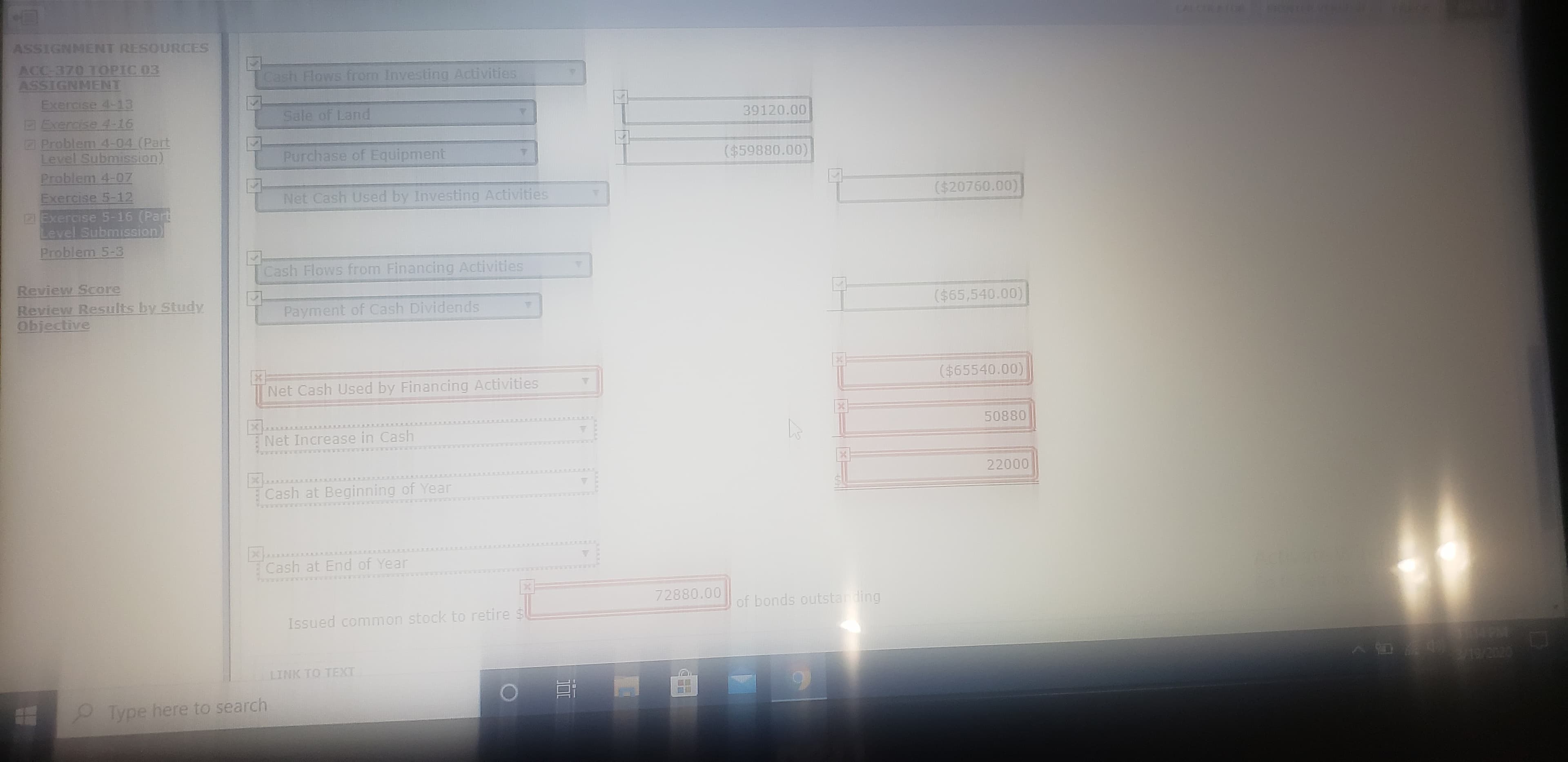

CALCRATOR ASSIGNMENT RESOURCES ACC-370 TOPIC 03 ASSIGNMENT Exercise 4-13 Cash Flows from Investing Activities Sale of Land DExercise 4-16 Problem 4-04 (Part Level Submission) Problem 4-07 Exercise 5-12 2Exercise 5-16 (Part Level Submisssion) Problem 5-3 39120.00 Purchase of Equipment ($59880.00) Net Cash Used by Investing Activities ($20760.00) Cash Flows from Financing Activities Review Score Review Results by Study Objective Payment of Cash Dividends ($65,540.00) Net Cash Used by Financing Activities ($65540.00) 50880 Net Increase in Cash .... Cash at Beginning of Year 22000 .... Cash at End of Year 72880.00 of bonds outstanding Issued common stock to retire $ LINK TO TEXT 9/2020 Type here to search SySteni cements CALCULATOR PRIATER VER T RESOURCES OPIC 03 NT Exercise 5-16 (Part Level Submission) A comparative balance sheet for Vaughn Corporation is presented as follows. 4-13 December 31 2020 $72,880 84,590 182,590 73,590 262,590 (71,590) $604,650 4-16 Assets Cash Accounts receivable Inventory Land Equipment Accumulated Depreciation-Equipment Total Liabilities and Stockholders' Equity Accounts payable Bonds payable Common stock ($1 par) Retained earnings Total 2019 4-04 (Part omission) $ 22,000 68,710 191,710 112,710 202,710 (44,710) 4-07 5-12 5-16 (Part emission) 5-3 $553,130 $ 36,590 150,000 214,000 204,060 $604,650 $ 49,710 200,000 164,000 139,420 $553,130 re sults by Study Additional information: 1. Net income for 2020 was $130,180. No gains or losses werer in 2020. 2. Cash dividends of $65,540 were declared and paid. 3. Bonds payable amounting to $50,000 were retired through isuance of common stock. (a) Your answer is partially correct. Try again. Cornoration. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or pare

CALCRATOR ASSIGNMENT RESOURCES ACC-370 TOPIC 03 ASSIGNMENT Exercise 4-13 Cash Flows from Investing Activities Sale of Land DExercise 4-16 Problem 4-04 (Part Level Submission) Problem 4-07 Exercise 5-12 2Exercise 5-16 (Part Level Submisssion) Problem 5-3 39120.00 Purchase of Equipment ($59880.00) Net Cash Used by Investing Activities ($20760.00) Cash Flows from Financing Activities Review Score Review Results by Study Objective Payment of Cash Dividends ($65,540.00) Net Cash Used by Financing Activities ($65540.00) 50880 Net Increase in Cash .... Cash at Beginning of Year 22000 .... Cash at End of Year 72880.00 of bonds outstanding Issued common stock to retire $ LINK TO TEXT 9/2020 Type here to search SySteni cements CALCULATOR PRIATER VER T RESOURCES OPIC 03 NT Exercise 5-16 (Part Level Submission) A comparative balance sheet for Vaughn Corporation is presented as follows. 4-13 December 31 2020 $72,880 84,590 182,590 73,590 262,590 (71,590) $604,650 4-16 Assets Cash Accounts receivable Inventory Land Equipment Accumulated Depreciation-Equipment Total Liabilities and Stockholders' Equity Accounts payable Bonds payable Common stock ($1 par) Retained earnings Total 2019 4-04 (Part omission) $ 22,000 68,710 191,710 112,710 202,710 (44,710) 4-07 5-12 5-16 (Part emission) 5-3 $553,130 $ 36,590 150,000 214,000 204,060 $604,650 $ 49,710 200,000 164,000 139,420 $553,130 re sults by Study Additional information: 1. Net income for 2020 was $130,180. No gains or losses werer in 2020. 2. Cash dividends of $65,540 were declared and paid. 3. Bonds payable amounting to $50,000 were retired through isuance of common stock. (a) Your answer is partially correct. Try again. Cornoration. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or pare

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.1MBA

Related questions

Question

Need help with the red box. Thank you

Transcribed Image Text:CALCRATOR

ASSIGNMENT RESOURCES

ACC-370 TOPIC 03

ASSIGNMENT

Exercise 4-13

Cash Flows from Investing Activities

Sale of Land

DExercise 4-16

Problem 4-04 (Part

Level Submission)

Problem 4-07

Exercise 5-12

2Exercise 5-16 (Part

Level Submisssion)

Problem 5-3

39120.00

Purchase of Equipment

($59880.00)

Net Cash Used by Investing Activities

($20760.00)

Cash Flows from Financing Activities

Review Score

Review Results by Study

Objective

Payment of Cash Dividends

($65,540.00)

Net Cash Used by Financing Activities

($65540.00)

50880

Net Increase in Cash

....

Cash at Beginning of Year

22000

....

