Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Stanley Smothers receives tips from customers as a standard component of his weekly pay. He is paid $5.10/hour by his employer and receives $305 in tips during the most recent 41-hour workweek. Gross Pay = $ 2: Arnold Weiner receives tips from customers as a standard component of his weekly pay. He is paid $4.40/hour by his employer and receives $188 in tips during the most recent 47-hour workweek. Gross Pay = $ 3: Katherine Shaw receives tips from customers as a standard component of her weekly pay. She is paid $2.20/hour by her employer and receives $553 in tips during the most recent 56-hour workweek. Gross Pay = $ 4: Tracey Houseman receives tips from customers as a standard component of her weekly pay. She is paid $3.90/hour by her employer and receives $472 in tips during the most recent 45-hour workweek. Gross Pay = $

Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Stanley Smothers receives tips from customers as a standard component of his weekly pay. He is paid $5.10/hour by his employer and receives $305 in tips during the most recent 41-hour workweek. Gross Pay = $ 2: Arnold Weiner receives tips from customers as a standard component of his weekly pay. He is paid $4.40/hour by his employer and receives $188 in tips during the most recent 47-hour workweek. Gross Pay = $ 3: Katherine Shaw receives tips from customers as a standard component of her weekly pay. She is paid $2.20/hour by her employer and receives $553 in tips during the most recent 56-hour workweek. Gross Pay = $ 4: Tracey Houseman receives tips from customers as a standard component of her weekly pay. She is paid $3.90/hour by her employer and receives $472 in tips during the most recent 45-hour workweek. Gross Pay = $

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter12: Preparing Payroll Records

Section12.1: Calculating Employee Earnings

Problem 1WT

Related questions

Question

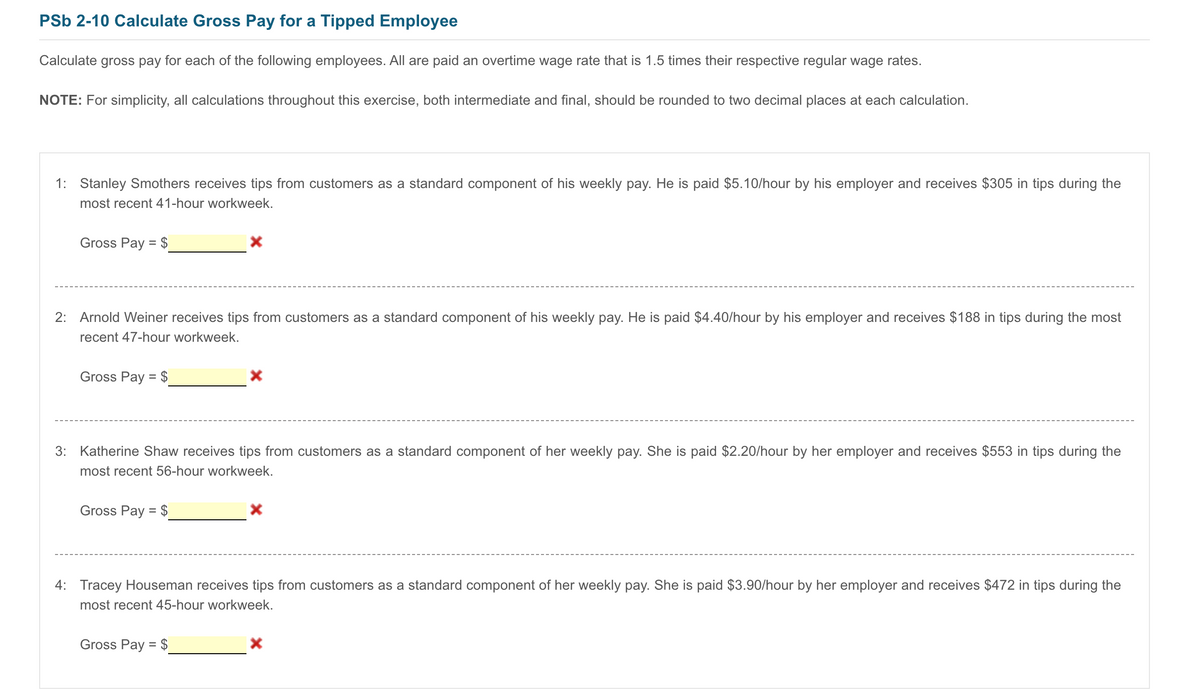

Transcribed Image Text:PSb 2-10 Calculate Gross Pay for a Tipped Employee

Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates.

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

1: Stanley Smothers receives tips from customers as a standard component of his weekly pay. He is paid $5.10/hour by his employer and receives $305 in tips during the

most recent 41-hour workweek.

Gross Pay = $

2: Arnold Weiner receives tips from customers as a standard component of his weekly pay. He is paid $4.40/hour by his employer and receives $188 in tips during the most

recent 47-hour workweek.

Gross Pay = $

3: Katherine Shaw receives tips from customers as a standard component of her weekly pay. She is paid $2.20/hour by her employer and receives $553 in tips during the

most recent 56-hour workweek.

Gross Pay = $

4: Tracey Houseman receives tips from customers as a standard component of her weekly pay. She is paid $3.90/hour by her employer and receives $472 in tips during the

most recent 45-hour workweek.

Gross Pay = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1 Introduction

VIEWStep 2 Calculation of Gross Pay during the week of Stanley Smothers

VIEWStep 3 Calculation of Gross Pay during the week of Arnold Weiner

VIEWStep 4 Calculation of Gross Pay during the week of Katherine Show

VIEWStep 5 Calculation of Gross Pay during the week of Tracey Houseman

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning