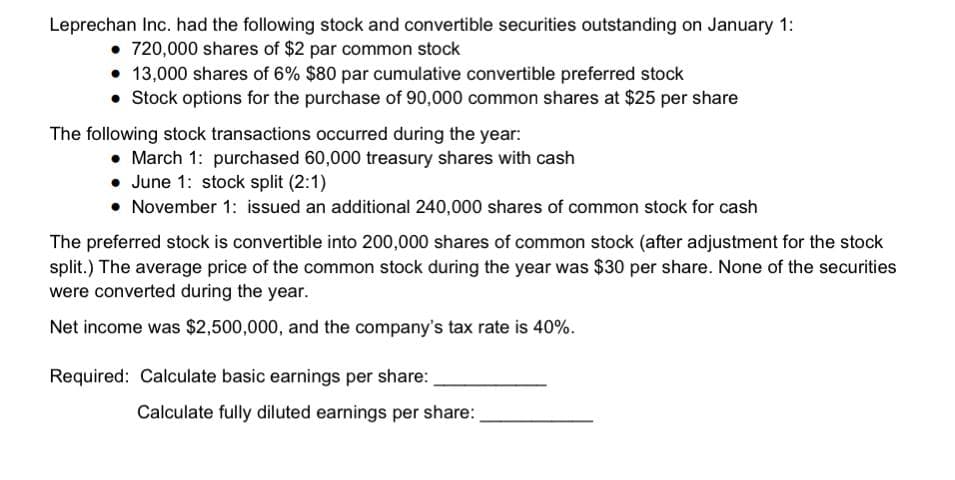

Calculate basic earnings per share: Calculate fully diluted earnings per share:

Q: Compute earnings per share in a complex situation.

A: Earnings per share measures per share amount of earnings generated by a company. It is shown on the…

Q: Define each of the following terms.b. Cumulative dividends; arrearages

A: Cumulative dividend: It may be a power related to a given firm's preferred shares. A set amount or…

Q: I need the exact format for the earnings per share please

A: Step 1 Financial Statements are the reports which provide the entity's financial information in…

Q: 2. Based on the balance sheet, Are the earnings per share increasing or decreasing? Explain

A: The amount distributed to the shareholders from earnings available to shareholders is known as the…

Q: formula for the following: 1. price earnings ratio 2. dividend yield ratio 3. dividend payout ratio…

A: Note: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Refer to Table 8-1. What were company D's earnings per share?

A: Earnings Per Share: It is the earnings of the company per share. It is calculated by dividing the…

Q: Compute basic earnings per share.

A: Share: Shares refer to a unit of ownership interest in a corporation that provide an equal…

Q: Match each computation to one of the profitability measures in the table. Profitability Measures…

A: Assets turnover ratio = net sales /average total Assets Return on total Assets = net income/average…

Q: Compute basic and diluted earnings per share for a business combination.

A: Basic EPS refers to company's profits divided by number of outstanding shares. Diluted EPS refers to…

Q: How do I calculate the price / earnings ratio, earnings per common share, and dividend payout?

A: Price/ Earnings ratio: Price Earnings ratio is the ratio of firm’s present share price to its…

Q: A. What amount should be reported as basic earnings per share? B. What amount should be reported as…

A: Earning per share (EPS) is the ratio that describes how much profit is earned by the company for…

Q: Describe to Becky the difference between basic and diluted earnings per share.

A: Earnings per share (EPS): It is the profit per outstanding share of a public company. A higher EPS…

Q: What is the definition of “basic earnings per share”

A: Definition: Net income: The bottom line of an income statement which is the result of the excess of…

Q: EPS is computed by dividing net income by the average number of shares outstanding. True False

A: Earnings per share(EPS) refers to an indicator or a financial ratio that shows how much a company is…

Q: Define the following terms. Basic earnings per share. Potentially dilutive security. Diluted…

A: Basic earning per share is the amount of a company’s earnings allocable to each share of its common…

Q: Explain how to calculate earnings per share.

A: Earnings per share shows the profits available to each common stock shareholder after paying the…

Q: Book value per share is computed by dividing the net assets to the total number of shares…

A: Book value per share: It is the financial ratio that represents the minimum value of a company's…

Q: It is calculated, taking into account the outstanding equity shares of the company A. Conversion…

A: Issue of shares is an important source of finance for the business. Several type of shares can be…

Q: explain mean reversion in earnings and how the accruals component of earnings aff ects thespeed of…

A: Earnings mean reversion means earnings of the company come to a normal level if the earnings for…

Q: Define earnings per share.

A: Ratio Analysis: This refers to the performance measurement of the business, in order to know the…

Q: Explain the Summary of the Effect of Potential Common Shares on Earnings Per Share.

A: The companies which are listed on securities exchange are required to report the Earnings per share…

Q: In its most basic form, the Earnings per Share (EPS) ratio is calculated as: Net income divided by…

A: EPS = earnings per share .

Q: is Diluted Earnings Per Share (EPS) an easy calculation to prepare and understand?

A: The diluted EPS calculation is a little more complex than the EPS calculation. Both are…

Q: TRUE OR FALSE? In computing earnings per share, we must interpret this in terms of the number of…

A: EPS or Earnings-per-Share refers to portion of net profit that belongs to each single unit of common…

Q: Calculate dividend per share.

A: A dividend is a form of distributing the profits of a company to its shareholders. Almost all…

Q: Using the data above, calculate the following: • Cost of common equity using retained earnings •…

A: Cost of preference shares refers to the amount paid to the preference shareholders of the company in…

Q: diluted earnings per share?

A: Diluted Earning Per Share (Diluted EPS) is a financial ratio to check the quality of the Earnings…

Q: How to calculate earnings per share.

A: Earnings per share represent the amount of income earned per share of outstanding common stock in a…

Q: What is the company's cost of retained earnings? Round your answer to two decimal places.…

A: Growth rare (G) = 2% Market price of share (P) = $ 24 Recent dividend = $ 2.50 Next dividend (D1) =…

Q: how is an increase of share prices recorded on a company's income statement, balance sheet, and cash…

A: Answer: An increase in share prices will not have any monetary impact. It simply means that the no.…

Q: Why is earnings per share called “the bottom line”? What is EBIT, or operatingincome?

A: Earnings per share is the company’s net revenue/income that can be distributed among its…

Q: Define Diluted Earnings Per Share.

A: Earnings per share: An amount available as earnings for each of the common shares outstanding for a…

Q: The ____________________per share is the amount of income attributable to each share ofcommon…

A: answer: a. earnings

Q: c. How much Resulting APIC is to be charged or debited for the stock issuance cost d. How much…

A: According to IFRS 3 Business Combination, the cost incurred for issuing stock shall not be treated…

Q: The amount of income earned per share of outstanding common stock is known as: Multiple Choice…

A: Shares: Shares are the units of the total stock of a company that show the fractional ownership of…

Q: What does the P/E ratio measure? C . Th e earnings for one common share of stock.

A: Pe ratio = share price/ earning per share The PE ratio is the ratio of a company's share price to…

Q: Compute basic earnings per share

A: The Earnings per share(EPS) is a measure to indicate the profitability of a company. It is the…

Q: Compute dividend payout ratio

A: Dividend payout ratio = Dividend per share / Earning per Share * 100

Q: Determine the earnings per share

A: Earning per share is the earning of equity shareholders. It is available after paying all interest…

Q: True

A: Common stock refers to the shares in a company that is owned by the general public and has several…

Q: Why are companies required to report the diluted earnings per share figures in addition to the basic…

A: Earnings per share is a ratio which determines and indicates the profit available to common…

Q: a. Times interest earned ratio times b. Earnings per share on common stock c. Price-earnings ratio…

A: Required Formula a.Time Interest Earned Ratio = (Income before tax+Interest Expense)/ Interest…

Q: It is possible for the postmerger P/E ratio to move in a direction opposite to that of the immediate…

A: A merger is the combination of two organizations, which eventually form a new legal entity under one…

Q: The ratio of the market price per share of common stock on a specific date to the annual earnings…

A: Price earnings ratio is the ratio of market price per share with Earnings per shares. This ratio is…

Q: TRUE OR FALSE Price earnings ratio refers to the multiplier applied to earnings per share to…

A: Price earnings ratio is P/E ratio. It shows the relationship between price per share and earnings…

Q: Explain the disclosure of Earnings per Share.

A: Earnings per share (EPS) indicate the profitability of the company. High Earnings per share means…

Step by step

Solved in 2 steps

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.

