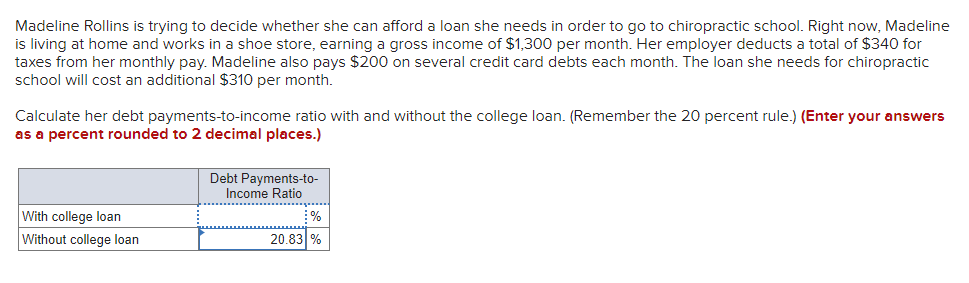

Calculate her debt payments-to-income ratio with and without the college loan. (Remember the 20 percent rule.) (Enter your answers as a percent rounded to 2 decimal places.)

Calculate her debt payments-to-income ratio with and without the college loan. (Remember the 20 percent rule.) (Enter your answers as a percent rounded to 2 decimal places.)

Chapter7: Credit Cards And Consumer Loans

Section: Chapter Questions

Problem 1FPC

Related questions

Question

3

Transcribed Image Text:Madeline Rollins is trying to decide whether she can afford a loan she needs in order to go to chiropractic school. Right now, Madeline

is living at home and works in a shoe store, earning a gross income of $1,300 per month. Her employer deducts a total of $340 for

taxes from her monthly pay. Madeline also pays $200 on several credit card debts each month. The loan she needs for chiropractic

school will cost an additional $310 per month.

Calculate her debt payments-to-income ratio with and without the college loan. (Remember the 20 percent rule.) (Enter your answers

as a percent rounded to 2 decimal places.)

Debt Payments-to-

Income Ratio

With college loan

%

Without college loan

20.83 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning