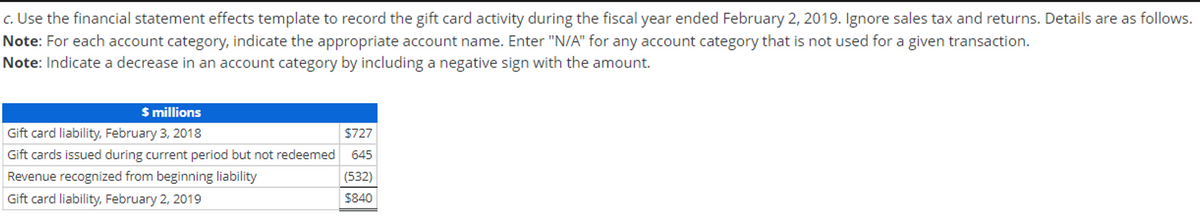

c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. $ millions Gift card liability, February 3, 2018 $727 Gift cards issued during current period but not redeemed 645 Revenue recognized from beginning liability Gift card liability, February 2, 2019 (532) $840 ($ millions) Transaction May: Gift card sale May: Gift card redemption Cash N/A Cash Asset 645✓ N/A 0✓ Inventory Noncash Assets 0 Balance Sheet Liabilities Contrib. Capital Earned Capital 645✓ 0 0 Unearned Revenue N/A ✓ N/A ✓ N/A x = -532✓ 0 ✓ 0 x Unearned Revenue N/A ÷ Retained Earnings Revenue Income Statement Expenses Net Income 0 0 Revenues 0 N/A 532 ▼ ÷ COGS x = ×

c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. $ millions Gift card liability, February 3, 2018 $727 Gift cards issued during current period but not redeemed 645 Revenue recognized from beginning liability Gift card liability, February 2, 2019 (532) $840 ($ millions) Transaction May: Gift card sale May: Gift card redemption Cash N/A Cash Asset 645✓ N/A 0✓ Inventory Noncash Assets 0 Balance Sheet Liabilities Contrib. Capital Earned Capital 645✓ 0 0 Unearned Revenue N/A ✓ N/A ✓ N/A x = -532✓ 0 ✓ 0 x Unearned Revenue N/A ÷ Retained Earnings Revenue Income Statement Expenses Net Income 0 0 Revenues 0 N/A 532 ▼ ÷ COGS x = ×

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 5C: Receivables Issues Magrath Company has an operating cycle of less than one year and provides credit...

Related questions

Question

please help...need help finding noncash assets

Transcribed Image Text:c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows.

Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction.

Note: Indicate a decrease in an account category by including a negative sign with the amount.

$ millions

Gift card liability, February 3, 2018

$727

Gift cards issued during current period but not redeemed 645

Revenue recognized from beginning liability

Gift card liability, February 2, 2019

(532)

$840

Transcribed Image Text:($ millions)

Transaction

May: Gift card sale

May: Gift card redemption

Cash

N/A

Cash Asset

645✓

N/A

0✓

Inventory

Noncash Assets

0

Balance Sheet

Liabilities

Contrib. Capital

Earned Capital

645✓

0

0

Unearned Revenue

N/A

✓

N/A

✓ N/A

x =

-532✓

0 ✓

0 x

Unearned Revenue

N/A

÷

Retained Earnings

Revenue

Income Statement

Expenses

Net Income

0

0

Revenues

0

N/A

532 ▼

÷

COGS

x =

×

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College