- CASH DIVIDENDS, STOCK DIVIDEND, AND STOCK SPLIT During the year ended December 31, 20--, Baggio Company completed the following transactions: Apr. 15 Declared a semiannual dividend of 0.65 per share on preferred stock and 0.45 per share on common stock to shareholders of record on May 5, payable on May 10. Currently, 6,000 shares of 50 par preferred stock and 70,000 shares of 1 par common stock are outstanding. May 10 Paid the cash dividends. Oct. 15 Declared semiannual dividend of 0.65 per share on preferred stock and 0.45 per share on common stock to shareholders of record on November 5, payable on November 20. Nov. 20 Paid the cash dividends. 22 Declared a 10% stock dividend to shareholders of record on December 8, distributable on December 16. Market value of the common stock was estimated at 15 per share. Dec. 16 Issued certificates for common stock dividend. 20 Board of directors declared a two-for-one common stock split. REQUIRED Prepare journal entries for the transactions.Prepare general journal entries for the following transactions of GOTE Company: (a) Received subscriptions for 10,000 shares of 2 par common stock for 80,000. (b) Received payment of 30,000 on the stock subscription in transaction (a). (c) Received the balance in full for the stock subscription in transaction (a) and issued the stock. (d) Purchased 1,000 shares of its own 2 par common stock for 7.50 a share. (e) Sold 500 shares of the stock on transaction (d) for 8.50 a share.MacKenzie Mining Corporation is authorized to issue 50,000 shares of $500 par value 7% preferred stock. It is also authorized to issue 5,000,000 shares of $3 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.

- Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000 shares of $100 par value 8% cumulative preferred stock. It is also authorized to issue 750,000 shares of $6 par value common stock. It has issued 50,000 of the common shares and 1,000 of the cumulative preferred shares. The corporation has never declared a dividend and the preferred shares are one years in arrears. Aggregate Mining has the following transactions this year: Journalize these transactions. For the stock split, show the calculation for how many shares are outstanding after the split and the par value per share after the splitEffective May 1, the shareholders of Baltimore Corporation approved a 2-for-1 split of the companys common stock and an increase in authorized common shares from 100,000 shares (par value 20 per share) to 200,000 shares (par value 10 per share). Baltimores shareholders equity items immediately before issuance of the stock split shares were as follows: What should be the balances in Baltimores Additional Paid-in Capital and Retained Earnings accounts immediately after the stock split is effected?Issuances of Stock Cada Corporation is authorized to issue 10,000 shares of 100 par, convertible, callable preferred stock and 80,000 shares of no-par, no-stated value common stock. There are currently 7,000 shares of preferred and 30,000 shares of common stock outstanding. The following are several alternative transactions: 1. Purchased land by issuing 640 shares of preferred stock and 1,000 shares of common stock. Preferred and common are currently selling at 113 and 36 per share, respectively, No reliable appraisal of the land is available. 2. Same as Transaction 1, except that land is appraised at 104,000, and the preferred stock has no current market value. 3. Issued, for 99,000 cash, a combination of 400 shares of preferred stock and bonds payable with a face value of 50,000. Currently, the preferred stock is selling for 120 per share and the bonds at 104. 4. Same as Transaction 3, except that the bonds do not have a current market value. 5. Same as Transaction 3, except that the preferred stock does not have a current market value. 6. Preferred shareholders (who had originally paid the corporation 110 per share for their stock) convert 6,500 preferred shares into 19,500 shares of common stock. The current market prices of the preferred stock and the common stock are 120 and 41 per share, respectively. 7. The corporation calls the 7,000 shares of preferred stock (originally issued at 110 per share) at 123 per share. Common stock is currently selling for 42 per share. Shareholders elect not to convert into common stock. 8. Same as Transaction 7, except that shareholders owning 2,000 shares of preferred stock elect to convert each share into 3 shares of common stock The remaining 5,000 preferred shares are retired. Required: Next Level Prepare the journal entry necessary to record each transaction. Below each entry, explain your reason for the values used.

- Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Winona Company began 2019 with 10,000 shares of 10 par common stock and 2,000 shares of 9.4%, 100 par, convertible preferred stock outstanding. On April 2 and June 1, respectively, the company issued 2,000 and 6,000 additional shares of common stock. On November 16, Winona declared a 2-for-1 stock split. The preferred stock was issued in 2018. Each share of preferred stock is currently convertible into 4 shares of common stock. To date, no preferred stock has been converted. Current dividends have been paid on both preferred and common stock. Net income after taxes for 2019 totaled 109,800. The company is subject to a 30% income tax rate. The common stock sold at an average market price of 24 per share during 2019. Required: 1. Prepare supporting calculations for Winona and compute its: a. basic earnings per share b. diluted earnings per share 2. Show how Winona would report the earnings per share on its 2019 income statement. Include an accompanying note to the financial statements. 3. Next Level Assume Winona uses IFRS. Discuss what Winona would do differently for computing earnings per share, and then repeat Requirement 1 under IFRS.