Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.3: Modeling Data With Linear Functions

Problem 18E: Tax Table Here are selected entries from the 2014 tax table that show the federal income tax owed by...

Related questions

Question

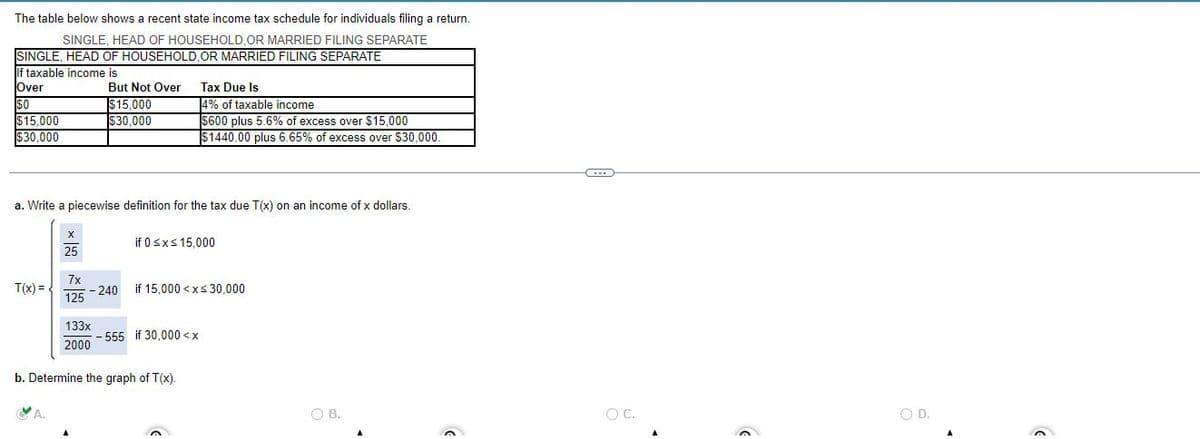

Transcribed Image Text:The table below shows a recent state income tax schedule for individuals filing a return.

SINGLE, HEAD OF HOUSEHOLD, OR MARRIED FILING SEPARATE

SINGLE, HEAD OF HOUSEHOLD, OR MARRIED FILING SEPARATE

If taxable income is

Over

Tax Due Is

But Not Over

$15.000

$0

4% of taxable income

$30,000

$15,000

$30,000

$600 plus 5.6% of excess over $15,000

$1440.00 plus 6.65% of excess over $30,000.

a. Write a piecewise definition for the tax due T(x) on an income of x dollars.

X

if 0 ≤x≤ 15,000

25

7x

T(x)=

if 15,000 < x≤ 30,000

125

133x

2000

b. Determine the graph of T(x).

CA.

- 240

555 if 30,000<x

OB.

G

OC.

(

O D.

(

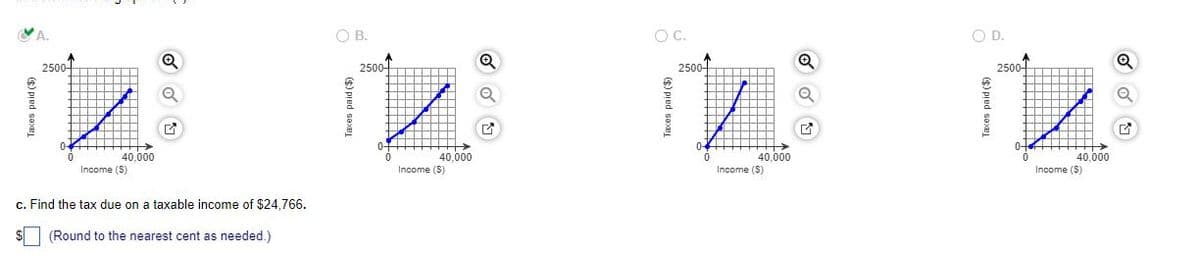

Transcribed Image Text:A.

2500

40.000

Income (S)

c. Find the tax due on a taxable income of $24,766.

(Round to the nearest cent as needed.)

OB.

Taxes paid ($)

2500

40,000

Income (S)

G

O.C.

2500-

40,000

Income (S)

OD.

2500

40,000

Income ($)

Q

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning