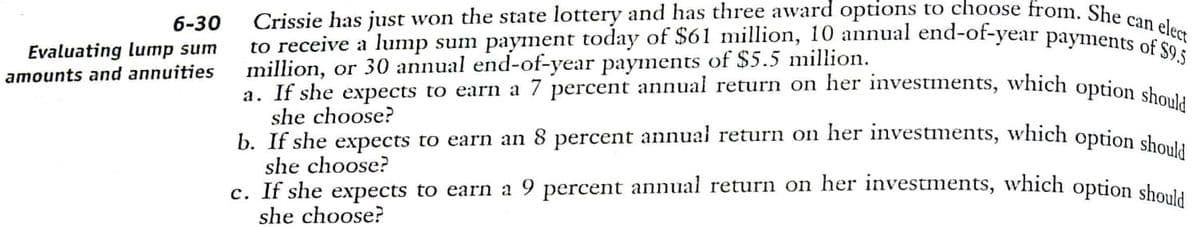

c. If she expects to earn a 9 percent annual return on her investments, which option should b. If she expects to earn an 8 percent annual return on her investments, which option should a. If she expects to earn a 7 percent annual return on her investments, which option should to receive a lump sum payment today of $61 million, 10 annual end-of-year payments of $9.5 Crissie has just won the state lottery and has three award options from. She can elect 6-30 Evaluating lump sum amounts and annuities million, or 30 annual end-of-year payments of $5.5 million. she choose? she choose? she choose?

c. If she expects to earn a 9 percent annual return on her investments, which option should b. If she expects to earn an 8 percent annual return on her investments, which option should a. If she expects to earn a 7 percent annual return on her investments, which option should to receive a lump sum payment today of $61 million, 10 annual end-of-year payments of $9.5 Crissie has just won the state lottery and has three award options from. She can elect 6-30 Evaluating lump sum amounts and annuities million, or 30 annual end-of-year payments of $5.5 million. she choose? she choose? she choose?

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:c. If she expects to earn a 9 percent annual return on her investments, which option should

b. If she expects to earn an 8 percent annual return on her investments, which option should

a. If she expects to earn a 7 percent annual return on her investments, which option should

to receive a lump sum payment today of $61 million, 10 annual end-of-year payments of $9.5

Crissie has just won the state lottery and has three award options to choose from. She can elect

6-30

Evaluating lumnp sum

amounts and annuities

million, or 30 annual end-of-year payments of $5.5 million.

she choose?

she choose?

she choose?

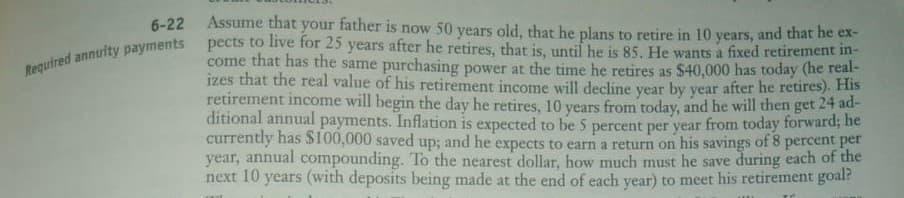

Transcribed Image Text:Assume that your father is now 50 years old, that he plans to retire in 10 years, and that he ex-

pects to live for 25 years after he retires, that is, until he is 85. He wants a fixed retirement in-

come that has the same purchasing power at the time he retires as $40,000 has today (he real-

izes that the real value of his retirement income will decline year by year after he retires). His

retirement income will begin the day he retires, 10 years from today, and he will then get 24 ad-

ditional annual payments. Inflation is expected to be 5 percent per year from today forward; he

currently has $100,000 saved up; and he expects to earn a return on his savings of 8 percent per

year, annual compounding. To the nearest dollar, how much must he save during each of the

years (with deposits being made at the end of each year) to meet his retirement goal?

6-22

Required annuity payments

next 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning