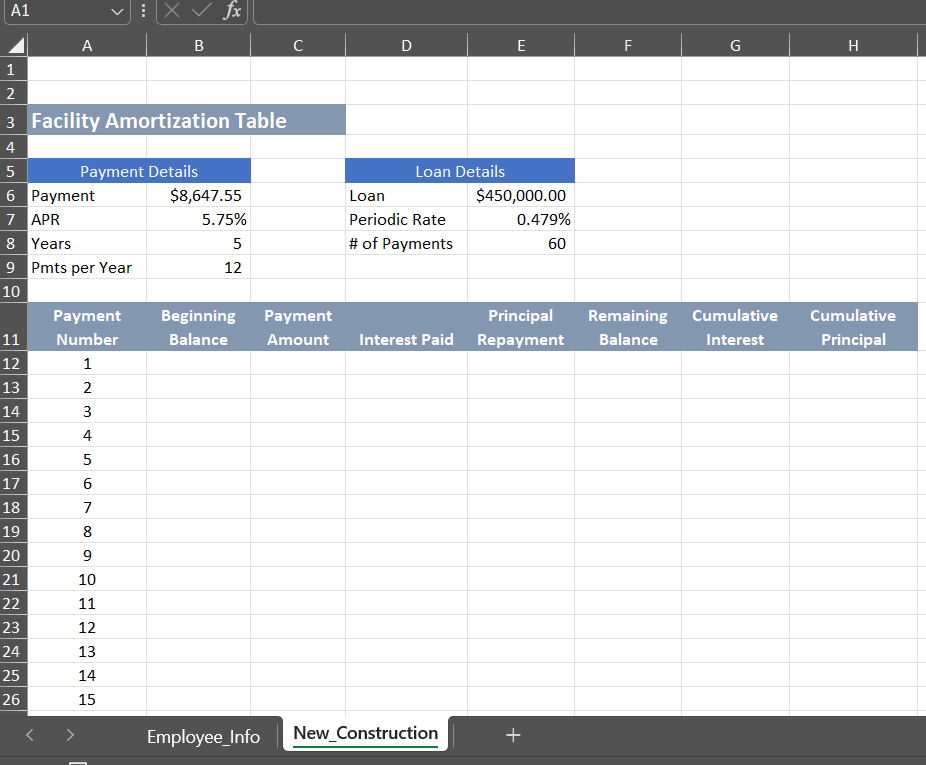

Transcribed Image Text:mortization Schedule

To continue your analysis of facility expenditures, you want to complete an amortization table

detailing payment, principal, interest, cumulative principal, and cumulative interest.

35. Ensure that the New_Construction worksheet is active

36. Enter a reference in cell B12 to the beginning loan balance.

37. Enter a reference in cell C12 to the payment amount.

38. Enter a function in cell D12 based on the payment and loan details that calculates the

amount of interest paid on the first payment. Be sure to use the appropriate absolute, relative,

or mixed cell references. All results should be formatted as positive numbers.

39. Enter a function in cell E12 based on the payment and loan details that calculates the

amount of principal paid on the first payment. Be sure to use the appropriate absolute, rela-

tive, or mixed cell references and ensure the results are positive.

40. Enter a formula in cell F12 to calculate the remaining balance after the current payment.

The remaining balance is calculated by subtracting the principal payment from the balance

in column B.

41. Enter a function in cell G12 based on the payment and loan details that calculates the

amount of cumulative interest paid on the first payment. Be sure to use the appropriate abso-

lute, relative, or mixed cell references and ensure the results are positive.

42. Enter a function in cell H12 based on the payment and loan details that calculates the

amount of cumulative principal paid on the first payment. Be sure to use the appropriate ab-

solute, relative, or mixed cell references. All results should be formatted as positive numbers.

43. Enter a reference to the remaining balance of payment 1 in cell B13.

44. Use the fill handle to copy the functions created in the prior steps down to complete the amor-

tization table. Expand the width of columns D:H as needed.

45. Save the workbook.

orm, PowerPivot, and 3D Maps

You want to create a PivotTable to analyze sales information. To complete this task, you will use

Get & Transform to connect and transform the data. Then you will use 3D Maps to create a geo-

graphic visualization of warehouse information.

MAC TROUBLESHOOTING: The standard installation of Excel for Mac does include drivers

for importing SQL databases but does not include drivers to import data from Access. To import data

from Access, third-party ODBC drivers must be purchased and installed. The required drivers can be

downloaded. For more information search ODBC drivers that are compatible with Excel for Mac on

https://support.office.com.

Transcribed Image Text:C

D

E

1

2

A1

A

⠀ |× ✓ fx

B

3 Facility Amortization Table

Payment Details

4

5

6

Payment

7 APR

8 Years

9 Pmts per Year

Loan Details

$8,647.55

Loan

$450,000.00

5.75%

Periodic Rate

5

# of Payments

0.479%

60

12

LL

F

G

H

10

Payment

11

Number

Beginning

Balance

Payment

Amount

Principal

Interest Paid Repayment

Remaining

Balance

Cumulative

Interest

Cumulative

Principal

12

1

13

2

3

14

15

st

16

5

17

6

18

7

19

8

20

9

21

10

22

11

23

12

24

13

25

14

26

15

Employee_Info

New_Construction

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education