Cash at End of Year

72880.00

of bonds outstanding

Issued common stock to retire $

LINK TO TEXT

9/2020

Type here to search

Transcribed Image Text:SySteni

cements

CALCULATOR

PRIATER VER

T RESOURCES

OPIC 03

NT

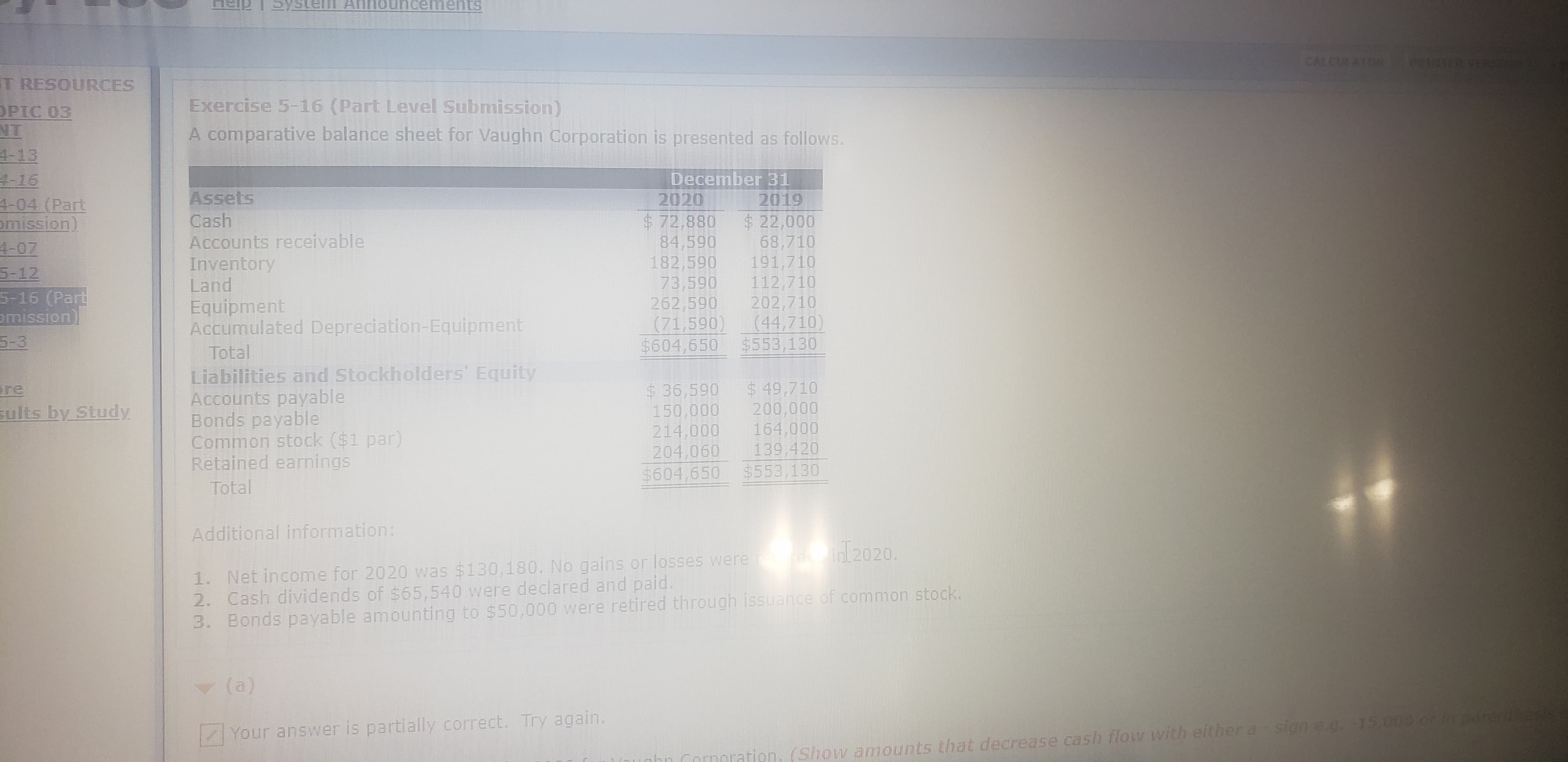

Exercise 5-16 (Part Level Submission)

A comparative balance sheet for Vaughn Corporation is presented as follows.

4-13

December 31

2020

$72,880

84,590

182,590

73,590

262,590

(71,590)

$604,650

4-16

Assets

Cash

Accounts receivable

Inventory

Land

Equipment

Accumulated Depreciation-Equipment

Total

Liabilities and Stockholders' Equity

Accounts payable

Bonds payable

Common stock ($1 par)

Retained earnings

Total

2019

4-04 (Part

omission)

$ 22,000

68,710

191,710

112,710

202,710

(44,710)

4-07

5-12

5-16 (Part

emission)

5-3

$553,130

$ 36,590

150,000

214,000

204,060

$604,650

$ 49,710

200,000

164,000

139,420

$553,130

re

sults by Study

Additional information:

1. Net income for 2020 was $130,180. No gains or losses werer in 2020.

2. Cash dividends of $65,540 were declared and paid.

3. Bonds payable amounting to $50,000 were retired through isuance of common stock.

(a)

Your answer is partially correct. Try again.

Cornoration. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or pare

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning