c. Prepare a statement of members equity for 20Y2 A decrease to members' equity should be entered as a negative amount. if an amount box anter Jenunt bisek

c. Prepare a statement of members equity for 20Y2 A decrease to members' equity should be entered as a negative amount. if an amount box anter Jenunt bisek

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

.

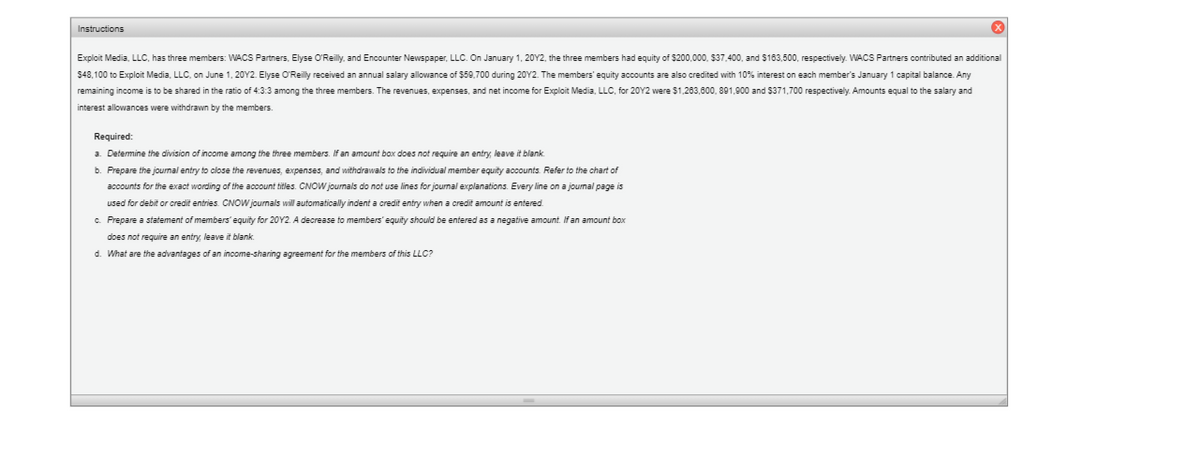

Transcribed Image Text:Instructions

Exploit Media, LLC, has three members: WACS Partners, Elyse O'Reilly, and Encounter Newspaper, LLC. On January 1, 20Y2, the three members had equity of $200,000, $37,400, and S163,500, respectively. WACS Partners contributed an additional

$48,100 to Exploit Media, LLC, on June 1, 20Y2. Elyse O'Reilly received an annual salary allowance of $59,700 during 20Y2. The members' equity accounts are also credited with 10% interest on each member's January 1 capital balance. Any

remaining income is to be shared in the ratio of 4:3:3 among the three members. The revenues, expenses, and net income for Exploit Media, LLC, for 20Y2 were $1,263,800, 891,900 and 5371,700 respectively. Amounts equal to the salary and

interest allowances were withdrawn by the members.

Required:

a. Determine the division of income among the three members. If an amount box does not require an entry, leave it blank.

b. Prepare the journal entry to close the revenues, expenses, and withdrawals to the individual member equity accounts. Refer to the chart of

accounts for the exact wording of the account titles. CNOW journals do not use lines for jourmal explanations. Every line on a jourmal page is

used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

c. Prepare a statement of members' equity for 20Y2. A decrease to members' equity should be entered as a negative amount. If an amount box

does not require an entry, leave it blank.

d. What are the advantages of an income-sharing agreement for the members of this LLC?

Transcribed Image Text:Instructions

Chart of Accounts

Schedule of Division of Income

Journal

Statement of Members' Equity

Final Question

Journal

Statement of Members' Equity

b.

not use lines for journ

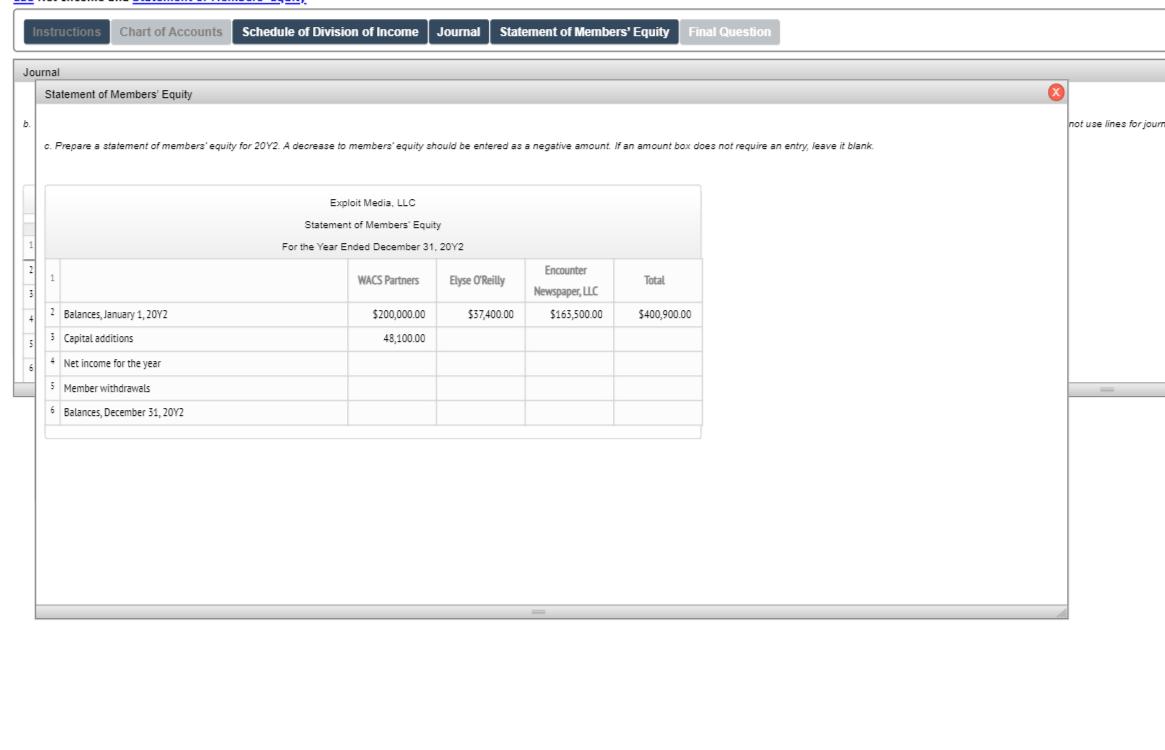

c. Prepare a statement of members' equity for 20Y2. A decrease to members' equity should be entered as a negative amount. If an amount box does not require an entry, leave it blank.

Exploit Media, LLC

Statement of Members' Equity

For the Year Ended December 31, 20Y2

Encounter

WACS Partners

Elyse O'Reilly

Total

Newspaper, LLC

2 Balances, January 1, 20Y2

$200,000.00

$37,400.00

$163,500.00

$400,900.00

3 Capital additions

48,100.00

+ Net income for the year

5 Member withdrawals

6 Balances, December 31, 20Y2

| |" |* * * " °

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning