c. Indicate the amount of income that would be reported on the 2020 income statement and the investment balance on the 2020 year-end balance: under requirement (a) and requirement (b). Income Investment Net Balance 2020 Dec. 31, 2020 a. Investment accounted for under the equity method $ 18,000 v $ 406,500 x b. Investment measured at FV-NI 18,000 x 67,500 x Check

c. Indicate the amount of income that would be reported on the 2020 income statement and the investment balance on the 2020 year-end balance: under requirement (a) and requirement (b). Income Investment Net Balance 2020 Dec. 31, 2020 a. Investment accounted for under the equity method $ 18,000 v $ 406,500 x b. Investment measured at FV-NI 18,000 x 67,500 x Check

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 17P

Related questions

Question

I got the first two parts, but could you explain to me how to find part C?

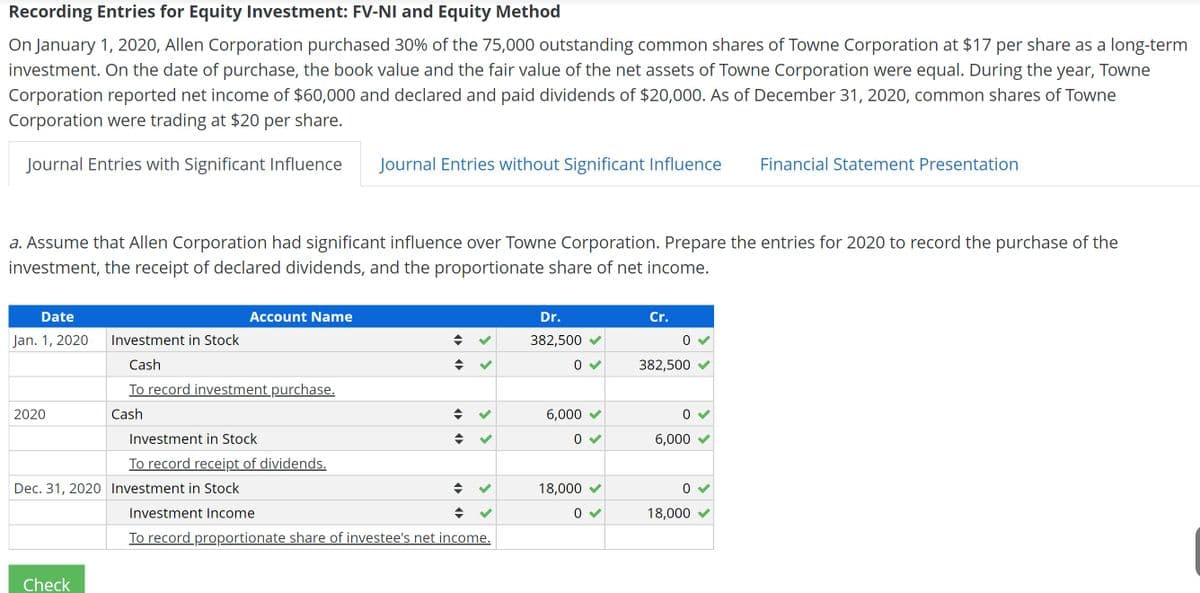

Transcribed Image Text:Recording Entries for Equity Investment: FV-NI and Equity Method

On January 1, 2020, Allen Corporation purchased 30% of the 75,000 outstanding common shares of Towne Corporation at $17 per share as a long-term

investment. On the date of purchase, the book value and the fair value of the net assets of Towne Corporation were equal. During the year, Towne

Corporation reported net income of $60,000 and declared and paid dividends of $20,000. As of December 31, 2020, common shares of Towne

Corporation were trading at $20 per share.

Journal Entries with Significant Influence

Journal Entries without Significant Influence

Financial Statement Presentation

a. Assume that Allen Corporation had significant influence over Towne Corporation. Prepare the entries for 2020 to record the purchase of the

investment, the receipt of declared dividends, and the proportionate share of net income.

Date

Account Name

Dr.

Cr.

Jan. 1, 2020

Investment in Stock

382,500

Cash

382,500

To record investment purchase.

2020

Cash

6,000

Investment in Stock

6,000

To record receipt of dividends.

Dec. 31, 2020 Investment in Stock

18,000

Investment Income

18,000

To record proportionate share of investee's net income.

Check

>

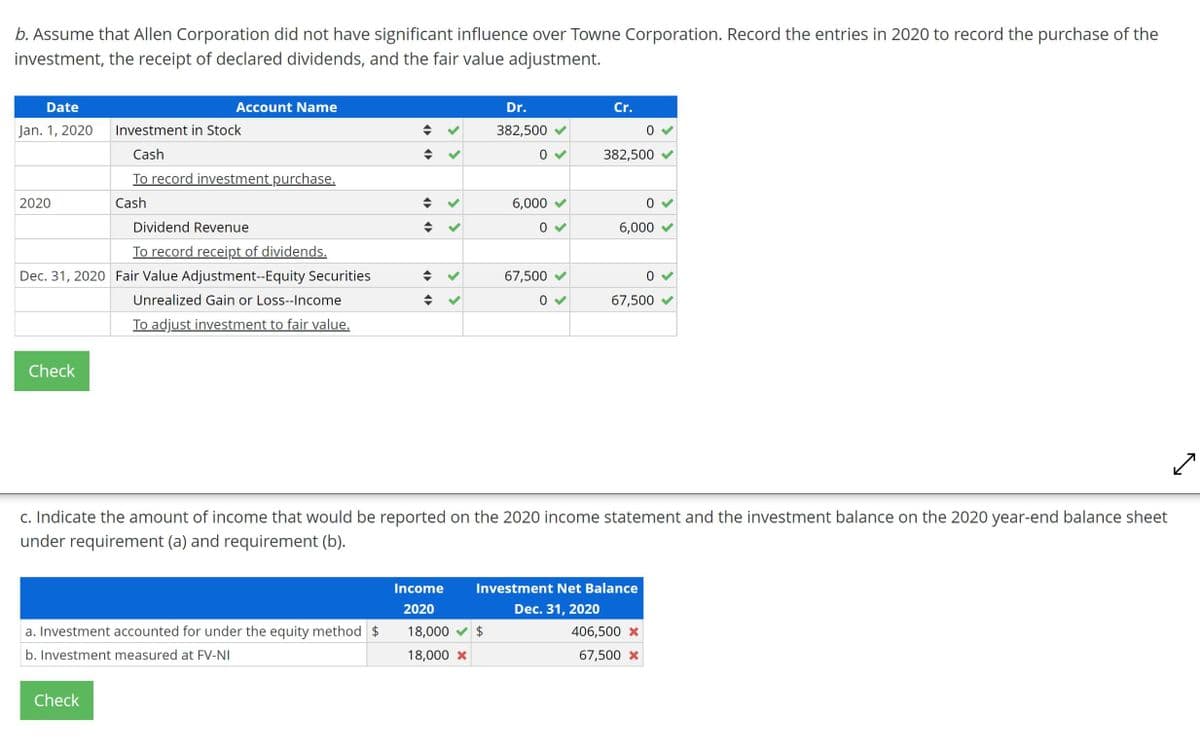

Transcribed Image Text:b. Assume that Allen Corporation did not have significant influence over Towne Corporation. Record the entries in 2020 to record the purchase of the

investment, the receipt of declared dividends, and the fair value adjustment.

Date

Account Name

Dr.

Cr.

Jan. 1, 2020

Investment in Stock

382,500

Cash

382,500

To record investment purchase.

2020

Cash

6,000

Dividend Revenue

6,000

To record receipt of dividends.

Dec. 31, 2020 Fair Value Adjustment--Equity Securities

67,500

Unrealized Gain or Loss--Income

67,500

To adjust investment to fair value.

Check

c. Indicate the amount of income that would be reported on the 2020 income statement and the investment balance on the 2020 year-end balance sheet

under requirement (a) and requirement (b).

Income

Investment Net Balance

2020

Dec. 31, 2020

a. Investment accounted for under the equity method $

18,000

406,500 x

b. Investment measured at FV-NI

18,000 x

67,500 x

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning