c. Another stock in the same industry has had the following year end prices and dividends: Year Price $60.18 73.66 94.18 89.35 78.49 95.05 Dividend 2 3 4 5 $.60 .64 .72 .80 1.20 What are the arithmetic and geometric returns for the stock?

c. Another stock in the same industry has had the following year end prices and dividends: Year Price $60.18 73.66 94.18 89.35 78.49 95.05 Dividend 2 3 4 5 $.60 .64 .72 .80 1.20 What are the arithmetic and geometric returns for the stock?

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Concept explainers

Equations and Inequations

Equations and inequalities describe the relationship between two mathematical expressions.

Linear Functions

A linear function can just be a constant, or it can be the constant multiplied with the variable like x or y. If the variables are of the form, x2, x1/2 or y2 it is not linear. The exponent over the variables should always be 1.

Question

please solve c,d,e thank you

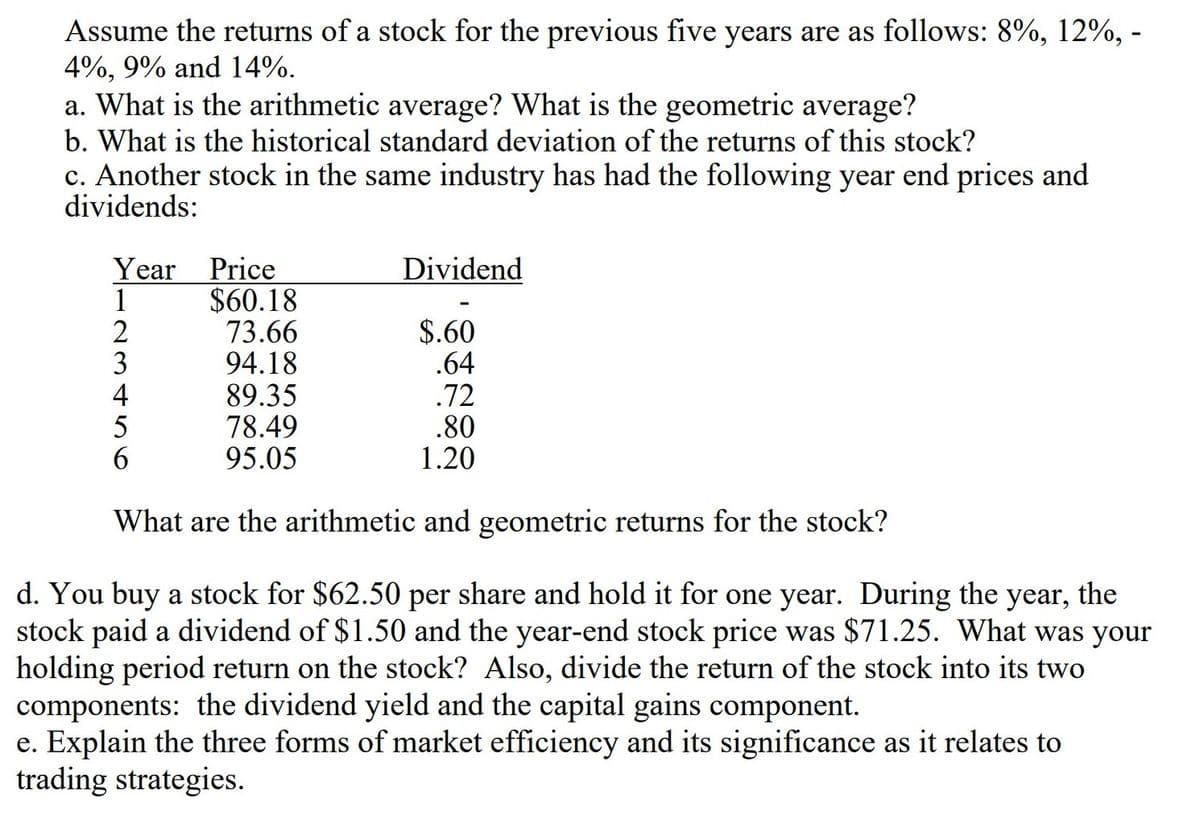

Transcribed Image Text:Assume the returns of a stock for the previous five years are as follows: 8%, 12%, -

4%, 9% and 14%.

a. What is the arithmetic average? What is the geometric average?

b. What is the historical standard deviation of the returns of this stock?

c. Another stock in the same industry has had the following year end prices and

dividends:

Year Price

$60.18

73.66

94.18

89.35

78.49

95.05

Dividend

1

$.60

.64

.72

.80

1.20

4

What are the arithmetic and geometric returns for the stock?

d. You buy a stock for $62.50 per share and hold it for one year. During the year, the

stock paid a dividend of $1.50 and the year-end stock price was $71.25. What was your

holding period return on the stock? Also, divide the return of the stock into its two

components: the dividend yield and the capital gains component.

e. Explain the three forms of market efficiency and its significance as it relates to

trading strategies.

T23t56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt