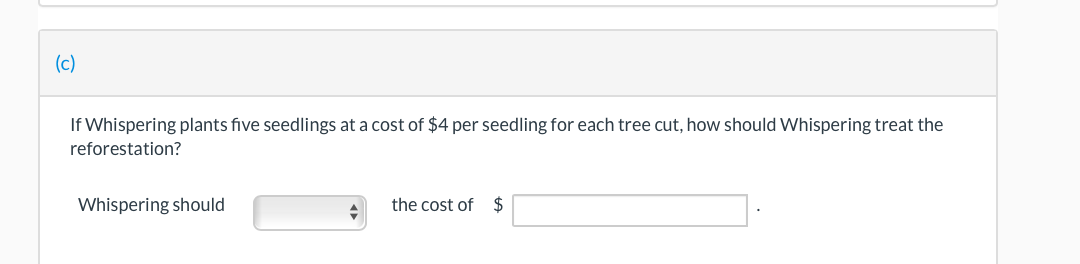

(c) If Whispering plants five seedlings at a cost of $4 per seedling for each tree cut, how should Whispering treat the reforestation? Whispering should the cost of $

(c) If Whispering plants five seedlings at a cost of $4 per seedling for each tree cut, how should Whispering treat the reforestation? Whispering should the cost of $

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 69TA

Related questions

Question

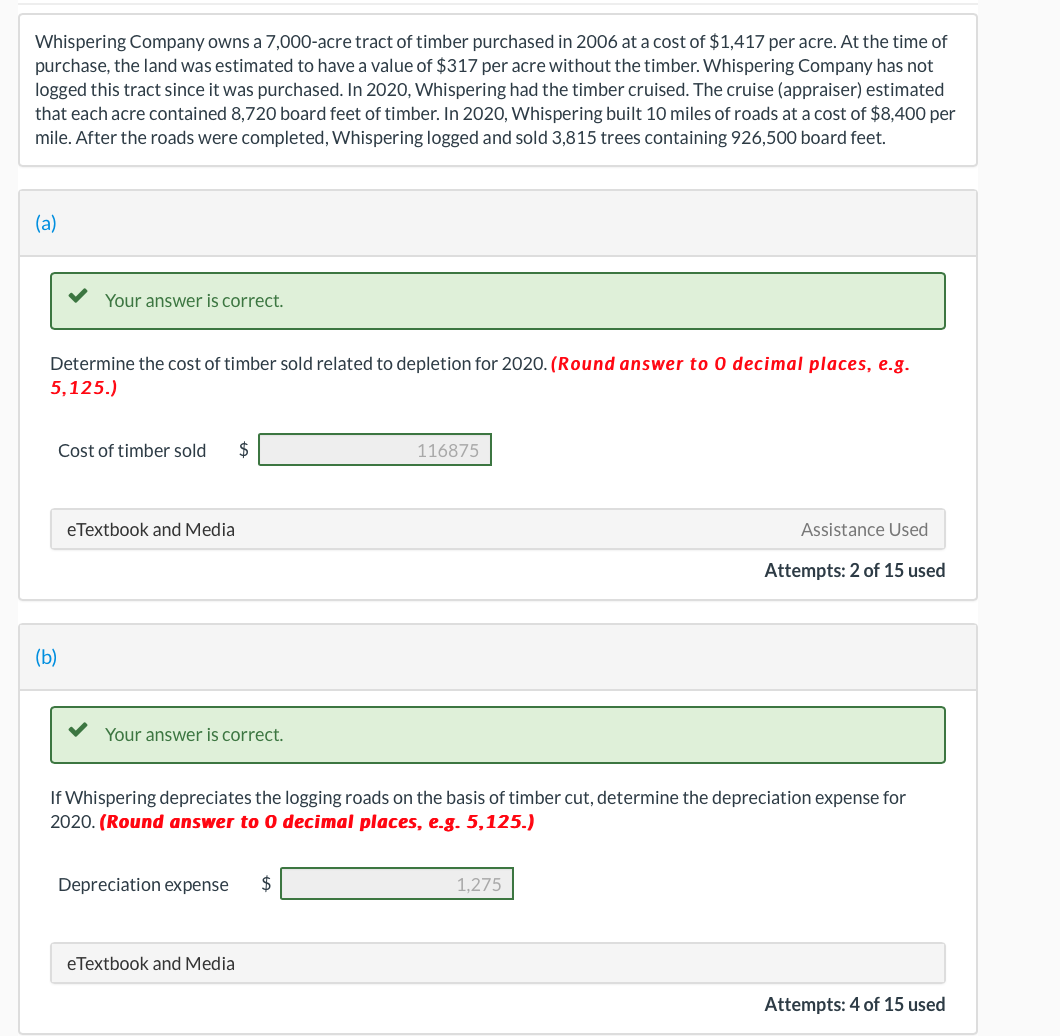

Transcribed Image Text:Whispering Company owns a 7,000-acre tract of timber purchased in 2006 at a cost of $1,417 per acre. At the time of

purchase, the land was estimated to have a value of $317 per acre without the timber. Whispering Company has not

logged this tract since it was purchased. In 2020, Whispering had the timber cruised. The cruise (appraiser) estimated

that each acre contained 8,720 board feet of timber. In 2020, Whispering built 10 miles of roads at a cost of $8,400 per

mile. After the roads were completed, Whispering logged and sold 3,815 trees containing 926,500 board feet.

(a)

Your answer is correct.

Determine the cost of timber sold related to depletion for 2020. (Round answer to 0 decimal places, e.g.

5,125.)

(b)

Cost of timber sold $

eTextbook and Media

Your answer is correct.

Depreciation expense $

116875

If Whispering depreciates the logging roads on the basis of timber cut, determine the depreciation expense for

2020. (Round answer to 0 decimal places, e.g. 5,125.)

eTextbook and Media

Assistance Used

Attempts: 2 of 15 used

1,275

Attempts: 4 of 15 used

Transcribed Image Text:(c)

If Whispering plants five seedlings at a cost of $4 per seedling for each tree cut, how should Whispering treat the

reforestation?

Whispering should

the cost of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College